On February 19, 2019, the Center for Medicare and Medicaid Innovation (CMMI) released a Request for Applications (RFA) for the Part D Payment Modernization Model (PMM).1,2 The PMM is a voluntary program whose goal is to reduce Part D federal reinsurance costs by adding new program flexibilities and introducing a two-sided risk-sharing arrangement around federal reinsurance costs. Interested Part D plan sponsors are required to submit an application to the Centers for Medicare and Medicaid Services (CMS) by March 15 in order to participate in the 2020 plan year. With less than one month to respond, many details unknown, and multiple impending changes to the Part D program, the PMM RFA brings more questions than answers. Below, we identify and discuss many of those questions.

Who is eligible to participate (and who would want to)?

Plans nationwide are able to participate on a voluntary basis. Both PDP and MAPD plan sponsors are eligible; however, certain special plan types are excluded, including special needs plans (SNPs), private fee for service (PFFS), Medicare Cost plans, and others. While direct contract employer and union plans are excluded, employer group waiver plans (EGWPs) are not mentioned, and it is unclear whether those plan sponsors may participate or how they would do so given that bids are not required for EGWPs.

Participating plans must pick a Part D region or regions to participate in, and all plan benefit packages (PBPs) within that region must also participate. For plan sponsors that have large regional plans with multiple overlapping service areas, the number of PBPs required to participate may be significant. This may also pose challenges for plan sponsors with large EGWP populations if EGWP plans are not excluded.

The PMM is authorized for five years; however, plans are only applying to participate for 2020. If CMS continues the program, a new application would be required for 2021 and future years. CMS may decide to only open the application for future years to current model participants, which may preclude plans not currently in the model from participating in future years. CMS is also limiting the number of participants in a given region so there are enough non-participants to create a control group; however, the number of plans that could be selected per region is unknown.

What types of formulary or other program flexibility might be offered?

CMMI will notify provisionally approved plans of formulary flexibility and non-formulary management options not offered currently to other Part D plans. These flexibilities could be of interest to plans as a way to manage high-cost members more tightly than in the traditional Part D program. However, these will not be known until the plan is provisionally approved, which may not be until close to the Part D bid submission deadline in June. These flexibilities could vary from something significant, i.e., covering only one drug per United States Pharmacopeial Convention (USP) category and class instead of the current two drugs per class and category or additional protected class flexibility, to something less significant, i.e., additional mid-year negative formulary flexibility.

It may be intriguing for plans to apply for the model to see how significant these flexibilities could be. However, they will need to take into account:

a) How quickly they can measure the impact of the new flexibilities so they can be priced into the bid

b) How easy it would be to revise the bid submission if they determine the flexibilities do not provide enough value to cover the cost of the program

What costs are associated with participating?

The upfront costs associated with the PMM include the application process, which includes quantitative support of cost savings, and the costs of designing and implementing Rewards and Incentives (RI) programs or other program flexibilities. As part of its program monitoring and reporting, CMS indicated that model participants would also be required to participate in surveys, interviews, site visits, and other activities to assist CMS with program evaluation. In addition to the cost of implementing and administering RI programs, RI programs also add cost through the rewards and incentives themselves and potentially through increased Part D utilization (e.g., Part D vaccines or increased adherence).

Will this really result in Part D savings?

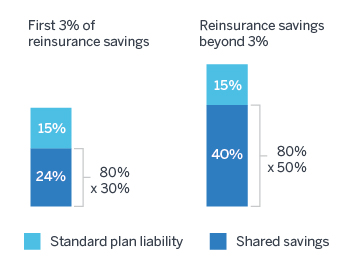

PMM participants are eligible for a portion of the calculated reinsurance savings: 30% of savings for the first 3% of federal reinsurance savings and 50% of savings thereafter. Participants would also be subject to a 10% penalty for federal reinsurance costs in excess of the CMS-calculated benchmark. In order to achieve net savings, plan sponsors will need to generate enough savings to offset additional costs.

-

Partial return of catastrophic savings: Plan sponsors will still only benefit partially from catastrophic cost reductions. Because plans are currently liable for 15% of costs in the catastrophic phase, for every $1.00 in catastrophic cost reduction, plan sponsors will only save $0.39 for the first 3% of reinsurance savings: $0.15 due to the reduction to plan liability, and $0.24 for the 30% shared savings on reinsurance ($1.00 x 30% x 80%). Plans will save $0.55 thereafter: $0.15 for plan liability, plus $0.40 for 50% of shared savings ($1.00 x 50% x 80%). Thus, each $1.00 spent on PMM would need to generate $1.00 / 39% = $2.56 of catastrophic savings for the first 3% of federal reinsurance savings ($1.82 thereafter) to be a net savings for the plan sponsor.

Figure 1: Catastrophic cost savings under PMM

- Unclear return on investment (ROI) on RI programs: It is not clear how the RI program examples provided by CMS would decrease Part D costs, particularly federal reinsurance costs. In fact, some examples could increase Part D costs (e.g., vaccines and disease management programs). It is possible that a Medicare Advantage plan sponsor that offers prescription drug coverage (MA-PD) could benefit from these RI programs through reductions in Medicare Part A/B spending. However, standalone prescription drug plans (PDPs) would not benefit from the reduction in Part A/B spending.

How should plans determine information required for the application without insight on key program aspects?

Plan sponsors submitting applications are required to provide significant detail around each proposed intervention or program, including key details such as expected value of the reward or incentive, how many enrollees are expected to be targeted and engaged, the expected cost of the program, the expected financial and clinical outcomes, and the expected reduction in Part D spending. Without knowing the details about what flexibility is allowed, projecting these program components will be difficult. Plans sponsors will need to use the guidelines outlined in the RFA to make a judgment call as to whether certain programs will be deemed acceptable to CMS. Additionally, with applications due by March 15, most of these details will be difficult to put together in a two-week time frame, especially with the multitude of other potential Part D program changes being analyzed. This may introduce compliance risks with this program if the application or program development is rushed.

How would the benchmark be calculated?

The RFA provides limited additional detail on how the benchmark would be determined and compared to a plan’s actual reinsurance. Key considerations include whether adjustments would be made for members taking unusually high-cost drugs, plan credibility, and other population or contracting differences between the experience used to develop the benchmark and the plan-specific experience. CMS indicated additional detail on the spending target benchmark methodology will be provided to provisionally approved organizations in April.3

How could this be affected by the HHS proposal to move drug rebates to point of sale (POS)?

An important question is how this model will be affected by the recent proposed rule from the Department of Health and Human Services, thus creating a new safe harbor that would move manufacturer rebates to the POS.4

If the proposed rule is finalized, the reinsurance amount per member per month (PMPM) would be lower than under current rules. However, there could be volatility in the actual reinsurance as the industry works through how the actual rebates provided by manufacturers may change (upward or downward) with potential changes to rebate negotiations under the proposed rule. As well, plan sponsors that use a third-party pharmacy benefit manager (PBM) may not know the details of their rebates at a drug level, which could pose an additional challenge in predicting how the proposed rule could affect members’ movement through the Part D benefit phases and thus reinsurance amounts.

What are the financial implications to the bid?

According to the RFA, plans will be required to include the cost to administer the model in the Part D bid, including any initiatives developed. Plans may also include the expected impact from these initiatives to the cost and utilization of drugs in the bid.

Plan sponsors will also need to consider whether the potential financial upside of the model offsets the cost of implementing and maintaining the programs needed to manage reinsurance costs. As this may actually increase cost for plans, they will need to consider how that potentially affects competitive positioning in the market.

Another question unanswered in the RFA is whether the payments to/from plans will be subject to sequestration. Plan sponsors will need to consider this issue when looking at the impact to their margins.

What are the potential risks with participating?

Compared to the savings potential, there appears to be relatively low downside risk to participating. If a plan’s actual reinsurance is higher than the calculated benchmark, the plan sponsor would pay 10% of the difference. The upside potential is much greater: plans sponsors would receive 30% of any savings between 0% to 3% of the benchmark, and 50% of savings in excess of 3%. However, plan sponsors should consider key risks, including:

- Costs. Plan sponsors’ cost to administer the program and provide RI programs may be greater than any potential savings.

- Timing. Would plan sponsors have enough time to submit a meaningful application before the March 15 deadline? If approved, would there be enough time to reflect the PMM in the June bid submission and implement changes prior to the 2020 plan year?

- Regulatory uncertainty. The 2020 bid year is shaping up to be one of the most uncertain in the Part D program’s history. Would plan sponsors have enough resources to devote to the PMM in addition to other potential bid year 2020 changes, such as HHS’s POS drug rebate proposal?

- Compliance risk. The initiatives implemented with this program are still subject to CMS audit and review, which will require regular oversight to avoid any compliance issues.

The limited information on the PMM poses many questions and potential challenges for plan sponsors. However, plan sponsors do not need to fully commit to the program at this time, as CMS indicated they could opt out after submitting an application. With so many unknowns, plan sponsors may want to move forward with the application simply to receive more information and reassess the risks after more details are known.

1CMS. Part D Payment Modernization Model. Retrieved February 26, 2019, from https://innovation.cms.gov/initiatives/part-d-payment-modernization-model/.

2CMS. Part D Payment Modernization Model Request for Application. Retrieved February 28, 2019, from https://innovation.cms.gov/Files/x/partd-payment-modernization-model-rfa.pdf.

3CMS. Medicare Advantage Value-Based Insurance Design Model and Part D Payment Modernization Model - Deep Dive. (February 28, 2019). Webinar. Retrieved March 7, 2019, from https://innovation.cms.gov/Files/slides/vbid-partd-deepdive-slides.pdf.

4Alston, M., Bazell, C. & Mike, D. (February 8, 2019). Changing the rebate game: A primer on the HHS proposed rule to shift drug rebates to the POS. Milliman. Retrieved February 26, 2019, from http://us.milliman.com/insight/2019/Changing-the-rebate-game-A-primer-on-the-HHS-proposed-rule-to-shift-drug-rebates-to-POS/.