Background

Dual eligible special needs plans, or D-SNPs, are Medicare Advantage (MA) plans that only enroll beneficiaries who are dually eligible for Medicare and Medicaid. D-SNPs have become increasingly popular among both MA organizations (MAOs) and dual eligible beneficiaries because of their ability to tailor benefit designs to the needs of this population. D-SNPs have also become increasingly popular with state Medicaid agencies, some of which require Medicaid managed care organizations to also offer D-SNPs as a way to facilitate Medicare-Medicaid integration. Figure 1 shows the increase in D-SNP enrollment over the past 10 years.

Figure 1: D-SNP enrollment (CY 2011-CY 2021)

The Centers for Medicare and Medicaid Services (CMS) recently released initial information about CY 2022 MA plan offerings including D-SNPs.1 The remainder of this paper discusses key takeaways from a review of CY 2022 D-SNP plan offering data.

1. The D-SNP market continues its high growth rate

The number of D-SNPs will increase by more than 16% in CY 2022. Figure 2 shows the growth in D-SNPs over the past five years.

Figure 2: Number of D-SNPs (CY 2018-CY 2022)

In CY 2022, the pace of growth of offered D-SNPs (16.4%) will more than double the pace of growth of general enrollment plans (8.0%). Figure 3 shows the average annual growth in MA plans by year from 2018 through 2022 separately for D-SNPs and general enrollment plans.

Figure 3: Annual growth in number of plans by plan type (CY 2018-CY 2022)

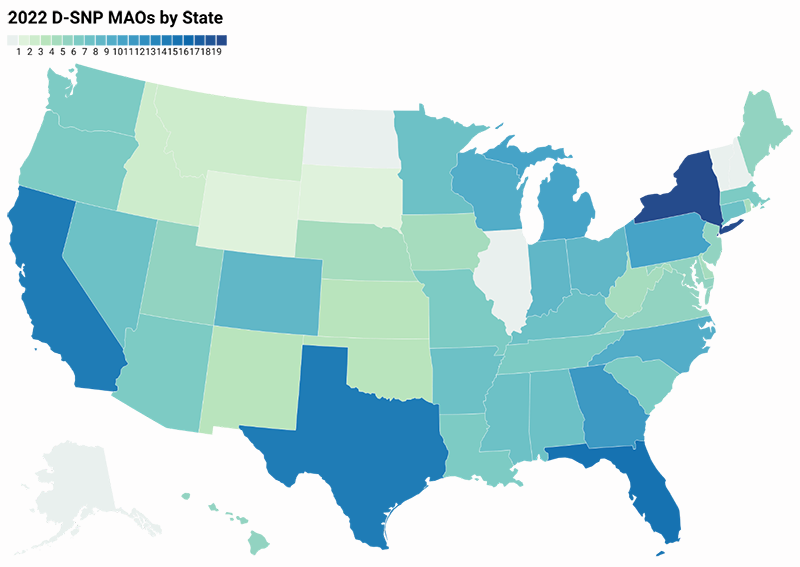

In addition to growth in the total number of plans, D-SNPs will be offered in two states that previously lacked this plan type (Wyoming and South Dakota). All but four states (Alaska, New Hampshire, North Dakota, and Vermont) will now have at least one D-SNP or Medicare-Medicaid Plan (MMP).2 Figure 4 shows the number of unique MAOs offering D-SNPs in each state.

Figure 4: Number of MAOs offering D-SNPs by state (CY 2022)

2. D-SNP enrollment and plan offerings continue to be concentrated in a few national MAOs.

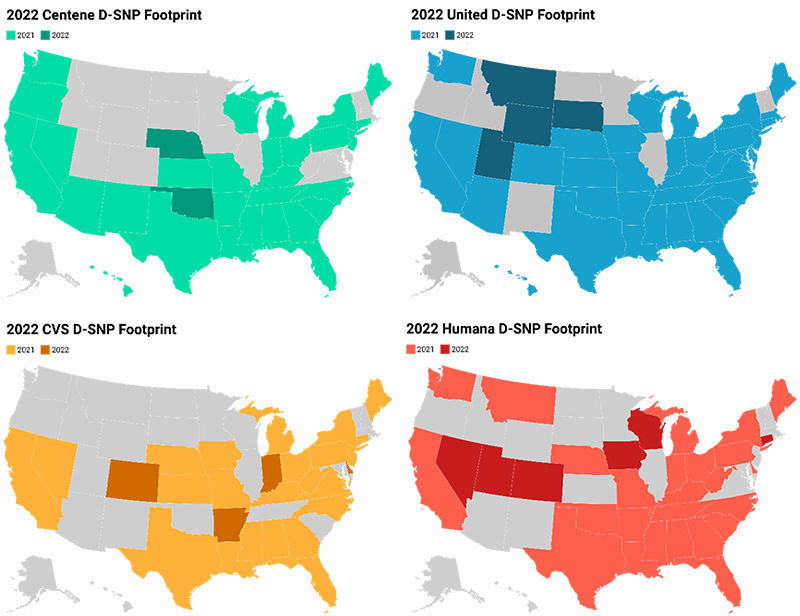

UnitedHealthcare continues to offer D-SNPs in more states (42 in CY 2022) and cover more D-SNP beneficiaries (1.23 million or 34% of the D-SNP market as of July 2021) than any other MAO. Centene (Allwell) and Humana tie for the second largest footprint with 32 states. Aetna (CVS Health) has the fourth largest footprint with 27 states. Figure 5 shows the MAOs with the largest D-SNP footprints.

Humana will expand its D-SNP footprint significantly in CY 2022 by offering or acquiring D-SNPs in six new states (Colorado, Connecticut, Iowa, Nevada, Utah, and Wisconsin). Molina HealthCare also expanded in CY 2022 with five new states and UnitedHealthcare added four states.

Figure 5: National MAO D-SNP footprints (CY 2022)

3. The average star rating for D-SNPs increased, with over 70% of D-SNPs achieving a 4-star rating or higher

In 2022, the average star rating among D-SNPs increased from 3.60 to 3.79. The number of D-SNPs with star ratings of 4 or greater has increased from approximately half in 2018 to nearly 70% in 2022. The trend in D-SNP star ratings is generally consistent with those observed in general enrollment plans. Figure 6 illustrates the improvement in D-SNP star ratings over the last five years.

Figure 6: Average D-SNP star rating by year (CY 2018-CY 2022)

4. D-SNP integration requirements have largely been met through coordination and have not significantly deterred MAO participation in the D-SNP market

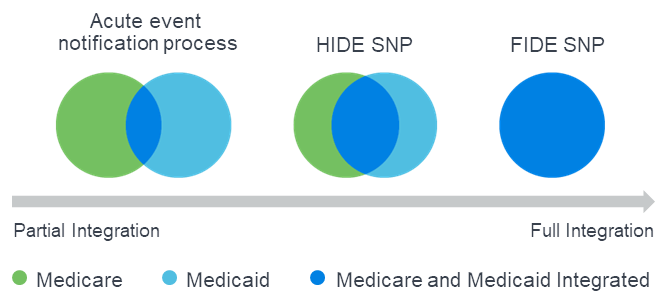

Beginning in CY 2021, D-SNPs were required to meet new minimum integration standards through at least one of the three avenues shown in Figure 7: Fully Integrated D-SNP (FIDE SNP), Highly Integrated D-SNP (HIDE SNP), or an acute event notification process (“coordination only”) between the D-SNP and the state Medicaid agency.3,4

Figure 7: CY 2021 D-SNP integration options

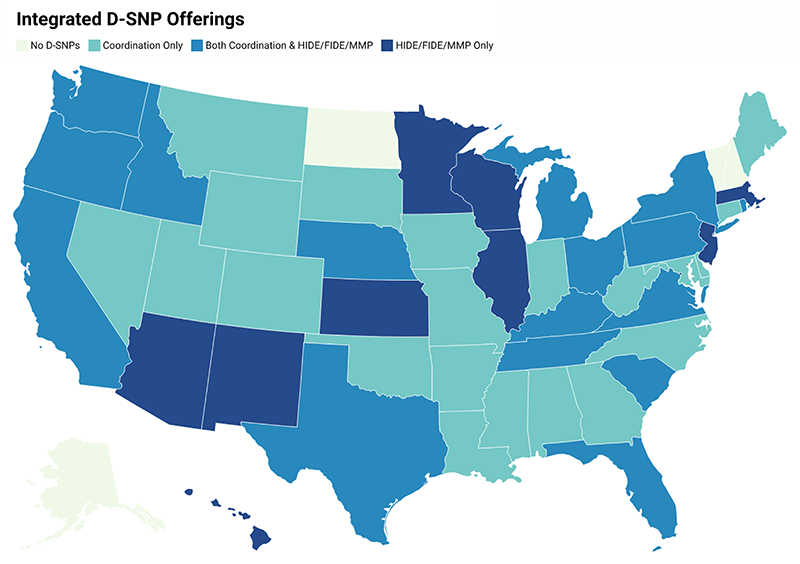

The new integration requirement do not appear to have significantly altered the D-SNP landscape for CY 2022 through either market exits or curtailed growth. Figure 8 shows the growth in each type of D-SNP plan from CY 2021 to CY 2022. In both years, coordination-only plans represent approximately 58% of plans while HIDE and FIDE plans represent over 40% of plans.

Figure 8: Number of D-SNPs by integration status (CY 2021-CY 2022)

D-SNP offerings in eleven states (including Puerto Rico and Washington D.C.) are limited to HIDE, FIDE, or MMP plans. Figure 9 illustrates whether each state offers coordination only plans, only integrated plans, or a combination of both in CY 2022.

Figure 9: CY 2022 D-SNP plan offerings by state

5. Impending regulatory changes are likely to impact the D-SNP market in 2023, especially in California

In 2023, two significant regulatory changes will impact the D-SNP market:

First, CMS will not renew D-SNP look-alike plans in states with existing D-SNPs or MMPs.

D-SNP look-alike plans will be identified by CMS as general enrollment plans whose membership is comprised of over 80% dual eligible beneficiaries.5 We estimate that approximately 250,000 dual eligible beneficiaries are currently enrolled in D-SNP look-alike plans, over half of which are in California. Barring a regulatory change or increased non-dual enrollment in these plans, beneficiaries in D-SNP look-alike plans will be disenrolled in 2023 and may seek coverage in D-SNPs.

Second, California’s Financial Alignment Initiative (FAI) will end, and dual eligible beneficiaries currently enrolled in MMPs will be transitioned to aligned D-SNPs and Medicaid managed care plans.

California is one of eleven states currently participating in the CMS FAI, which allows states to test models to integrate care for dual eligible beneficiaries. California’s FAI model, known as Cal MediConnect, was implemented in seven of California’s largest counties and uses MMPs to provide Medicare and Medicaid benefits under a single health plan. As of October 2021, approximately 115,000 dual eligible beneficiaries are enrolled in California’s MMPs. This represents over 40% of the combined D-SNP/MMP enrollment in California.

One component of California’s CalAIM healthcare transformation initiative is ending Cal MediConnect and transitioning to a model that includes separate, but aligned, Medicare and Medicaid managed care plans. The first major step in the transition occurs in January 2023 when MMP members will be cross-walked into aligned D-SNPs offered by the MMP plan sponsor in 2023.6 This will significantly increase D-SNP enrollment in California.

Limitations

The opinions stated in this article are those of the authors and do not represent the viewpoint of Milliman.

Guidelines issued by the American Academy of Actuaries require actuaries to include their professional qualifications in all actuarial communications. Nick Johnson, Annie Hallum, and Nick Gipe are members of the American Academy of Actuaries and meet the qualification standards for sharing the information in this article. To the best of their knowledge and belief, this information is complete and accurate.

This information is intended to provide an overview of the CY 2022 Medicare Advantage D-SNP market. The list of considerations outlined in this article is not exhaustive. This information may not be appropriate, and should not be used, for other purposes.

Milliman does not intend to benefit and assumes no duty of liability to parties who receive this information. Any recipient of this information should engage qualified professionals for advice appropriate to its own specific needs.

1 CMS. Prescription Drug Coverage – General Information. Retrieved October 19, 2021, from https://www.cms.gov/Medicare/Prescription-Drug-Coverage/PrescriptionDrugCovGenIn/index.

2 MMPs, authorized under the Financial Alignment Initiative (FAI), are health plans that provide coordinated Medicare and Medicaid benefits for dually eligible individuals.

3 CMS (October 7, 2019). CY 2021 Medicare-Medicaid Integration and Unified Appeals and Grievance Requirements for Dual Eligible Special Needs Plans (D-SNPs). Medicare-Medicaid Coordination Office. Retrieved October 26, 2020, from https://www.cms.gov/Medicare-Medicaid-Coordination/Medicare-and-Medicaid-Coordination/Medicare-Medicaid-Coordination-Office/Downloads/DSNPsIntegrationUnifiedAppealsGrievancesMemorandumCY202110072019.pdf.

4 CMS (January 17, 2020). Additional Guidance on CY 2021 Medicare-Medicaid Integration Requirements for Dual Eligible Special Needs Plans (D-SNPs). Medicare-Medicaid Coordination Office. Retrieved October 26, 2020, from https://www.cms.gov/files/document/CY2021dsnpsmedicaremedicaidintegrationrequirements.pdf.

5 D-SNP Look-Alike Transitions for CY 2021. Retrieved February 3, 2022, from https://www.hhs.gov/guidance/sites/default/files/hhs-guidance-documents/cy21%20d-snp%20look-alike%20transition%20hpms%20memo%20final.pdf.

6 Cal MediConnect to D-SNP Transition. Retrieved February 3, 2022, from https://www.dhcs.ca.gov/provgovpart/Pages/Cal-MediConnect-to-D-SNP-Transition.aspx.