Sign up to participate in an upcoming Pulse Survey

Survey summary

Most employers taking this survey acknowledge the pandemic as short-term and over the next year are deemphasizing many of the offerings to employees that were popular during the pandemic. However, there appears to be an exploration for the long run of new ways to provide employees with greater access to care through new solutions. But the challenges of a multiple vendor solution appear to be a burden on the limited resources of human resource (HR) departments, most likely due to the prevalence of specialty vendors in the market.

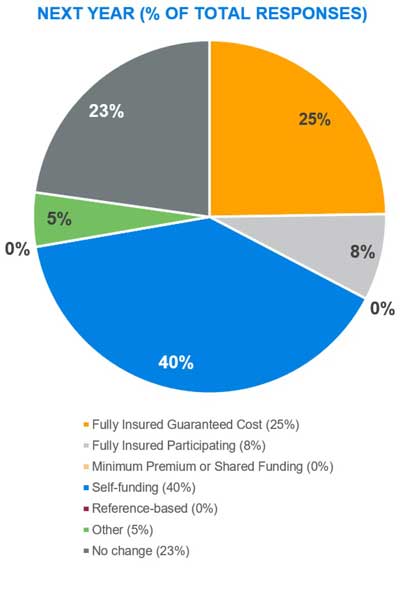

Plan funding

The results regarding near-term changes support what we have witnessed in benefits elsewhere. The disruptive impact of COVID-19 put many anticipated program changes on hold while employers waited to see what the work environment would look like once we exited the pandemic. Given that 2020 was such an anomaly in terms of actual healthcare costs only exacerbates the challenge of evaluating the financial advantages of taking on additional funding risk. Consequently, the survey shows that most employers will stay the course with their current funding approach.

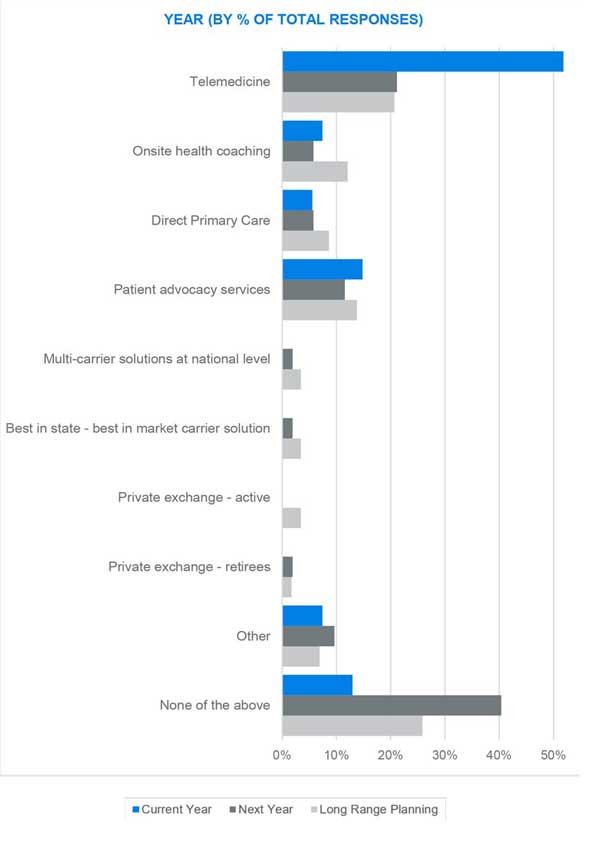

Access to care

Results from our survey suggest that employers will be deemphasizing telemedicine after this year, but we interpret this as more of a shift in priorities for future plan years. Telemedicine gained a strong foothold with the pandemic and employers are now focused more on maintaining that momentum. The results show enhanced interest in other point solutions focused more on primary care such as onsite and near-site clinics and health coaching services. The other interesting result is a renewed focus on helping participants better engage with the various benefit resources available to them within their benefits program, as well as navigate a complex healthcare delivery system.

Interest in some of the more “traditional” provider network solutions (multicarrier, best-in-market, etc.) to enhance access to care is waning. The next segment of this survey may explain where employers have refocused their efforts.

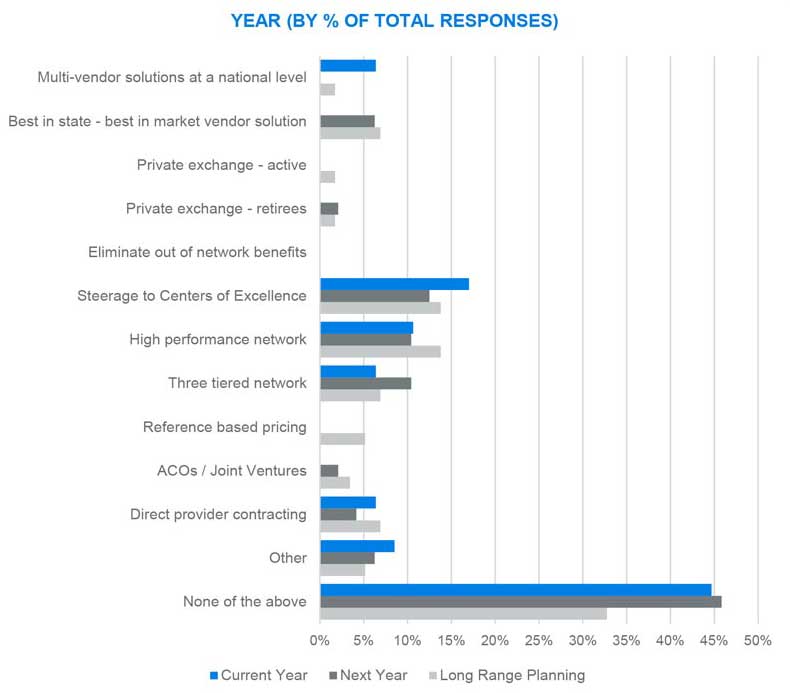

Provider network

Results from this portion of the survey were quite interesting. Although a large percentage of respondents are staying the course with more traditional network solutions (e.g., PPO, POS, or HMO, over half of respondents where either actively engaged in or contemplating a move to a more focused provider network solution. Among those responses, there is a clear leaning toward driving more care into narrower solutions such as High Performance Networks and Centers of Excellence (COEs).

COEs are often defined as a highly limited network of providers specializing in a focused field such as transplants, joint replacement, and higher-level mental health. The downside to a restricted network solution is member disruption, which can be very high.

The survey suggests that the need to gain a better handle on the cost and quality of patient outcomes has surpassed this concern for many employers.