This article was updated on November 16, 2016.

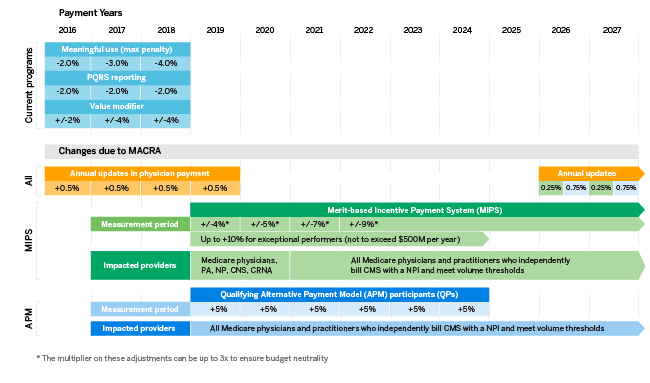

This paper clearly lays out the key deadlines and timeframes for various aspects of MACRA. In many cases, it appears the programs start in 2019 or later, but in reality, there are performance and analysis periods that are as early as 2017.

The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) ties physicians’ payment to greater accountability of cost and quality with the introduction of two distinct pathways: the Merit-Based Incentive Payment System (MIPS) and the Advanced Alternative Payment Model (APM) track. The two pathways adjust physicians’ payment based on different criteria. MIPS seeks to tie Medicare payments to provider performance, whereas the Advanced APM track encourages groups of providers to shift away from fee for service (FFS) to delivery models where physicians assume more accountability and risk for cost and quality of care through APMs, providing lump sum incentive payments for the initial years of the program for early adopters of such models.

In this paper, we will cover the timeframes associated with MACRA, with a focus on MIPS and APM. This paper reflects information provided from the following sources:

- The MACRA proposed rule released in April 2016

- The 2017 Physician Fee Schedule proposed rule released in July 2016

- The MACRA final rule released in October 2016

Note that in all cases, any materials cited from the MACRA proposed rule have been updated to reflect the final rule, such that all information in this paper is current as of November 2016.

Transition from current programs

Sustainable growth rate (SGR) formula

The sustainable growth rate (SGR) formula was a statutory formula, initially passed in 1997, and was meant to be used for calculating annual payment updates to physicians and other professionals under Medicare. The formula was designed to provide an incentive for physicians to be more efficient and rein in utilization, and to ensure that overall spending by Medicare on physician services did not grow faster than gross domestic product (GDP) growth. Tying the payment rate to national utilization rates provided little incentive for individual physicians to alter their behavior – and in some years, application of the SGR formula would have resulted in significant cuts to physician payments. For several years, Congress passed a series of short-term “patches” (referred to as a “doc fix”) instead of passing a long-term repeal. MACRA permanently repeals and replaces SGR. According to MACRA, the SGR formula was no longer to be used as of mid-2015, and the key MACRA provisions begin in payment year 2019.

CMS pre-MACRA payment programs

Prior to the passage of MACRA, physicians and other clinicians have experienced an increasing number of payment adjustment programs. The current programs that affect Medicare Part B payment are in effect for payment through 2018, with 2016 as the last performance year. The programs are as follows:

1. Physician Quality Reporting System (PQRS)

2. Physician Value-based Payment Modifier (VM)

3. Medicare Electronic Health Record (EHR) Incentive Program for eligible professionals (EPs), aka “Meaningful Use” (MU)

For payment year 2018 (based on performance year 2016), a clinician can have up to a 10% negative adjustment (-2% for PQRS, -4% for VM, and -4% for MU) or a 4% upward adjustment (+4% from VM). Physicians, physician assistants (PA), nurse practitioners (NP), clinical nurse specialists (CNS), and certified registered nurse anesthetists (CRNA) are all included for the 2018 payment year.

Overview of MACRA participation options

The MACRA legislation will influence payments to physicians and certain types of non-physician practitioners, referred to as eligible clinicians. Certain eligible clinicians will be exempt from both the MIPS and Advanced APM tracks, including those who are in their first year of Medicare Part B participation and those below low patient volume thresholds.

Eligible clinicians who are subject to the payment changes implemented by MACRA have some flexibility in how they participate in MACRA. Eligible clinicians can choose to participate in an Advanced APM1, a MIPS APM2, or no APM. As such, eligible clinicians can find themselves in one of four categories:

1. MIPS eligible clinicians not in a MIPS APM

2. MIPS eligible clinicians in a MIPS APM

3. Partially Qualifying APM Participants (Partial QPs) in Advanced APMs

4. Qualifying APM Participants (QPs) in Advanced APMs

Overall MACRA timeline

Figure 1 represents an overall view of many of the MACRA activities from 2016 to 2027. Each of these is described below.

Figure 1: MACRA timeline

Fee schedule update timeline

One of the first changes to go into effect was the Medicare Physician Fee Schedule update. Physicians and other clinicians received a 0.5% update for the remainder of 2015 as well as annual 0.5% fee updates each year through 2019.3

There are no fee schedule updates from 2020 through 2025. In 2026, CMS has defined that the fee schedule update will be based upon Qualifying APM Participant (QP) status. The fee schedule updates for 2026 and beyond are as follows:

- Qualifying APM Participants – 0.75%

- All other eligible clinicians – 0.25%

Changes to CMS billing requirements

The MACRA statute states that 1) ordering physician or applicable practitioner (if different from the billing physician or applicable practitioner) National Provider Identifier (NPI), 2) care episode groups and patient condition groups, and 3) patient relationship categories under sections 1848(r)(2) and (3) of the Act be required for all claims submitted on or after January 1, 2018. This new information provided on claims will likely change attribution methodology for a number of programs, including APMs and MIPS.

MIPS timeline

Performance, reporting, analysis, and payment periods

The MACRA statute defined the first payment period to be calendar year 2019. In the final rule, CMS has implemented a program referred to as “pick your pace” within the MIPS track for payment year 2019 (with performance to be assessed in 2017). Specifically, in 2017, providers can choose one of the following options:

- Don’t participate: Providers who send in no data in 2017 will receive the maximum -4% payment adjustment in 2019.

- Submit something: If providers submit a minimum amount of 2017 data (only one measure, for example), they will be insulated from downward payment adjustments.

- Submit a partial year: If providers submit 90 days of 2017 data, they may earn a neutral or small positive payment adjustment for 2019.

- Submit a full year: If providers submit a full year of 2017 data, they can earn a moderate positive payment adjustment.

The pick your pace program will only be available for the first year of MACRA implementation (performance year 2017/payment year 2019).

Similar to existing programs, CMS has defined the performance period to be two calendar years prior (2017) and the analysis period to be the year in between (2018) to allow for adequate run-out, reporting, distribution of results, and investigation of any feedback.

Reporting for MIPS will occur in the first quarter after the conclusion of the performance year. Specifically, for 2017 performance, clinicians will have a data submission deadline of no later than March 31, 2018. That deadline may differ based on the submission mechanism selected.

Performance reports including feedback on performance under the quality and resource use performance categories can be expected in July of the analysis year, meaning that clinicians will receive information about their 2017 performance in July 2018. The performance reporting may become more frequent, and CMS has also maintained discretion to provide feedback on the clinical practice improvement activities and advancing care information performance categories. This is in line with the current programmatic approach and distribution of the Quality and Resource Use Reports (QRUR) that have been distributed for several years. Clinicians will have an opportunity to respond to any perceived inaccuracies within the performance reports.

Payment adjustments, including the scaling factor for both the upward MIPS adjustment and the exceptional performance adjustment, will be sent at least 30 days prior to January 1 of each payment year.

MIPS APM participation determination

CMS will use the APM Entity Participation List on December 31 of the Performance Period to determine APM participation status for each tax identifier number (TIN)/NPI. For certain APMs, other resources such as an Affiliated Practitioner list may be used in lieu of APM Entity Participation Lists for identifying eligible clinicians participating in the APM.

Change to MIPS adjustments

MIPS downwards and upwards adjustment will change over time (see Figure 2). The maximum downwards and upwards adjustments for each payment year are defined by statute, starting at -4%/+4X% in 2019 and growing to -9%/+9X% by 2022. In addition, for payment years 2019 to 2024, there is a potential exceptional performance adjustment of up to 10% available for the top quartile of performers.

Figure 2: MIPS adjustment changes over time

| Payment Year | Performance Year | Maximum downward adjustment | Maximum upwards adjustment* | Maximum exceptional performance adjustment** | Total potential adjustment range |

| 2019 | 2017 | -4% | +4X | +10Y | -4% to +22% |

| 2020 | 2018 | -5% | +5X | +10Y | -5% to +25% |

| 2021 | 2019 | -7% | +7X | +10Y | -7% to +31% |

| 2022 to 2024 | 2020 | -9% | +9X | +10Y | -9% to +37% |

| 2025 and beyond | 2023 and beyond | -9% | +9X | - | -9% to +27% |

|

*Each year the upwards adjustment scaling factor "X" will be calculated to determine the actual percent of the adjustment. The scalar can be 0 to 3 and is designed to be budget neutral in regards to the downwards adjustments. |

|||||

| **Each year the exceptional performance adjustment scalar "Y" will be calculated so that the total exceptional performance adjustment payments do not exceed $500 million. The scalar can be 0 to 1. | |||||

For the 2019 to 2020 payment years, only physicians, NPs, PAs, CRNAs, and CNS clinicians are included in MIPS. Starting with the 2021 payment year, CMS can designate additional clinicians whose fees are also described under the Physician Fee Schedule. The statute provides specific examples of clinicians who may be included in the 2021 payment year: certified nurse midwives, clinical social workers, clinical psychologists, registered dietitians/nutritionists, physical or occupational therapists, qualified speech-language pathologists, and qualified audiologists.4

Change in composite performance score (CPS) category weighting

Payment year 2019 has a significant focus on quality with less focus on resource use. In the final rule, CMS indicated that the 2017 performance year (for 2019 payment) will not include resource use in MIPS performance scoring, waiting until the 2018 performance year to roll out this category. This is a significant departure from the Value Modifier program that was 50-50 quality and cost and may be related to updates to CMS billing requirements (discussed above) that are expected to improve attribution in the future. By the 2021 payment year, quality and cost will be equally weighted.

The weighting of CPS categories changes over time and will likely differ for eligible clinicians in MIPS APM from those not in MIPS APM. Furthermore, CMS maintains the flexibility to change this weighting in future performance years. See Figure 3 for the CPS category weighting currently defined by the proposed rule.

Figure 3: CPS category weighting

| MIPS performance category | MIPS eligible clinicians not in a MIPS APM | MIPS eligible clinicians participating in MSSP or NGACO | MIPS eligible clinicians participating in any other MIPS APM (exclusive of MSSP and NGACO) | ||||

| 2019 | 2020 | 2021 and subsequent years | 2019 | 2020 and subsequent years | 2019 | 2020 and subsequent years | |

| Quality |

60%

|

50%

|

30%

|

50%

|

Not yet defined

|

0%

|

Not yet defined

|

| Resource use |

0%

|

10%

|

30%

|

0%

|

0%

|

||

| Advancing care information5 |

25%

|

25%

|

25%

|

30%

|

75%

|

||

| Clinical practice improvement activities |

15%

|

15%

|

15%

|

20%

|

25%

|

||

Advanced APM incentive payment timeline

Performance, reporting, analysis, and payment periods

As with the MIPS payment adjustment, the performance year is two years prior to the payment year. For 2019, this means that 2017 is the performance year. CMS will first determine if the clinician is a participant in an Advanced APM on December 31 of the Performance Period. CMS will use the payments in 2017 to determine if the APM entity meets the volume threshold requirements.

CMS states in the MACRA proposed rule that it anticipates notifying APM entities of their Qualifying APM Participant (QP) or Partially Qualifying APM Participant (Partial QP) status not before the summer after the performance year. This means that for the 2019 payment year, APM entities will likely be notified in the third quarter of 2018.

If the clinician achieves QP status for any year between 2019 and 2024, the APM Incentive Payment for that year is a lump sum equal to 5% of the QP’s estimated aggregate payments for Medicare Part B covered professional services (services paid under or based on the Medicare PFS) for the prior year. In the proposed rule, CMS proposes a three-month run-out period after the end of the payment determination year and an approximately six-month calculation period. CMS stresses that there is no firm timeline for the issuance of the lump sum incentive payment, but based on the timeline provided, clinicians could expect their incentive payment in the third or fourth quarter of the payment year.

To summarize for the payment year 2019, CMS will use

- 2017 - determination of participation in Advanced APM and thresholds

- Third quarter of 2018 – notification of QP or PQ status

- Second and third quarter of 2019 – calculation of incentive payment (based on payments for services rendered in 2018 and paid through March 2019)

- Third or fourth quarter of 2019 – issuance of incentive payments

Change to threshold levels over time

Over time, the threshold levels for both the patient count and payment amount methods change. In addition, beginning with payment year 2021, CMS will offer the all-payer combination option. See Figure 4 for a description below.

Figure 4: Advanced APM threshold levels

| Patient Count Method | ||||||

| Payment Year | Medicare Option | All-Payer Combination Option (must meet both Medicare FFS and all patients) | ||||

| Medicare FFS (partial) | Medicare FFS (qualified) | Medicare FFS (partial) | Medicare FFS (qualified) | All Patients (partial) | All Patients (qualified) | |

| 2019-20 | 10% | 20% | Medicare Option only in these years | |||

| 2021-22 | 25% | 35% | 10% | 20% | 25% | 35% |

| 2023 and subsequent years | 35% | 50% | 10% | 20% | 35% | 50% |

| Payment Amount Method | ||||||

| Payment Year | Medicare Option | All-Payer Combination Option (must meet both Medicare FFS and all patients) | ||||

| Medicare FFS (partial) | Medicare FFS (qualified) | Medicare FFS (partial) | Medicare FFS (qualified) | All Patients (partial) | All Patients (qualified) | |

| 2019-20 | 20% | 25% | Medicare Option only in these years | |||

| 2021-22 | 40% | 50% | 20% | 25% | 40% | 50% |

| 2023 and subsequent years | 50% | 75% | 20% | 25% | 50% | 75% |

Enrolling in Advanced APMs

For clinicians hoping to participate in existing APMs for the 2017 performance year, each APM has application and participation deadlines.

1. Medicare Shared Savings Programs

a. New applications – deadlines are announced each year and are in the summer. The application deadline to start a new Medicare Shared Savings APM on January 1, 2017, is July 29, 2016.

b. TIN participation – generally, TINs are required to be listed on the application and can be added annually.

c. Clinician participation – clinicians can join a participating TIN anytime in the performance year. The APM will update the participation roster periodically throughout the year. In order to be considered a participant by MACRA, the clinician must be a participant on December 31 of the performance year.

2. Next Generation Accountable Care Organizations (NGACOs) – CMS is not currently taking applications for this model. Practices and clinicians can inquire about joining existing NGACOs. The first round of NGACOs began three-year agreements in January 2016, and the second round will begin two-year agreements in January 2017.

3. Comprehensive Primary Care Plus (CPC+) – CPC+ is a five-year model that will begin in January 2017. CMS began the program with a payer solicitation period that ended on June 8, 2016. CMS announced the 14 regions from which they will accept applications for CPC+ on August 1, 2016. The application for practices is open from August 1 to September 15, 2016.

4. Comprehensive ESRD Care (CEC) – CMS is not currently taking applications for this model. The first round of CEC participants began their three-year agreements in October 2015, and those that applied in the second solicitation period (ending July 15, 2016) will begin two-year agreements in January 2017. Practices and clinicians can inquire about joining existing CEC organizations.

5. Oncology Care Model (OCM) – OCM is a five-year model that began on July 1, 2016. CMS is no longer taking applications for this model. Clinicians can inquire about joining existing OCM practices.

CMS also released a proposed rule on July 25, 2016, that introduces new Episode Payment Models (EPMs) surrounding hip fracture repairs, coronary artery bypass graft procedures, and acute myocardial infarctions. In this proposed rule, CMS indicates that these EPMs, as well as the existing Comprehensive Care for Joint Replacement (CJR) model, will qualify as Advanced APMs, and providers who are working with the hospitals affected by these programs may be able to achieve QP status based on their participation. More detail will be available when that rule is finalized, with the EPMs scheduled to begin on July 1, 2017 (with downside risk beginning on April 1, 2018). CMS also mentioned the creation of a Medicare Shared Savings Program ACO Track 1+, which would have enough downside risk to qualify as an Advanced APM but less downside risk than Tracks 2 and 3. More details on this model will be forthcoming, but we do not anticipate that it will be available for a January 1, 2017, start.

1For 2019, Advanced APMs are Medicare Shared Savings Program (MSSP) Tracks 2 and 3, Next Generation Accountable Care Organization Model (NGACO), Comprehensive ESRD Care (CEC) Large Dialysis Organization (LDO) arrangement and non-LDO two-sided risk arrangement, Comprehensive Primary Care Plus (CPC+), and Oncology Care Model (OCM) two-sided risk arrangement.

2MIPS APMs are Medicare Shared Savings Program (MSSP) all tracks, Next Generation Accountable Care Organization Model, Comprehensive ESRD Care (CEC) all options, Comprehensive Primary Care Plus (CPC+), and Oncology Care Model (OCM) all tracks. Note that all Advanced APMs are also MIPS APMs.

3This does not mean that all payments increase by this amount. If there were no other changes to the fee schedule, then the payments would increase by that percentage. However, there are many other factors that affect the Medicare Physician Fee Schedule each year. For example, 2016 payments were 0.29% less than 2015 payments despite the 0.5% increase from MACRA. The MACRA 0.5% increase only partially mitigated the overall decrease in payments.

4MACRA: Pub. L. 114-10, Sec. 101(c)(1) (April 16, 2015).

5The Advancing Care Information weights may decrease to as low as 15% if determined that 75% of eligible clinicians are meaningful users.