Storm Christoph

Storm Christoph brought strong winds, heavy rain and snow to the UK between 19 and 21 January 2021.

- The most intense rainfall occurred over north Wales and northern England, bringing localised flooding to many areas. The Environment Agency (EA) and Natural Resources Wales (NRW) issued flood warnings across much of the two countries, including severe flooding warnings on the River Mersey, River Bollin and the English and Welsh River Dee. Approximately 3,000 people were evacuated from their homes.

- Impact to property was not as severe as feared, with estimates ranging from 400 to 600 residential properties and about 100 commercial premises affected. The EA reported that 38,000 properties were protected by flood defences, although many defences, including those along the River Mersey in Didsbury, came within centimetres of being overtopped during the event.

- The Met Office reported that 50 to 100 mm of rain fell widely across Wales and northwest England, with over 100 mm across upland areas of Wales, southwest England, the Lake District and the Pennines. At several locations more than 100% of the January monthly average rainfall fell between 18 and 20 January.1

Storm Darcy

The UK experienced a week of severe winter weather from 7 to 13 February 2021, with easterly winds drawing a bitterly cold airflow from eastern Europe. Storm Darcy brought some strong winds and heavy snow to parts of southeast England on 7 February, while persistent snow showers resulted in significant accumulations across eastern England and Scotland. In the wake of the snowstorm, Braemar recorded -23°C on 12 February, the lowest temperature in the UK since 1995.2

July 2021 floods

The flooding in July 2021 was unusual as it resulted from several isolated days of intense rainfall across East and Southeast England:

- On 9 July 2021, nearly 90 mm of rain fell in Peterborough while parts of Norwich saw 50 mm of rain—nearly two months of rain in two hours.

- On 12 July 2021, nearly 76 mm of rain fell in 90 minutes in parts of London, resulting in 120 Kensington and Chelsea residents being evacuated from their homes. By lunchtime on 12 July, eight underground lines had been suspended and multiple underground stations had been closed, including Euston Station. The London Fire Brigade reported over 1,000 calls relating to flooding. Kew, in southwest London, experienced 47.8 mm of rainfall in a single hour, compared to an average monthly rainfall of 44.5 mm, which makes it Kew’s wettest day since 6 July 1983.

- Just five days later, on 17 July 2021, 76 mm of rain fell in 90 minutes, causing floods along Portobello Road, with flood levels reaching at least 0.45 metres.

- Torrential rain on 25 July 2021 deluged several locations around the south of England. Bethersden in Kent received 48.5 mm within one hour, between 3 p.m. and 4 p.m., while Ryde, on the Isle of Wight, received around 38.5 mm. Several roads and underground stations in London were affected. The wettest area in London was St James’s Park, which recorded 41.8 mm of rainfall in a day, equal to the total average monthly rainfall for July in London.

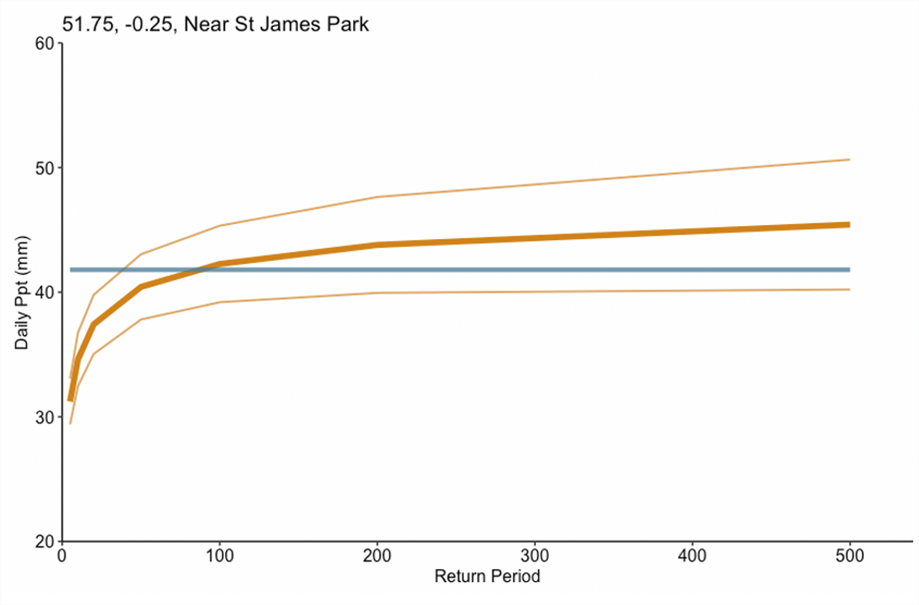

- As shown in Figure 1, a General Pareto Distribution curve was fitted to historical records available for the closest location (51.75, -0.25) to St James’s Park, London. The historical rainfall records were obtained from gridded rainfall between 1979 and 2020 from the NOAA Physical Science Laboratory Climate Prediction Center (CPC) Global Unified Gauge-Based Analysis of Daily Precipitation data set. Based on a daily total of 41.8 mm at St James’s Park, the estimated return period based on rainfall intensity is approximately 50 to 100 years.

Figure 1: Return periods for daily rainfall based on historical records near St James's park

Source: JBA Risk Management Ltd, Figure 1 retrieved from https://www.jbarisk.com/flood-services/event-response/a-retrospective-look-at-summer-2021-london-flash-floods/

- Following the floods on 25 July, two hospitals and eight tube stations were closed for a day. Among those were Whipps Cross Hospital, which had to evacuate 100 patients due to a power failure, and Pudding Mill Lane DLR station, which saw flood waters reach 0.4 to 0.5 metres deep. Other areas that were flooded include Nine Elms Park, Hampstead, Upper Leytonstone and Hackney Wick.3

Economic impact

Londoners have seen their homes "wrecked" and belongings "destroyed" after the July 2021 flash floods overflowed the capital’s roads and poured into properties. Damage to businesses, infrastructure and residential buildings was estimated in the millions of pounds after a month’s worth of rain fell in just over an hour.4

Historically, floods have caused billions in economic damages in the UK:

- The flood events that occurred during the 2013-2014 winter months incurred total economic damages of approximately GBP 1.3 billion.

- The winter flood events of 2016 (following storms Desmond, Eva and Frank) caused an estimated GBP 1.6 billion in damages.

- The flooding of summer 2007 occurred after one of the wettest May and June periods since records began in 1766. Over 55,000 homes in the Midlands and Home Counties were flooded, with losses totalling GBP 3.2 billion in economic damages.

- The economic cost of flooding in 2019 and 2020 was estimated to be GBP 78 million. The cost would have been GBP 2.1 billion higher without flood defences. This emphasises the importance of maintaining flood defences across the UK.

In 2020 the Environment Agency announced an investment in flood defences (for both capital and revenue) of GBP 5.2 billion, creating approximately 2,000 new flood and coastal defences to improve protection to 336,000 properties in England by 2027. However, flooding remains a significant risk in the UK.5

Low-income households are amongst the most at risk to flooding and the detrimental financial consequences. They are eight times more likely to live in tidal floodplains than affluent households and 61% of low-income renters do not have home contents insurance, leaving them more susceptible to financial shock.6

Human loss

No fatalities were reported in the UK due to 2021 extreme weather events. However, there is an impact on human health, including mental health. Government research found that people who experience extreme weather events such as storms or flooding are 50% more likely to suffer from mental health problems, including depression and anxiety, while a quarter of people who have been flooded still live with these issues at least two years after the event.7

Impact on insurers

PwC estimates losses from Storm Christoph at between GBP 80 million and GBP 120 million. Homeowners whose properties flooded will not necessarily see an increase in their flood premiums when their policies renew, because Flood Re charges a fixed premium for the flood element of home insurance for properties built before or during 2009.8

Insurance data specialist PERILS estimated the event to be less than a EUR 200 million property market loss.9

The aggregate insured losses from the 2021 July floods are yet to be reported and are expected to be more than GBP 100 million:

- Allianz and LV announced losses of GBP 15 million and GBP 7 million, respectively.10

- PERILS has estimated an industry loss of GBP 264 million.11

Estimating the impact of floods

Urban flash flooding, or surface water flooding, occurs after a heavy downpour of rain that hits the ground faster than it can drain or flow away. As a result, water builds up and develops the potential to flood properties. Estimating the realistic impact of urban flash flooding is difficult prior to the development of claims because:

- Flash flooding typically occurs in disconnected areas where there are depressions in the ground or the drainage system is overwhelmed, making the creation of a footprint challenging.

- Basement flooding is often not seen in overhead imagery or in the media and only becomes apparent when a claim is made.

The underwriting and pricing of the overwhelming majority of flood insurance in the UK relies on output from broad-scale nationwide flood maps. Flood maps indicate areas of increased surface water flood risk, but it is much more difficult to account for local features which can significantly impact a property’s flood risk. For example, some of the 2021 London flooding was driven by local features such as boundary walls, blocked drains, drain backup and basements. In some areas, like Portobello Road, flood hazard maps did not entirely capture the areas that flooded. In these locations, most claims were from properties with basements and localised features not captured in broad-scale mapping.12

Reasons for the large losses in London

- Basements. As a result of high property prices and a large number of Georgian and Victorian homes, London has a significantly higher percentage of properties with occupied basements than other areas in the UK. Additionally, London is renowned for multilevel basements, which often store high-value items that can lead to multimillion-pound claims when damaged. Both residential and commercial occupants often store valuable belongings, stock or equipment below ground, and basement flooding is likely to be deep, long-lasting and expensive to clean up.

London also has residential apartments at basement level, which can be dangerous as evidenced by the 2021 New York City floods where 11 people lost their lives in basement apartments. To further complicate insurance matters, basements are invisible from above so they do not appear in the height map data used to model flood risk, making it very difficult to represent this risk in flood maps.13 - Impermeable surfaces. London properties are highly susceptible to surface water flooding due to a predominance of impermeable surfaces that increase rainfall runoff. Trends that advocate moving from gardens to paving, and from tarmac to concrete surfaces, further increase surface water runoff.

- Ageing drainage system. Standard design and maintenance of drainage systems vary by location and nationwide data on drainage capacity is not available. However, within many cities, the design and construction of drainage system infrastructure lagged population growth. Inner London’s "Victorian" drainage system was designed for a city of 4 million, but now serves 9 million residents. This network is at 80% capacity in dry weather, so its capacity is highly constrained during heavy rainfall. Surface water flooding is most likely to occur when the drainage system fails, whether it is due to the drainage reaching capacity, or individual drains being blocked by debris. Furthermore, if the drainage system reaches capacity, internal pressure can lead to drainage backup in certain areas or within properties.

Claims reporting and settlement

Parametric insurtech firm FloodFlash quickly issued pay-outs to policyholders affected by flooding from Storm Christoph, in many cases on the same day that the flooding occurred. The fastest claims took just nine hours and 44 minutes from the property flooding to the client receiving the full settlement in their account, which FloodFlash says is a new catastrophe claims record. FloodFlash internet of things (IoT) sensors began to detect floods on Wednesday, 20 January, triggering claims on parametric policies across the country, which are based on a pre-agreed depth of flooding. FloodFlash also set the previous record for fastest property flood claims following Storm Ciara in February 2020, at 26 hours and 15 minutes.14

Sedgwick, one of the UK's leading loss adjusters, received over 2,000 flood claims across 12 July, 17 July and 25 July. Many of these are classified as large claims.15

Outlook for the future

The economic loss and damage from flooding in the UK is projected to increase, from rivers, at the coasts and from intense downpours in urban areas.

- There is a 10% chance of a catastrophic flood happening in England within the next two decades causing more than GBP 10 billion in damage. Such a flood would cause 10 times more flood damage than the combined impact of the tidal surge and storms of winter 2013-14, and three to four times more damage than in 2007.16

- The UK’s biggest insurer, Aviva, estimates that one in five properties in the UK are at risk of surface-water, river or coastal flooding. According to Aviva, there has been a “major spike” in claims in the past two years. Even more worryingly, as seen in July 2021, there appears to be a rise in the number of flood events outside of winter months, due to increased surface water following heavy downpours.17

- While most business owners are worried about the impact of climate change over the next 10 years, 75% of small and medium-sized enterprises do not have business continuity plans that consider climate change risks and just 38% have flood insurance in place. Only 18% of all businesses have implemented any flood resilience measures to protect their premises.18

- With a projected increase in the frequency of severe storms due to climate change, these problems in dense urban areas will only worsen in the future. Under a 1°C global warming scenario, daily rainfall rates are expected to increase by 6% to 7%, with sub-daily rainfall rates—those causing these short sharp severe downpours as experienced during the July 2021 events—likely to increase by 12% to 14%. This is expected to be compounded by population growth in cities and increased urbanisation.19

In July 2020, the Government and Environmental Agency announced a new GBP 5.2 billion flood prevention and coastal management strategy to be brought in over the next 10 years, including protection of 336,000 properties in England by 2027. The National Audit Office argues that investing in flood defences is highly cost-effective, concluding that each GBP 1 not invested means communities will suffer up to GBP 8 in unnecessary flood damage.20

Heat waves are also a rising and deadly threat.

- These heat waves pose an increased risk of subsidence and many homes are unprepared.

- Wildfires can also endanger cities near moorlands such as Manchester and Sheffield.21

- An adverse impact on the agriculture industry is likely.

The UK has the capacity and resources to adapt, but more effort is needed from the government and individuals.

For questions or more information on country-specific climate change and risk management, contact the author listed here or your usual Milliman consultant.

1 JBA Risk Management. Storm Christoph. Retrieved 11 March 2022 from https://www.jbarisk.com/flood-services/event-response/storm-christoph/.

2 Met Office. Severe winter weather and storm Darcy, February 2021. Retrieved 11 March 2022 from https://www.metoffice.gov.uk/binaries/content/assets/metofficegovuk/pdf/weather/learn-about/uk-past-events/interesting/2021/2021_02_low_temperatures.pdf.

3 JBA Risk Management. A retrospective look at London surface water flash floods. Retrieved 11 March 2022 from https://www.jbarisk.com/flood-services/event-response/a-retrospective-look-at-summer-2021-london-flash-floods/.

4 Metro (13 July 2021). London floods cause millions in damage after "biblical" storms hit city. Retrieved 11 March 2022 from https://metro.co.uk/2021/07/13/tube-lines-suspended-after-flash-flooding-in-london-14919615/.

5 JBA Risk Management (May 2021). Modelling the Impact of Spending on Defence Maintenance on Flood Losses. Retrieved 13 March 2020 from https://www.abi.org.uk/globalassets/files/publications/public/flooding/modelling-the-impact-of-spending-on-defence-maintenance.pdf.

6 Energy and Climate Intelligence Unit. Flood risk and the UK: How will flood risk to the UK change in future – and are we prepared? Retrieved 13 March 2022 from https://eciu.net/analysis/briefings/climate-impacts/flood-risk-and-the-uk.

8 Insurance Business (25 January 2021). Revealed: Estimated insurance losses from Storm Christoph. Retrieved 13 March 2022 from https://www.insurancebusinessmag.com/uk/news/breaking-news/revealed-estimated-insurance-losses-from-storm-christoph-244464.aspx.

9 PERILS loss data. Retrieved 13 March 2022 from https://www.perils.org/losses.

10 JBA Risk Management. A Retrospective Look at London Surface Water Flash Floods. Retrieved 13 March 2022 from https://www.jbarisk.com/flood-services/event-response/a-retrospective-look-at-summer-2021-london-flash-floods/.

12 JBA Risk Management, A Retrospective Look at London Surface Water Flash Floods, op cit.

14 Reinsurance News (25 January 2021). FloodFlash pays Storm Christoph claims on same day. Retrieved 13 March 2022 from https://www.reinsurancene.ws/floodflash-pays-storm-christoph-claims-on-same-day/.

15 JBA Risk Management, A Retrospective Look at London Surface Water Flash Floods, op cit.

16 Energy and Climate Intelligence Unit, Flood risk and the UK, op cit.

17 The Guardian (5 September 2021). Flood warning: How to protect your home as insurance hikes seep in. Retrieved 13 March 2022 from https://www.theguardian.com/money/2021/sep/05/flood-warning-how-to-protect-your-home-as-insurance-hikes-seep-in.

18 Aviva (23 September 2021). One in three business properties at risk from flooding, many unprotected from climate risks. Retrieved 13 March 2022 from https://www.aviva.com/newsroom/news-releases/2021/09/one-in-three-business-properties-at-risk-from-flooding/.

19 JBA Risk Management, A Retrospective Look at London Surface Water Flash Floods, op cit.

20 JBA Risk Management (May 2021). Modelling the Impact of Spending on Defence Maintenance on Flood Losses. Retrieved 13 March 2022 from https://www.abi.org.uk/globalassets/files/publications/public/flooding/modelling-the-impact-of-spending-on-defence-maintenance.pdf.

21 The Guardian (4 March 2022). UK not prepared for climate impacts, warns IPCC expert. Retrieved 13 March 2022 from https://www.theguardian.com/environment/2022/mar/04/uk-not-prepared-climate-impacts-ipcc-intergovernmental.