Our initial forecast in March 2024 can be found here. It includes information about the limits for qualified retirement plans, how these limits are calculated, how they are affected by SECURE 2.0, and why they may be relevant for certain plan sponsors.

July 2024 forecast

Our limits forecast is projected using two assumption sets. One set is based on the current trailing 12 months of the consumer price index (CPI) and the second assumes that year-to-date CPI (since September 30, 2023) will continue to increase each month through September 30, 2024, by an estimated 25 basis points (3.0% annual).

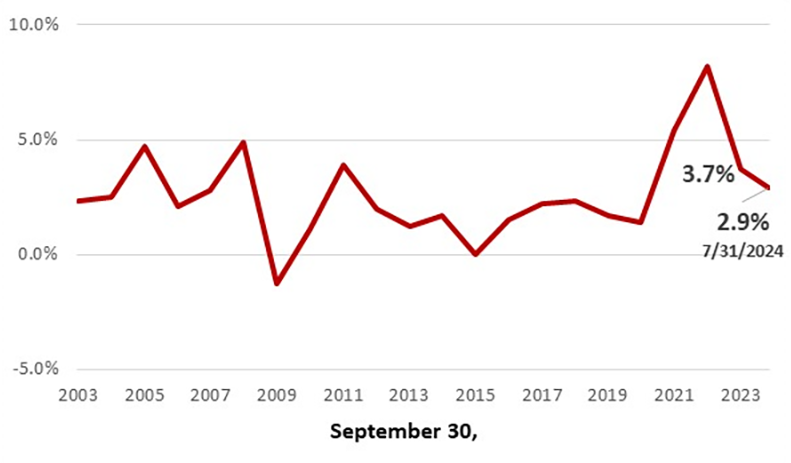

Historical rolling 12-month changes in the CPI as of each September 30 through 2023, and through July 31 for the current federal fiscal year (FFY), are shown in Figure 1.

Figure 1: Historical 12-month percentage change each September 30, Consumer Price Index, all items, not seasonally adjusted

Source: U.S. Bureau of Labor Statistics.

The CPI as reported by the BLS for the 12 months ended July 31, 2024, was 2.9%, down from 3.0% for the 12 months ended June 30, 2024. It is down from the 3.7% annual change in the CPI as of September 30, 2023, but higher than the 2.8% average annual change over the past 10 years and the 2.6% average annual change over the past 20 years.

Since September 30, 2023, the CPI has increased about 2.2%. Projecting monthly increases of 0.25% through September 2024 results in an annual increase of 2.7% for our 10-month actual/two-month forecast projection.

The chart in Figure 2 shows the limits forecast under both assumption sets. Bold type indicates the values that changed since our June forecast:

- Using the year-to-date CPI method, the maximum compensation limit decreased from $355,000 to $350,000 and the maximum annual addition limit for defined contribution (DC) plans decreased from $71,000 to $70,000, resulting in lower projections than the amounts under the 12-month trailing CPI methodology.

An analysis of the cumulative two-month changes in CPI for August and September 2024 that would result in the limits increasing or decreasing from this July forecast is shown below (using the IRS rounding rules).

- An increase of about 0.32% per month for the next two months (i.e., about 0.63% for the two months) would raise the maximum compensation limit and maximum annual addition limit to $355,000 and $71,000, respectively, to match our current projections under the 12-month trailing CPI methodology.

- If increases in August and September 2024 are about 0.14% per month (i.e., about 0.27% for the two months), then the maximum deferral and the catch-up contribution limits for DC plans would decrease from the amounts shown in this July forecast.

As a comparison, the CPI increase in July 2024 of 0.1% is less than the 0.2% increase in the monthly CPI back from June to July 2023, resulting in a 0.1% decrease in the 12-month cumulative rate mentioned above.

The BLS is expected to release the August CPI results on September 11, 2024, at which time this forecast will be updated.

Please contact your Milliman consultant for details and questions about how these limits apply to your retirement plan(s).

Figure 2: 2025 IRS Limits Forecast using actual FFY 2024 CPI as of July 31, 2024

| Category of annual IRS limits | 2024 IRS limits | Estimated 2025 IRS limits | Dollar increases from 2024 limit | ||

|---|---|---|---|---|---|

| Actual 12-month trailing CPI as of 7/31/2024 | 10-month actual 7/31/2024, 2-month forecast to 9/30/2024 | Actual 12-month trailing CPI as of 7/31/2024 | 10-month actual 7/31/2024, 2-month forecast to 9/30/2024 | ||

| Maximum annual annuity pension for DB plans | $275,000 | $280,000 | $280,000 | $5,000 | $5,000 |

| Maximum annual addition for DC plans | $69,000 | $71,000 | $70,000 | $2,000 | $1,000 |

| Maximum §401(k), §403(b), §457 deferral for DC plans | $23,000 | $24,000 | $24,000 | $1,000 | $1,000 |

| Catch-up contribution limit for DC plans* | $7,500 | $8,000 Ages 60 to 63: $12,000 |

$8,000 Ages 60 to 63: $12,000 |

$500 $4,500 |

$500 $4,500 |

| Compensation limit | $345,000 | $355,000 | $350,000 | $10,000 | $5,000 |

| HCE dollar amount | $155,000 | $160,000 | $160,000 | $5,000 | $5,000 |

| Key employee/officer compensation | $220,000 | $230,000 | $230,000 | $10,000 | $10,000 |

| Contribution limit to ESAs for DC plans | $2,500 | $2,500 | $2,500 | $0 | $0 |

| Prior year wage threshold triggering Roth catch-up contributions to DC plans | $145,000 | $145,000** | $145,000** | $0 | $0 |

* Under SECURE 2.0, plans are permitted (but not required) to increase the catch-up limit for participants aged 60, 61, 62, or 63. This higher limit assumes the limit for 2025 will ultimately be based on the regular catch-up limit in 2025, as noted in draft technical corrections, instead of 2024 as passed in SECURE 2.0.

** We assumed this threshold will be indexed for inflation during the two-year transition period ending December 31, 2025.

Source: https://www.bls.gov/cpi/ (retrieved August 14, 2024).

Actual 12-month trailing CPI for All Urban Consumers (CPI-U) of 2.9% ending July 31, 2024.

Actual 10-month CPI-U ending July 31, 2024, and 0.25% per month for August and September 2024.