As the Medicare Advantage (MA) market has become more saturated with MAOs offering a variety of supplemental benefits,1 many beneficiaries rely on the MPF tool to help select a plan that fits their needs.

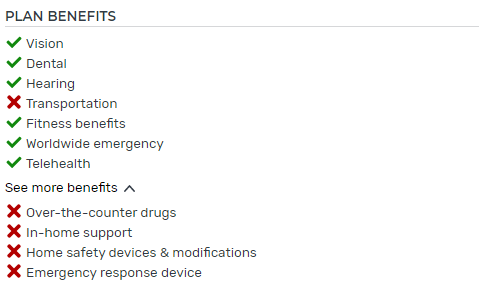

The Centers for Medicare and Medicaid Services (CMS) created MPF for Medicare beneficiaries to compare premiums and benefit offerings (e.g., deductibles, copays/coinsurance, supplemental benefits) for available plans and ultimately enroll in Medicare Advantage and Part D plans. The MPF tool underwent a major overhaul in 2019, which included layout changes and new sorting and filtering options.2 As shown in Figure 1, one change was the addition of green checkmarks ✔ and red X's ✖ to denote whether or not a plan covers certain supplemental benefits in a visual way.

Figure 1: Medicare plan finder display

Supplemental benefits are items or services not covered under traditional fee-for-service (FFS) Medicare that can be covered by MAOs. Offering these benefits is one way MAOs attract Medicare-eligible individuals to their plans and differentiate themselves from market competition and traditional Medicare. Nearly all MA plans offer supplemental benefits.3 This paper focuses on mandatory supplemental benefits—supplemental benefits covered for all enrollees.4

There is an additional cost to the MAO associated with offering supplemental benefits. Thus, MAOs must strategically select key benefits to offer to create a competitive advantage and meet their members’ needs while still offering a competitive premium.

This paper uses the following terms to distinguish the supplemental benefits5 in Figure 1:

- Checkmark benefits: Any of the 11 benefits listed in Figure 1 (i.e., benefits eligible for a checkmark in MPF).

- Filterable checkmark benefits (five in total): Benefits that MPF users can select to filter available plan offerings. They are vision, dental, hearing, transportation, and fitness benefits.

- Non-filterable checkmark benefits (six in total): MPF users cannot filter plans based on these benefits. They are worldwide emergency, telehealth, over-the-counter (OTC) drugs, in-home support, home safety devices & modifications, and emergency response device benefits.

Following MPF’s restructuring in 2019, some MAOs have added these checkmark benefits to their plans. In this paper, we review how enrollment trends correlate with checkmark benefit offerings. We focus on the count of benefits, rather than specific benefit combinations. That is to say, if a plan offers in-home support and OTC benefits or if a plan offers home safety and emergency response device benefits, we identify both situations as plans offering two non-filterable checkmark benefits, without considering the specific combination of benefits offered.

Results

In the sections below, we provide results for plans with at least four filterable checkmark benefits. Plans with at least four filterable checkmark benefits dominate the market. As of 2022, 96% of nationwide members are enrolled in plans with at least four filterable checkmark benefits and 47% of nationwide members are enrolled in plans with all five (up from 90% and 43%, respectively, in 2021). In contrast, plans with three or fewer filterable checkmark benefits showed a 52% enrollment decline from 2021 to 2022.

Market-wide trends

Figure 2 shows 2020 through 2022 enrollment by how many non-filterable checkmark benefits a plan offers.

Figure 2: Enrollment trends by count of non-filterable checkmark benefits, market-wide (millions)

Plans offering five to six non-filterable checkmark benefits experienced approximately 70% enrollment growth from 2021 to 2022. Plans offering three to four non-filterable checkmark benefits follow with 21% growth. Plans offering two or fewer non-filterable checkmark benefits saw a 23% decline in enrollment.

Regional plans6 offering five to six non-filterable benefits showed the highest enrollment growth (161%). All subsets of plans studied showed a similar growth pattern—plans with five to six non-filterable benefits growing the most, plans with three to four growing a moderate amount, and plans with two or fewer declining.

The most frequently added non-filterable benefits in 2022 were in-home support and emergency response device benefits. Approximately 200 plans added in-home support and 175 plans added emergency response device benefits in 2022.

Note that there are many drivers that can influence a beneficiary’s plan selection, such as broker steerage, compelling marketing, provider network, premium, and benefits outside of the ones studied in this analysis. The following figures show that higher counts of non-filterable checkmark benefits are correlated with higher enrollment growth rates, but there may be confounding variables also influencing enrollment trends. We do not attempt to normalize for any confounding variables to quantify how much enrollment is due to the non-filterable checkmark benefit offerings versus other variables. Said differently, we do not attempt to draw any conclusions about whether offering checkmark benefits or filterable benefits drives enrollment due to these confounding variables.

To understand these trends, we studied different types of plans in the following sections. The figures below focus on the change in enrollment growth, which is represented by the highlighted areas. For example, note that the plans offering five to six non-filterable benefits (green) expand in area while the plans offering two or fewer non-filterable checkmark benefits (blue) decrease from 2020 to 2022.

Nationwide vs. regional carriers

Figure 3 shows how enrollment trends differ between nationwide plans (dark) and regional plans (light).

Figure 3: Enrollment growth by count of non-filterable checkmark benefits, by regional/nationwide (millions)

There were larger enrollment increases among small to midsize carriers (regional plans) that offer five to six non-filterable checkmark benefits (161% growth from 2021 to 2022) when compared to nationwide carrier counterparts (45%).

Among plans offering three to four non-filterable checkmark benefits, nationwide carriers have experienced higher enrollment growth (26% growth from 2021 to 2022) than their regional counterparts, who have remained stagnant (5% growth).

Regardless of plan size, plans offering two or fewer non-filterable checkmark benefits saw enrollment decline.

While large nationwide carriers continue to enroll members in plans offering five to six non-filterable checkmark plans, regional carriers offering these benefits enrolled members at a more rapid pace.

Special needs plans

Figure 4 is similar to Figure 3 above, but with special needs plans (SNPs) in dark and non-SNPs in light broken out.

Figure 4: Enrollment growth by count of non-filterable checkmark benefits, by SNP type (millions)

Non-SNP plans offering five to six non-filterable checkmark benefits saw larger growth when compared to SNP counterparts.

Growth trends for plans offering four or fewer non-filterable checkmark benefits are similar between non-SNP and SNP plans.

$0 premium vs. non-$0 premium plans

Figure 5 is similar to Figures 3 and 4 above, but with $0 premium plans in dark and non-$0 premium plans in light broken out. Note that Figure 5 includes SNPs for consistency between graphs.

Figure 5: Enrollment growth by count of non-filterable checkmark benefits, by $0 premium (millions)

The $0 premium plans offering five to six non-filterable checkmark benefits saw larger growth when compared to their non-$0 premium counterparts. Among non-SNPs, the growth rate among non-$0 premium plans is higher due to a smaller number of members enrolled, but $0 premium plans continue to exhibit strong membership growth.

Growth trends for plans offering four or fewer non-filterable checkmark benefits are similar regardless of premium.

To facilitate comparison, Figure 6 summarizes enrollment growth rates for plans with five or six non-filterable checkmark benefits (i.e., the green sections in Figures 3, 4, and 5 above). For context, we include the Medicare Advantage market-wide average growth rate of 9%. Note, though, that these cohorts vary significantly in size so trends represent varying numbers of members.

Figure 6: Enrollment growth rate for plans with 5-6 non-filterable checkmark benefits, 2021 to 2022

Benefit trends

Almost all plans offer dental, vision, and hearing supplemental benefits and most plans additionally offer transportation and fitness.7 However, there is more variation among offerings for the non-filterable checkmark benefits.

In 2022, the most popular non-filterable checkmark benefits offered are telehealth, worldwide emergency, and OTC drugs.

Figure 7 shows the prevalence of each benefit, by the percentage of plans offering the benefit in 2022, limited to plans that existed in 2021 with at least four checkmark benefits.

Figure 7: Percentage of plans offering non-filterable checkmark benefits, 2022 (limited to plans existing in 2021 with at least 4 checkmark benefits in 2022)

From 2021 to 2022, the non-filterable checkmark benefits with the largest growth rates were in-home support, emergency response device, and home safety.

Figure 8 shows the number of plans adding each benefit.

Figure 8: Growth rate and number of plans adding each benefit from 2021 to 2022 (limited to plans existing in 2021 with at least 4 checkmark benefits in 2022)

Despite large growth in 2022, in-home support ranks as the second-least common non-filterable benefit offered, with 15% of all plans offering this benefit. Similarly, 26% of plans cover emergency response device benefits in 2022.

The rise in emergency response devices may be attributed to the increasing availability of technology to Medicare beneficiaries, simple features offered by the devices, and the public health emergency presented by the COVID-19 pandemic.

Similarly, the high prevalence of telehealth benefits was a response to the COVID-19 pandemic as a measure to provide alternatives to in-person facility care and comply with CMS requirements.8

Next steps for plans

It appears that plans offering at least five checkmark benefits across the nation are seeing significant enrollment growth as the MA landscape becomes more competitive. What can plans do to take advantage of this information?

Make benefit decisions with MPF in mind

Given that MPF allows beneficiaries to view, compare, and enroll in Medicare plans, it can play a large role in beneficiary enrollment decisions. Due to its importance, MPF is often already part of the benefit strategy discussion and, as MAOs prepare their 2023 bids and approach future discussions, they can consider selecting supplemental benefits that align directly with the MPF checkmark benefits. As MAOs consider the costs and value associated with new benefits, it’s important to note that supplemental benefits highlighted with checkmarks on MPF may result in “more bang for the buck” than supplemental benefits that are not, given the high visibility to members and based on the high growth rates shown in this paper.

We note that the checkmark benefits are one of many plan features highlighted on MPF, with premium being the most visually prominent (as well as a sorting option). MAOs should consider their pricing and benefit strategy holistically and employ strategies that are appropriate for their beneficiaries.

Marketing outreach and strategy

Marketing plays an important role in attracting new members. To appeal to members not using MPF or not relying on MPF alone, organizations can use their marketing materials to highlight non-filterable checkmark benefits offerings, especially the in-home support benefits that have been growing in the past few years.

Keep up with MPF

CMS periodically updates the MPF user interface and display information. In the future, MPF may summarize different plan features or highlight other benefits more prominently. It will be important for MAOs to be aware of changes to MPF as they are made.

For example, if MPF were to provide a filter that targets certain Value-Based Insurance Design (VBID)9, 10 conditions and associated benefits, MAOs could respond accordingly by placing more emphasis around VBID decisions and focusing marketing efforts on VBID target demographics, such as those with chronic obstructive pulmonary disease (COPD) or in low-income socioeconomic status.

Benchmark against competitors

MPF can serve as a starting point for MAOs to compare benefit offerings to their competitors from a high level; however, in a landscape in which regional carriers with at least five non-filterable checkmark benefits experienced a 161% membership growth rate, MAOs will need more compelling analysis to help distinguish themselves.

Methodology and Assumptions

We reviewed public data released by the Centers for Medicare and Medicaid Services (CMS) for the 2020 to 2022 plan years.11 Our analysis examines trends in February enrollment in each year while excluding Medicare Advantage-only plans (plans that do not cover Part D), Employer Group Waiver Plans (EGWPs), Medicare-Medicaid plans (MMPs), medical savings account (MSA) plans, and Medicare Cost plans.

Our analysis focuses on plans that offer four or five filterable checkmark plans, as this represents the vast majority of the market and facilitates easier comparison between plans.

In performing this analysis, we relied on the 2022 Milliman MACVAT®. The Milliman MACVAT contains enrollment statistics, supplemental benefit coverage, and general plan information (parent name, SNP detail, monthly premiums) for 2018 through 2022.

We considered health maintenance organization (HMO), HMO with a point-of-service option (HMO-POS), local preferred provider organization (LPPO), private fee-for-service (PFFS), and regional PPO (RPPO) plans.

Caveats, Limitations, and Qualifications

This report is intended to help MAOs prioritize which supplemental benefits to offer in 2023.

We note that correlation does not prove causation, and explicitly note that while plans with more checkmark benefits are correlated with higher enrollment growth rates, that does not imply that these benefits are the sole reason for this growth. The credibility of certain comparisons provided in this report may be limited, particularly where the number of plans in certain groupings is low. Some metrics may also be distorted by premium and benefit changes in a few plans with particularly high enrollment.

In preparing our analysis, we relied upon public information from CMS, which we accepted without audit. However, we did review it for general reasonableness. If this information is inaccurate or incomplete, conclusions drawn from it may change.

Julia Friedman, Michelle Klein, and Ivan Yen are actuaries for Milliman, members of the American Academy of Actuaries, and meet the qualification standards of the Academy to render the actuarial opinion contained herein. To the best of our knowledge and belief, this information is complete and accurate and has been prepared in accordance with generally recognized and accepted actuarial principles and practices.

The material in this article represents the opinion of the authors and is not representative of the view of Milliman. As such, Milliman is not advocating for, or endorsing, any specific views contained in this report related to the Medicare Advantage program.

1 Freed, M. et al. (November 2, 2021). Medicare Advantage 2022 Spotlight: First Look. Kaiser Family Foundation. Retrieved April 10, 2022, from https://www.kff.org/medicare/issue-brief/medicare-advantage-2022-spotlight-first-look/.

2 Klein, M. & Kranovich, M. (October 2019). Changes to 2020 Medicare Plan Finder. Milliman White Paper. Retrieved April 10, 2022, from https://www.milliman.com/-/media/milliman/importedfiles/ektron/changes_to_2020_medicare_plan_finder.ashx.

3 Murphy, C.M., Buzby, E., & Pittinger, S. (February 2022). Overview of Medicare Advantage Supplemental Healthcare Benefits and Review of Contract Year 2022 Offerings. Milliman Brief. Retrieved April 10, 2022, from https://www.milliman.com/en/insight/Overview-of-MA-supplemental-healthcare-benefits-review-2022-offerings.

4 As opposed to optional supplemental benefits, which members can opt into for an additional premium. See https://www.milliman.com/en/insight/trends-in-medicare-advantage-optional-supplemental-benefits.

5 Benefits are defined in the CMS Medicare Managed Care Manual. See https://www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/Downloads/mc86c04.pdf.

6 We define the size of nationwide carriers to be more than 250,000 members. These carriers include UnitedHealth Group, Humana, CVS, Anthem, Kaiser, Centene, and Cigna. Regional plans are all others.

7 Friedman, J.M. & Yeh, M. (April 1, 2022). Prevalence of Supplemental Benefits in the General Enrollment Medicare Advantage Marketplace: 2018 to 2022. Milliman Insight. Retrieved April 10, 2022, from https://www.milliman.com/en/insight/prevalence-of-supplemental-benefits-in-the-general-enrollment-medicare-advantage.

8 Friedman, J.M. (March 1, 2021). COVID-19 Creates a Compelling Environment in 2021 and Beyond for Medicare Advantage Telehealth Offerings. Milliman Insight. Retrieved April 10, 2022, from https://www.milliman.com/en/insight/COVID19-creates-a-compelling-environment-in-2021-and-beyond-for-Medicare-Advantage.

9 The VBID Model is designed to improve health outcomes and lower costs for MA enrollees by structuring incentives such as reduced cost sharing to encourage enrollees to use the services that can benefit them the most.

10 Murphy-Barron, C.M., Pelizzari, P.M., & Regan, B. (February 2019). The Medicare Advantage Value-Based Insurance Design Model: Overview and Considerations. Milliman White Paper. Retrieved April 10, 2022, from https://www.milliman.com/-/media/Milliman/importedfiles/uploadedFiles/insight/2019/medicare-advantage-value-based-insurance.ashx.

11 CMS. Medicare Advantage/Part D Contract and Enrollment Data. Retrieved April 10, 2022, from https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/MCRAdvPartDEnrolData/.