The Build Back Better Act (BBB) was passed by the U.S. House of Representatives on November 19, 2021.1 This legislation, if passed by the Senate, outlines numerous changes to the Medicare program, including a redesign of the Part D benefit with changes to the benefit phases and stakeholder liability by phase. We previously wrote a brief summary and more detailed summary outlining the proposed changes of the BBB.

The BBB faces some opposition in the Senate, and it is unclear if it will pass in its current form.2 The Senate Finance Committee proposed a revised version of the BBB on December 11, 2021, which includes, among other things, revisions to the Part D premium calculation from 2023 to 2027.3 This article discusses potential implications by stakeholder and questions to consider of the proposed Part D benefit redesign.

Proposed Part D benefit redesign

The BBB would restructure the Part D benefit materially starting in 2024. We summarized all changes in our previous articles linked above. To reiterate the key changes:

- Member cost-sharing would be capped at an annual maximum-out-of-pocket (MOOP) of $2,000.

- Federal reinsurance would be reduced from 80% to 20% for applicable (typically brand) and 40% for non-applicable (typically generic) drugs.

- As part of the new Manufacturer Discount Program (MDP), manufacturers would pay a discount of 10% above the deductible and below the MOOP and 20% above the MOOP for applicable (typically brand) drugs to replace the Coverage Gap Discount Program (CGDP).

- The coverage gap would be eliminated, member coinsurance would decrease from 25% to 23% below the MOOP, and member premium would decrease from 25.5% to 23.5% of total program costs. The premium changes from 2023 to 2027 would also be capped at a maximum of +4%.

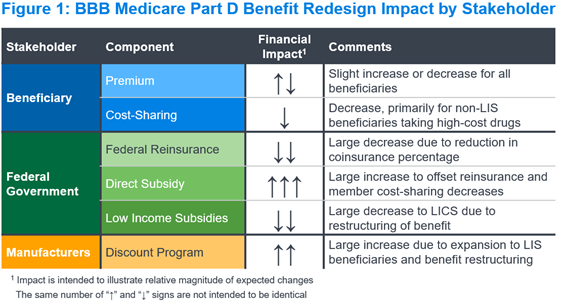

Figure 1 summarizes the expected impact of the Part D benefit redesign on each key stakeholder and financial component in the Part D program. We describe the implications for each stakeholder and component below.

Beneficiaries

Part D beneficiaries pay two components under the Part D program: premium and cost-sharing. Under the BBB, we expect beneficiary cost-sharing would decrease due to (a) lowering the MOOP, (b) eliminating cost-sharing above the MOOP, and (c) reducing coinsurance from 25% to 23% before the MOOP and after the deductible. Given the proposed benefit changes, we expect premiums would increase, all else equal, as seen with similar Part D redesign proposals (e.g., HR.3).4

Congress introduced a change to the BBB not present in prior Part D redesign proposals, to reduce the beneficiary premium calculation from 25.5% to 23.5% of total program costs, specifically to mitigate or eliminate the premium increase. In addition, the Senate Finance Committee proposed changes to the Part D premium calculation for 2023 through 2027 to mitigate premium potential increases. Specifically, the national average Part D premium would:

- For 2023 through 2025, be the lesser of (a) the prior year base beneficiary premium multiplied by 1.04, and (b) the standard Part D premium calculation (e.g., 23.5% of total program costs).

- For 2026, be the lesser of (a) the prior year base beneficiary premium multiplied by 1.04, plus 25% of the difference between the prior year premium and the standard Part D premium calculation for the current year, and (b) the standard Part D premium calculation (e.g., 23.5% of total program costs) for the current year.

- For 2027, be the lesser of (a) the prior year base beneficiary premium multiplied by 1.04, plus 50% of the difference between the prior year premium and the standard Part D premium calculation for the current year, and (b) the standard Part D premium calculation (e.g., 23.5% of total program costs) for the current year.

It is unclear if premiums would increase or decrease after these changes to the Part D beneficiary premium calculation. We expect changes would be small relative to other stakeholder payment changes, particularly if the premium stabilization changes described above were to be implemented.

The net impact of these changes would reduce costs for non-low-income beneficiaries taking high-cost drugs. Cost-sharing for these beneficiaries is currently unlimited, with a 5% coinsurance rate once the true out-of-pocket (TrOOP) threshold is reached.

Changes would be more limited for low-income Part D beneficiaries as well as those with low or no spend, with the premium change as the primary driver. These beneficiaries with low or no spend could end up paying more under the Part D redesign if the premium were to increase. As mentioned above, the Part D premium calculation would change under the BBB, which would partially offset potential premium headwinds or cause the premium to decrease.

Starting in 2023, copays for insulins would be capped at $35 per 30-day prescription across all phases of the benefit, which could similarly make payments more predictable for insulin-taking diabetics. The proposed insulin copay cap appears to be similar to the voluntary Senior Savings Model (SSM), and it is expected the SSM would dissolve with this change. This change would be the only direct impact of the Part D benefit redesign to beneficiaries for the upcoming 2023 bid cycle

The BBB would also allow beneficiaries to “smooth” their cost-sharing throughout the year. This would make payments less front-loaded for beneficiaries with high expected spend. This change, along with the insulin copay cap, could increase medication adherence and the likelihood of starting therapies.

Federal government

Under the BBB, the federal government would experience large changes to each of its three primary financial components, discussed below.

Federal reinsurance

We expect federal reinsurance would decrease materially under the revised Part D design. The federal reinsurance percentage would decrease from 80% for all drugs to 20% for applicable (typically brand) drugs and 40% for non-applicable (typically generic) drugs. A greater volume of claims in the Individual market may be eligible for federal reinsurance, as members taking high-spend drugs may reach the $2,000 MOOP more quickly than with the current TrOOP. However, we expect the decreases in reinsurance percentage would more than offset this change to the volume of claims above the MOOP.

Direct subsidy

We expect the direct subsidy would increase materially under the revised Part D design. The direct subsidy reflects payments made by the federal government to Part D plan sponsors to cover a portion of their bid revenue. These payments, which are risk-adjusted, would increase with bids to offset decreases in federal reinsurance and member cost-sharing. Actual payment impacts would vary by plan, based on the impact of risk adjustment and potential changes to the risk adjustment model used for the Part D program.

Low income subsidies

The government subsidizes both beneficiary cost-sharing and premiums for beneficiaries eligible for the low-income subsidy (LIS). We expect the low-income cost-sharing subsidy (LICS) would decrease under the revised Part D design, consistent with the decrease in beneficiary cost-sharing noted above. The impact would be greater than with the non-LIS design, because LICS covers more of the drug spend under the current Part D benefit. We expect the low-income premium subsidy (LIPS) changes would track closely with the changes in the overall beneficiary premium, which could see a slight decrease or increase.

Pharmaceutical manufacturers

Pharmaceutical manufacturers currently contribute to the Part D program costs through the CGDP, paying approximately 70% of point-of-sale costs for applicable drugs dispensed to non-LIS beneficiaries in the coverage gap. The revised Part D design would restructure these payments to be 10% above the deductible and below the MOOP, and 20% above the MOOP for all beneficiaries. This would expand the payments not only to the catastrophic phase, but also to LIS-eligible beneficiaries for the first time. Although the percentage is lower, the new discount program would apply to a larger portion of spending, and we expect manufacturer costs would increase on average across the market.

These changes would also affect specific manufacturers differently. For example, manufacturers of specialty drugs or high-cost treatments would be paying greater retrospective discounts through the MDP due to a concentration of spending above the MOOP. Conversely, manufacturers of more traditional brand drugs could see a decrease in MDP payments if spending is currently concentrated in the coverage gap for non-LIS beneficiaries. The exact impact by manufacturer would vary based on the disease state and average spend not only for its own products, but also for other products that beneficiaries are taking.

In addition, the beneficiary cost-sharing decrease could lead to an increase in medication adherence and new utilization for beneficiaries, particularly for high-cost medications. This could increase the volume of prescriptions for manufacturers, which may partially offset the revenue loss from the new MDP.

Part D plan sponsors

Under the revised Part D benefit design, costs that plan sponsors are responsible for would increase materially. This is particularly true above the MOOP, where plan sponsors would be responsible for 60% of costs compared to only 15% today, with the rest covered by federal reinsurance (80%) and member cost-sharing (5%). This could change incentives for plans to manage these costs more effectively, and potentially reconsider the impact of rebates on formulary considerations compared to list price discounts.

There are numerous other questions for Part D plan sponsors to consider in this revised design. To name a few:

- When would the Centers for Medicare and Medicaid Services (CMS) revise the risk score model to align with the revised benefit design? Would this occur for the first year of the benefit redesign (2024) or later? How would the timing dynamics affect population selection and payment dynamics? How would risk scores and the risk-adjusted direct subsidy vary materially for diseases states and beneficiary types between years? How would it affect how plan sponsors view LIS vs. non-LIS populations?

- Would the risk corridor program still be in effect for 2024? Could we see a change in the parameters similar to what was proposed when the point-of-sale (POS) rebate rule was announced in the spring of 2019?5

- How would plan sponsors administer the beneficiary cost-share “smoothing” provision? What portion is expected to be unpaid, and what controls would plan sponsors have over eligibility due to non-payment?

- How would the change to cover insulins at a maximum of $35 affect plan costs and strategic considerations for 2023? Would plan sponsors retain the full CGDP payments for non-LIS beneficiaries (similar to the Senior Savings Model)? Would plan sponsors lose LICS for LIS beneficiaries, especially in the coverage gap, by having the member cost limited to $35?

Employers

For employers offering a rich Part D Employer Group Waiver Plan (EGWP) design, the bill passed by the U.S. House of representatives could materially increase plan sponsor costs and EGWP premiums. In this version, fewer members may reach the catastrophic phase and be eligible for federal reinsurance with a rich EGWP design, as manufacturer discounts would no longer accumulate to the out-of-pocket threshold. There would also be a material decrease in manufacturer payments, as EGWPs would only receive a 10% discount payment for spending below the MOOP. EGWPs with leaner benefit designs (e.g., plans offering specialty coinsurance) would be less impacted.

However, this dynamic would change with the revised version of the text released by the Senate Finance Committee on December 11, 2021. With this version, the following would count towards the MOOP (as outlined on page 1,110):6

“…reimbursed through insurance, a group health plan, or certain other third party arrangements, but not including the coverage provided by a prescription drug plan or an MA-PD plan that is basic prescription drug coverage…or any payments by a manufacturer under the manufacturer discount program.”

Our understanding is that with this approach, the enhancement from an Other Health Insurance (OHI) design offered by an EGWP would count towards the MOOP. We expect this would be effectively the same as using the Part D defined standard cost-sharing to determine when a beneficiary reaches the MOOP. This would accelerate beneficiaries towards the MOOP, where claims are eligible for federal reinsurance and receive higher MDP payments. These changes would decrease plan liability for many EGWPs relative to the current Part D benefit design (without the BBB).

In addition, the direct subsidy is expected to increase materially based on expected Part D bid increases in the Individual market. This change, along with the acceleration of EGWP members towards the MOOP, could decrease EGWP plan liability and premiums materially. It is important to note that the revised text is not final and may be edited by the Senate.

In addition, the change in the richness of the Part D benefit design could have implications for Part D creditable coverage testing and the tests for the RDS program. These changes could make it more difficult to pass these tests, due to the richer benefit design. This could force employers to modify their benefits to make them richer or explore alternate avenues as necessary.

Next steps

Some members of the Senate have publicly opposed the BBB in its current form, leaving its future in doubt.7 As discussed above, there have been several proposals over the last few years to redesign the Part D benefit. With the U.S. House Committee on Oversight and Reform publishing its “Drug Pricing Investigation” report on December 10, 2021,8 the Part D redesign, drug price negotiation, inflation rebate provisions may have enough momentum to be pursued, even if the BBB isn’t passed.

If finalized, the Medicare provisions in the BBB would drive arguably the most significant changes to the Medicare Part D program since its inception in 2006. This redesign would create countless implications for all industry stakeholders to consider, with certain changes coming as soon as 2023.

1 The full text is available from: https://rules.house.gov/sites/democrats.rules.house.gov/files/BILLS-117HR5376RH-RCP117-18.pdf.

2 See article below for reference: https://thehill.com/homenews/senate/586504-manchin-undercuts-biden-leaving-his-agenda-in-limbo.

3 The full text is available from: https://www.finance.senate.gov/imo/media/doc/12.11.21 Finance Text.pdf .

4 The full text is available from: https://www.congress.gov/bill/117th-congress/house-bill/3.

5 HPMS memo is available at https://www.cms.gov/Research-Statistics-Data-and-Systems/Computer-Data-and-Systems/HPMS/Downloads/HPMS-Memos/Weekly/SysHPMS-Memo-2019-May-20th.pdf.

6 The full text is available from: https://www.finance.senate.gov/imo/media/doc/12.11.21 Finance Text.pdf.

7 See article below for reference: https://thehill.com/homenews/senate/586504-manchin-undercuts-biden-leaving-his-agenda-in-limbo.

8 See report here for reference: https://oversight.house.gov/sites/democrats.oversight.house.gov/files/DRUG%20PRICING%20REPORT%20WITH%20APPENDIX%20v3.pdf.