The Center for Retirement Research at Boston College recently published a study that found in-service withdrawals (partial withdrawals and hardships) and cash-outs were the main reasons for leakage from 401(k) plans and IRAs. Leakage refers to the erosion of assets in retirement accounts approximately 1.5% of retirement plan assets leak out every year. This can potentially lead to a reduction in total retirement assets of 20% to 25% over an employee's working years. The phenomenon is the result of the gradual change in retirement funding vehicles over time from predominantly defined benefit plans to defined contribution plans and, in recent years, IRAs.

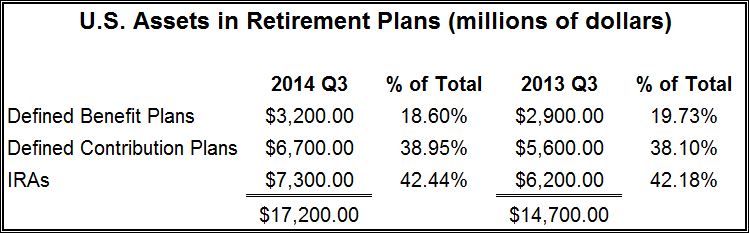

The impact of this 1.5% leakage is easier to grasp when the total dollar amount involved is known. The Investment Company Institute's quarterly reports show the following numbers. Consider the total assets affected and the significance of that annual number.

401(k) plans have three main sources of leakage:

In-service withdrawals: In-service encompasses one of two options: a hardship withdrawal or a withdrawal at age 59 . Hardships can be taken based on proof of an immediate financial need, but they are subject to an early 10% tax penalty (if applicable) on top of the required 20% federal tax and they force a participant to cease deferrals for six months. Hardships also require participants to use up their loan resources first. By the time a participant is eligible for a hardship, the account has been severely depleted. In-service withdrawals allow an active employee who has reached the age of 59 to remove funds from the account without the 10% penalty. These age 59 withdrawals are on the rise and the leakage arises when the funds are not rolled over. It is estimated that only about 70% are, in fact, rolled into an IRA.

Loans: Approximately 90% of actively working individuals enrolled in a retirement plan have access to some type of loan. While loans get a bad rap, they are not the leading offender in terms of leakage, but there is still some asset loss. If loans are repaid in a timely manner, the withdrawal is not taxed, but the employee no longer has the ability for gains on those assets during the repayment period. And while the participant has an obligation to repay, that does not always happen. When the loan has defaulted, it is deemed a distribution and is then subject to tax withholding.

Cash-outs: Cash-outs are the act of automatically paying out terminated participants below a certain threshold; for balances of $1,000 or less, checks are cut, whereas balances between $1,000 and $5,000 require a rollover to an IRA. And while plan sponsors do have a say in the dollar threshold and the timetable for cash-outs, virtually every 401(k) plan has this rule.

Looking at defined contribution plans only, withdrawal activity has increased slightly over the last three years, while hardships have remained steady. These numbers may seem small, but they do not include IRAs, which are considerably harder to track. And because IRAs lack the same rules as defined contribution plans, estimates suggest the percentages are much higher.

Source: Investment Company Institute

The Federal Reserve's 2013 Survey of Consumer Finance presented some scary results workers between the ages of 55 and 64 had average assets of only $111,000. What's more, assets in IRAs have surpassed assets in defined contribution plans. Looking at the numbers above for third quarter 2013 and 2014, IRAs consistently have 2.5% more in assets than defined contribution plans. IRAs can be risky for long-term retirement funding, if not used correctly, which is due to the lower levels of regulations and the lack of education and promotion to keep assets in. A recent Department of Labor report expands on this concern that rolling funds to IRAs puts the worker at the mercy of the investment advisor and asks whether all investment advisors take their fiduciary duties seriously or not. The report discusses what they call conflicting advice and estimates the leakage due to this is as high as 12% of an account balance.

There is hope. Some proposals that have been suggested include:

- Raise the age requirement for early withdrawal from 59 to 62 to match the earliest Social Security retirement age

- Limit balances for in-service withdrawals to only employee contributions

- Tighten hardship rules even more and only allow hardships in case of unpredictable events, for both 401(k) plans and IRAs

- Remove cash-outs altogether (this will mostly likely be met with resistance from plan sponsors because small balances can be expensive and burdensome to administer)

Plan sponsors can make many of these adjustments to their individual plans, but these proposals are working to ensure that the goal of preparing workers for retirement stays in sight.