The years following high school have always been a time of uncertainty for students choosing to pursue postsecondary education. The choices made around college and picking a major have big implications on a student’s career trajectory, not to mention financial situation, for years to come. The COVID-19 pandemic has added additional uncertainty to an already stressful time. Schools have announced plans for in-person and/or virtual learning and continue to change course as more is known about the virus. Students nearing graduation are faced with a historic unemployment rate and a sputtering economy.

The growing uncertainty concerning the format of higher education, the postgraduate job market, and the long-term impact of student debt leaves many individuals wondering if they will ever earn enough to free themselves from student debt. Innovation often arises in the midst of uncertainty.

There are already companies innovating in the student loan space, but significant opportunity remains for insurtechs and traditional insurance carriers to create a unique “win/win”: sustainable solutions that capture a portion of the $1.54 trillion student loan market, while also providing students with post-graduation financial stability—helping graduates achieve their future dreams.

Format of higher education, COVID-19, and beyond

As the global pandemic stretches into its sixth month, educators across the country are faced with difficult decisions. Academic leadership is tasked with trying to offer a quality learning environment while navigating student and faculty safety in the midst of constantly evolving information from health experts.

As the saying goes, “The best laid plans… often go awry.” This has certainly been the case as many universities have had to pivot their plans for the 2020-21 academic year multiple times as they attempt to offer their students a safe and effective learning environment while navigating changing regulations, differing health expert opinions, and the safety of their faculty and staff colleagues. Additionally, some schools that started in-person learning have already reversed those plans due to the quick emergence of the virus on campus. Notably, both the University of North Carolina at Chapel Hill and North Carolina State University began classes in person, but quickly changed directions when several clusters of COVID-19 appeared on campus within the first week of classes.1,2 Recently, both the University of Iowa and Iowa State University have seen concerning increases in COVID-19 test results, with the counties they are located in reporting positive rates of 30% to 40%.3 Other colleges have experienced similar issues, with numerous universities eclipsing 100 reported COVID-19 cases before the start of September.4

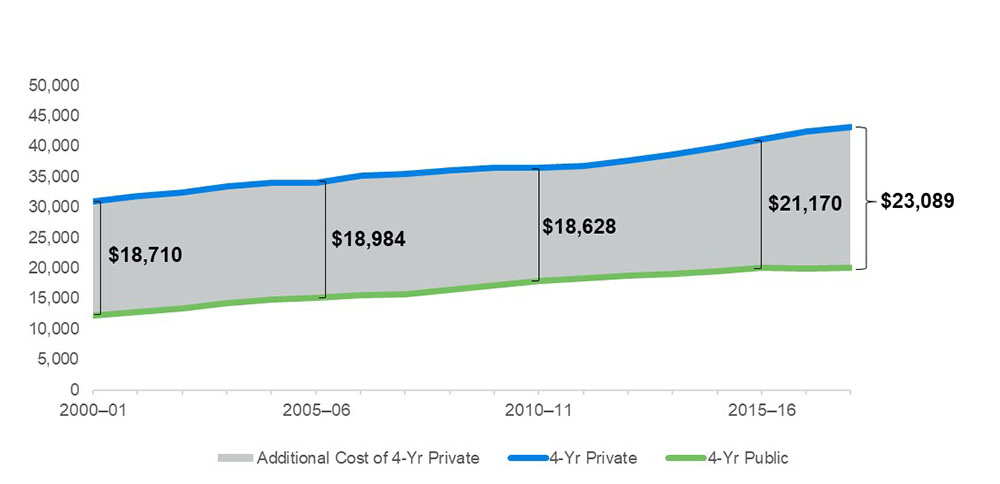

These frequent pivots have caused many students to pause and reevaluate their previous plans. According to data gathered by Davidson College, only 2% of the nearly 3,000 colleges it is monitoring plan to return to fully in-person classes in the fall of 2020.5 Students have cited concerns with remote learning such as not getting the same benefit of small in-person class sizes touted by many private institutions. For those schools offering hybrid learning environments, some students may consider transferring to smaller schools in the hopes of minimizing their exposure to COVID-19. In the most recently available data, 21% of full-time undergraduate students attend private institutions.6 The average annual tuition and room and board cost at a private college or university is $23,089 greater than that of a public institution, a gap that has increased substantially in the past 10 years (see Figure 1).7

Figure 1: Average Tuition, Room, and Board for Full-Time Undergraduates (in 2017-18 dollars)

With the announcements of more virtual learning environments, some students may opt to begin their education at a two-year college to save money on general education credits, while planning to transfer to a four-year institution once classes return to in-person. Additionally, two-year colleges may be better positioned to transition to virtual environments, as evidenced by the fact that they already have higher rates of enrollment in “distance education courses.”8 Still other students are opting to delay entering college altogether.

It is difficult to say whether these format changes will persist in a post-COVID-19 world, but it is feasible to believe that higher education may see some consolidation, along with the emergence of more programs specialized in distance education or virtual learning if enrollment sees sustained declines. With the emergence of more virtual learning environments, students entering their early college years have certainly had a lot to consider regarding their plans for the upcoming year, while students nearing graduation have another set of obstacles ahead.

Economic outlook for recent graduates

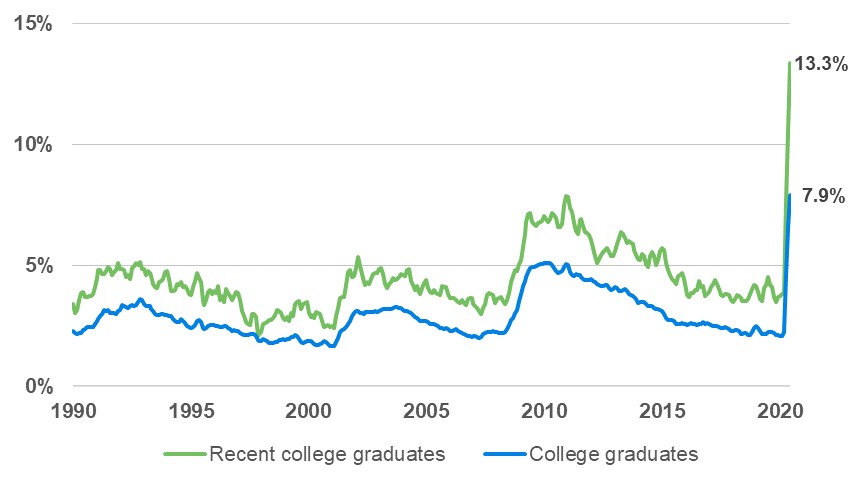

In addition to being saddled with large student loan debts, students nearing graduation are staring down a volatile economy with high unemployment, making the repayment of those debts more daunting. Perhaps even more stark is the realization that this high unemployment rate tends to disproportionately affect recent graduates. According to the Federal Reserve Bank of New York, June’s unemployment rate for all college degree holders rose to 7.9%, but if you are a recent college graduate, that rate jumps to 13.3% (see Figure 2).9

Figure 2: The Labor Market for Recent College Graduates, Unemployment Rates

Recent college graduates not only face these high unemployment rates, but they also face underemployment rates roughly 20% greater than the population of college graduates as a whole.10 Graduating into an uncertain job market may lead students to pursue postgraduate education, incurring additional debt, rather than enter the job market during a recession. It remains to be seen whether graduate programs will see a surge in students due to this most recent recession.

State of student debt and COVID-19 relief

Regardless of what effect COVID-19 has on this year’s enrollment, student loan debt remains at an all-time high of $1.54 trillion, more than double where it was a decade ago.11 According to Sallie Mae, approximately 21% of the cost of college for a typical family was financed through borrowing. Federal student loans are still the primary source of borrowing, with 30% of students utilizing them. Beyond federal borrowing, 13% of students used private student loans and 6% used other student-borrowed loans.12

The combination of unemployment or underemployment with large outstanding loan balances can create a financial burden for recent college graduates. This burden was addressed in the first COVID-19 aid bill, the Coronavirus Aid, Relief, and Economic Security (CARES) Act, and further extended by a presidential memorandum in August. Through this legislation, payments associated with federally held student loan debt are suspended until 2021 without penalty and 0% interest will accumulate on the debt during this time.13

While the CARES Act provides relief for struggling graduates, it does not address outstanding private student debt or federal loans not held by the U.S. government. Ten U.S. states negotiated an agreement with private lenders to provide some form of temporary relief that will address private student loan debt during the COVID-19 pandemic. While the provisions differ by lender, they can include at least 90 days of forbearance, waiving late payment fees, forgoing negative credit reporting, and other options. Other states addressed student loan debt issues not covered by the CARES Act by opting to provide relief from state-serviced loan debt or by offering broader protections, such as suspending wage garnishments on certain types of consumer debt.14 While federal and state relief provisions will help graduates in the short term, the long-term concern remains that student debt continues to grow at an astronomical rate.

New options to insure student loan debt

To address the student loan burden, several alternative solutions have recently emerged with an aim of helping students guarantee that their postgraduate incomes will be sufficient to start chipping away at their college debt. While these products existed before the pandemic hit, they offer insight into how insurance and loan repayment programs can be a vital support for recent graduates.

Since 2009, the federal government has offered a variety of income-driven repayment (IDR) plans to help reduce the monthly payment burden for low-income graduates. However, these programs do not apply to private debt, and they often increase the repayment term of the loan, which in turn can increase the total payment over the lifetime of the loan due to more accumulated interest. While there is a safety valve at the end of many IDR plans that will fully forgive the remaining loan balance, the repayment period is at least 20 years for most individuals, with the exception of the 10-year public service loan forgiveness program.15

A number of insurtechs also offer insight as to how to innovate in the student loan space. A start-up known as Degree Insurance touts a product called American Dream Insurance that insures student income for the first five years following graduation. The company estimates a student’s expected income based on the degree attained as well as the graduating institution, and then agrees to guarantee a portion of that estimate. Upon conclusion of the five years, if a student has not earned the sum of money projected, the insurance company writes a check for the difference. Degree Insurance is still in its early stages, but the state of Illinois just gave Degree the green light to begin writing policies there.16

A pioneer in student loan insurance, Ardeo Education Solutions, has been offering its Loan Repayment Assistance Program (LRAP) since 2008. The purpose of LRAP is to help students pursue college by mitigating fears that postgraduate income will not be enough to cover their student loan payments. In Ardeo’s own words, “LRAP is a financial safety-net. Ultimately, we hope you land a great job that compensates you well after graduation. If you are unable to find a well-paying job or find something meaningful that pays less, however, we want to support you in pursuing your passions, confident that loans will not stand between you and your successful future.”17

Rather than marketing these products toward students, both Degree and Ardeo are targeting the schools themselves. Colleges that purchase the coverage on behalf of their students are able to offer the post-graduation income and loan payment guarantees to current and prospective students, with the hope that these benefits lead to higher retention and enrollment.

Another similarity between the programs is that their viability is tied to actuaries. Dennis Murashko, a cofounder of Degree Insurance, has a background as an actuary18 and LRAP “was developed in conjunction with an industry-leading actuarial firm” to ensure it can keep its long-term promises to students.19 Creating sustainable programs of this nature requires the ability to project long-term trends as well as an understanding of economic modeling, drawing similarities to actuarial work performed for traditional insurance products. Believe it or not, the insurance industry might be the place to look for other innovative solutions to help students pay for college.

As the future of higher education evolves to meet today’s challenges, it will be important to handle the economic uncertainty amidst a global pandemic, as well as long-term concerns about increasing student debt. The student loan market is in need of a cure, so innovators should continue to consider ways to help alleviate both the immediate and deep-rooted uncertainties students face.

1The Well (August 17, 2020). Carolina to switch to remote instruction, reduce residential density. University News. Retrieved September 9, 2020, from https://www.unc.edu/posts/2020/08/17/shift-to-remote/.

2NC State University (August 20, 2020). Letter from Randy Woodson, Chancellor: Fall semester undergraduate classes moving online. Retrieved September 9, 2020, from https://www.ncsu.edu/coronavirus/fall-semester-undergraduate-classes-moving-online/.

3Jaschik, S. (September 1, 2020). COVID-19 roundup: A pool party "almost like Mardi Gras." Inside Higher Ed. Retrieved September 9, 2020, from https://www.insidehighered.com/news/2020/09/01/covid-19-roundup-pool-parties-outbreaks-iowa-new-database.

4New York Times (September 3, 2020). Tracking Coronavirus Cases at U.S. Colleges and Universities. Retrieved September 9, 2020, from https://www.nytimes.com/interactive/2020/us/covid-college-cases-tracker.html.

5Davidson College. College Crisis Initiative Dashboard. Retrieved September 9, 2020, from https://collegecrisis.shinyapps.io/dashboard/. Calculation by the authors (69 / 2,958 = 2.3%). Note that numbers are subject to change as plans continue to evolve for the fall semester.

6College Board. Trends in College Pricing, Figure 21: Postsecondary Fall Enrollment by Attendance Status and Level of Enrollment. Retrieved September 9, 2020, from https://research.collegeboard.org/trends/college-pricing.

7IES National Center for Education Statistics. Fast Facts: Tuition costs of colleges and universities. Calculation by the authors ($43,139 – $20,050 = $23,089).

8IES National Center for Education Statistics (May 2020). Undergraduate Enrollment, Figure 6: Percentage of Undergraduate Students at Degree-Granting Postsecondary Institutions Who Enrolled Exclusively in Distance Education Courses, by Level and Control of Institution: Fall 2018. Retrieved September 9, 2020, from https://nces.ed.gov/programs/coe/indicator_cha.asp. Excludes private for-profit institutions.

9Federal Reserve Bank of New York (July 17, 2020). The Labor Market for Recent College Graduates: Unemployment. Retrieved September 9, 2020, from https://www.newyorkfed.org/research/college-labor-market/college-labor-market_unemployment.html.

10Ibid. Calculation by the authors (39.0% – 32.7%) / (32.7%) = 19.3%.

11Federal Reserve Bank of New York (August 2020). Center for Microeconomic Data: Quarterly Report on Household Debt and Credit. Retrieved September 9, 2020, from https://www.newyorkfed.org/microeconomics/hhdc.html.

12Sallie Mae (2020). How America Pays for College. Retrieved September 9, 2020, from https://www.salliemae.com/assets/research/HAP/HowAmericaPaysforCollege2020.pdf.

13U.S. Department of Education (August 21, 2020). Secretary DeVos fully implements President Trump's presidential memorandum extending student loan relief to borrowers through end of year. Press release. Retrieved September 9, 2020, from https://www.ed.gov/news/press-releases/secretary-devos-fully-implements-president-trumps-presidential-memorandum-extending-student-loan-relief-borrowers-through-end-year.

14Porter, K. (June 4, 2020). How states are supporting student loan coronavirus relief. U.S. News & World Report. Retrieved September 9, 2020, from https://loans.usnews.com/articles/how-states-are-supporting-student-loan-coronavirus-relief.

15Individuals must be working full-time for a government or a not-for-profit organization to qualify for the 10-year public service loan forgiveness program. See https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service.

16Prosser, D. (August 20, 2020). How entrepreneurs Wade Eyerly and Dennis Murashko plan to take the risk out of a college education. Forbes. Retrieved September 9, 2020, from https://www.forbes.com/sites/davidprosser/2020/08/20/how-entrepreneurs-wade-eyerly-and-dennis-murashko-plan-to-take-the-risk-out-of-a-college-education/#698a6859629e.

17LRAP. How LRAP Works. Retrieved September 9, 2020, from https://mylrap.org/how-lrap-works/.

19Ardeo. Frequently Asked Questions. Retrieved September 9, 2020, from https://ardeoeducation.org/faq/.