Introduction

Milliman maintains a national group commercial health insurance claims experience database representing approximately 74 million members and $250 billion in medical allowed charges. We reprice this experience data to Medicare fee-for-service (FFS) payment rates using the Milliman Medicare Repricer™.1 The Milliman Medicare Repricer contains a full Medicare FFS adjudication engine for all service types, including Medicare Severity Diagnosis-Related Group (MS-DRG) and Ambulatory Payment Classification (APC) groupers, allowing for a full comparison of the commercial reimbursement to the Medicare-allowed amounts. We calculate a percentage of Medicare FFS rates as the commercial allowed divided by the repriced Medicare FFS allowed to provide a more consistent payment rate benchmark.

Percentage of Medicare FFS rates is one of the most widely accepted commercial reimbursement benchmarks when evaluating provider reimbursement level and comparing contracts in the healthcare industry. It can reflect the mix of services across providers and plans while removing impacts from billed charges that can vary widely across providers and regions.

Nationally, we estimate 2022 commercial reimbursement for medical services to be approximately 190% of fully loaded Medicare FFS rates,2 with a significant difference between facility reimbursement and professional reimbursement as shown in Figure 1. Figure 1 also shows that while the overall reimbursement as a percentage of Medicare FFS rates has remained static from 2021 to 2022, there have been changes by major service category. The changes observed are driven by the updates to the underlying data that is used in the analysis instead of changes in the reimbursement methodology.

Figure 1: Estimated national commercial reimbursement as a percentage of Medicare FFS rates

| YEAR | INPATIENT | OUTPATIENT | PROFESSIONAL | TOTAL |

| 2021 | 198% | 261% | 141% | 190% |

| 2022 | 206% | 257% | 141% | 190% |

| Change | +8% | -4% | 0% | 0% |

“Percentage of Medicare FFS rates” and how it is calculated

Milliman’s 2022 commercial reimbursement benchmarks are based on nationwide commercial medical claims data that are aggregated from several sources, including Milliman’s Consolidated Health Cost Guidelines™ (HCG) Sources Database (CHSD), which reflects commercial claims incurred in 2020, and the IBM MarketScan data, which reflects commercial claims incurred in 2019. The commercial-allowed charges are trended to 2022.

The claims are repriced to the 2021 Medicare FFS fee schedule, and the Medicare-allowed amounts trended to 2022 using area- specific unit price trends. The percentage of Medicare FFS rates is a simple ratio of the total commercial-allowed charges over the total Medicare-allowed charges. The data is summarized by metropolitan statistical areas (MSAs) and major service types: inpatient hospital (IP), outpatient hospital (OP), and professional (Prof) services. Statewide and nationwide totals are determined by weighting the MSA-level results to reflect the distribution of the under-65 population.

The Medicare FFS-allowed charges are assigned with the Milliman Medicare Repricer. The Milliman Medicare Repricer supports the major Medicare fee schedules including the inpatient and outpatient prospective payment systems (IPPS and OPPS) and can be set to include or exclude provider-specific adjustments like disproportionate share hospital payments and indirect medical education payments (among others). For this study, PPS rates are assigned to non-PPS facilities, including critical access hospitals, cancer and children’s hospitals, and Maryland waiver hospitals.

Under Medicare, most acute hospitals receive additional disproportionate share (DSH) and uncompensated care, and many receive indirect medical education (IME) payments for inpatient stays. These additional payments make up approximately 18% of the total Medicare payments under IPPS nationally. We have included these additional payments in our analysis, with the exception of inpatient pass-through payments.

The professional Medicare reimbursement does not reflect any adjustments for Merit-based Incentive Payment System (MIPS), healthcare professional shortage area, or professional bills through critical access hospitals.

The Milliman Medicare Repricer is validated against Medicare FFS claims to ensure consistency with the allowed payments under Medicare FFS.

Trending experience

The experience data reflects calendar year (CY) 2019 and 2020 incurred claims data. Fiscal year (FY) 2021 Medicare FFS-allowed amounts have been assigned through the Milliman Medicare Repricer tool. The commercial and Medicare-allowed amounts throughout the benchmarking model are trended forward to 2022. These trends—approximated values shown in Figure 2—exclude service mix and intensity changes.

Figure 2: Nationwide trends by experience source, claim type, and trend year

| 2019 to 2020 | 2020 to 2021 | 2021 to 2022 | |

| Commercial-Allowed | |||

| Inpatient | 2.7% | 1.9% | 2.1% |

| Outpatient | 4.1% | 3.2% | 3.4% |

| Professional | 2.5% | 1.7% | 2.3% |

| Medicare-Allowed | |||

| Inpatient | 2.8% | 2.3% | 2.6% |

| Outpatient | 1.1% | 2.4% | 1.6% |

| Professional | -0.1% | 3.0% | -2.4% |

Variances in reimbursement rates across geographic areas

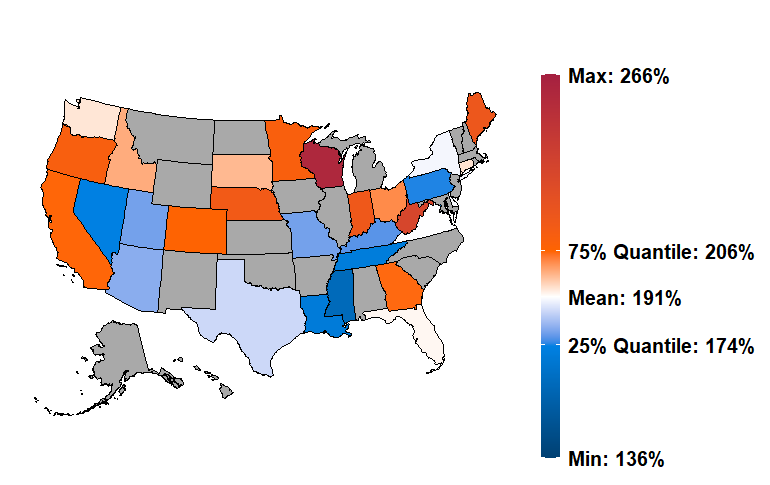

Provider reimbursement rates vary significantly across geographic areas. Figure 3 provides a state-level view of total 2022 reimbursement as a percentage of Medicare FFS rates, excluding retail pharmacy claims (gray states indicate results are unavailable). As shown, most states are within a narrow range; however, there are a number of states with very high or low reimbursements relative to Medicare. For example, we estimate that Wisconsin has a total commercial reimbursement of 260% of Medicare FFS, while Mississippi has low commercial reimbursement relative to Medicare FFS at 161%. We also observe significant variations by market (defined by MSA) within states as well. For example, the MSA-level results in California range from 165% of Medicare in Visalia-Porterville to 265% in Vallejo-Fairfield. There are several reasons why reimbursement can vary widely across markets, including the relative negotiating power of providers or payers, and the variation in regional Medicare FFS rates.

Figure 3: Estimated national commercial reimbursement as a percentage of Medicare FFS rates

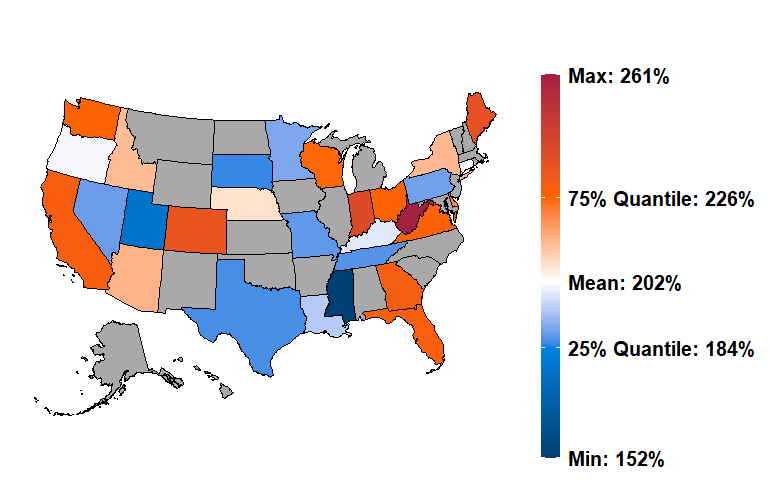

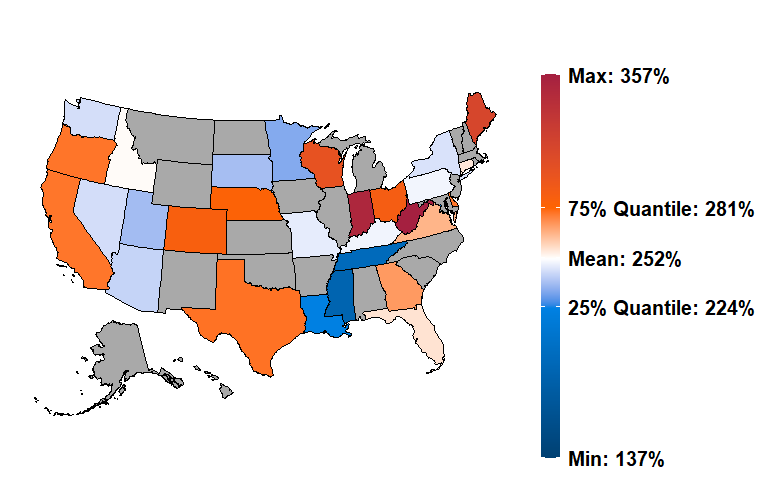

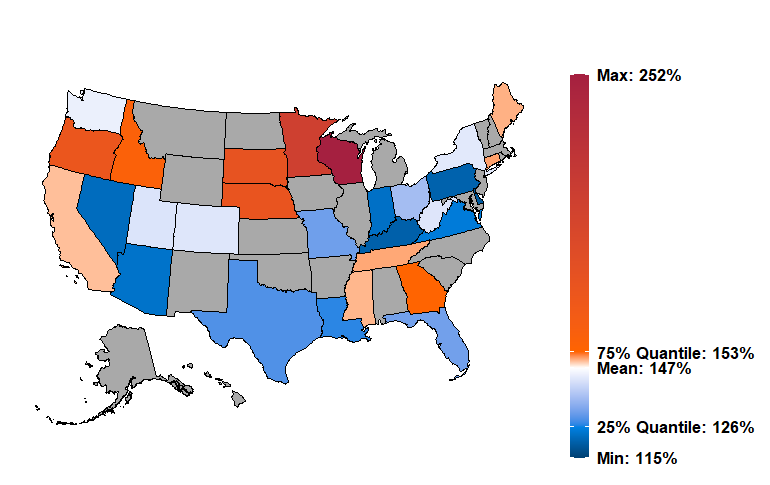

Commercial reimbursement also varies by type of service. Figures 4, 5, and 6 show the average statewide reimbursements as a percentage of Medicare FFS rates for inpatient, outpatient, and professional services, respectively. The nationwide reimbursement by this measure is lowest for professional services, at 141% of Medicare, and highest for outpatient services, at 257% of Medicare. Commercial inpatient reimbursement averages 206% nationwide.

Figure 4: Estimated average commercial inpatient reimbursement as a percentage of Medicare FFS rates

Figure 5: Estimated average commercial outpatient reimbursement as a percentage of Medicare FFS rates

Figure 6: Estimated average commercial professional reimbursement as a percentage of Medicare FFS rates

Milliman reimbursement benchmarks are also available by MSA to drill down to market-specific reimbursement. Additionally, these benchmarks are also available at more granular service levels, e.g., inpatient maternity, outpatient emergency, anesthesia, and professional surgical procedures. The additional service category detail allows for more detailed review of specific elements of provider reimbursements, and a better understanding of where reimbursement contracts are relative to the market. As an example, if we look into professional reimbursement in Wisconsin relative to Medicare, the data shows that this is partly driven by the state’s lower-than-average Medicare reimbursement (approximately 4% below national for professional) and the average commercial reimbursement for professional radiology services (approximately 444% of Medicare).

Comparison to other benchmarks

We validated our benchmarks by comparing our results to other publicly available data, specifically the Health Care Cost Institute (HCCI) study3 on 2017 professional reimbursement, and the 2020 RAND study “Nationwide Evaluation of Health Care Prices Paid by Private Health Plans.”4

The HCCI study is limited to professional claims and is based on 2017 commercial and Medicare fee schedule levels. The Milliman benchmarks are based on 2019 and 2020 incurred data, trended forward to 2022 charge levels.

Figure 7 compares the Milliman results to the HCCI results. The Milliman results are consistently higher than the HCCI results; however, both studies show similar variation among the states measured, and the relativity between states is consistent. For example, Wisconsin has the highest reimbursement, and Alabama and Maryland are among the states with the lowest reimbursement. The HCCI study includes approximately 23% of the allowed claims volume included in our study and also focuses on metropolitan areas. In contrast the Milliman benchmarks are inclusive of urban and rural areas. Urban and rural areas can have very different reimbursements as a percentage of Medicare FFS rates due to differences in Medicare reimbursement rates as well as commercial market dynamics that can impact provider contracts, e.g., there are typically fewer provider competitors in rural areas. The Milliman benchmarks show the ratio of commercial allowed to the Medicare PPS allowed, including claims for non-PPS providers. The benchmarks are available at the MSA level, enabling comparisons to urban and rural areas separately.

Figure 7: Milliman and HCCI professional reimbursement benchmarks

| PROFESSIONAL | ||

| MILLIMAN | HCCI | |

| Valuation Year | 2022 | 2017 |

| Nationwide Mean | 141% | 122% |

| Highest | 252% (WV) | 188% (WI) |

| Lowest | 119% (DC) | 98% (AL) |

| Data Volume ($M) | $95,955 | $13,389 |

| Repricing/Methodology | Full-service, line-level claim repricing using the Medicare Physician Fee Schedule (PFS) | Medicare PFS amount with limited modifier adjustments (26, TC, and 53 only) |

Figures 8 and 9 compare the Milliman benchmark results to the RAND study for inpatient and outpatient services, respectively. The RAND study estimates are slightly higher than our results for both inpatient and outpatient reimbursement rates. The RAND study is an estimate of the 2018 commercial reimbursement rates, while our results are 2022 estimates.

We excluded professional results from our comparison as our professional reimbursement benchmarks include all professional settings, and the RAND study focuses on services provided in a hospital setting.

Figure 8: Milliman and RAND inpatient reimbursement benchmark comparison

| INPATIENT | ||

| MILLIMAN | RAND | |

| Valuation Year | 2022 | 2018 |

| Nationwide Mean | 206% | 208% |

| Highest | 261% (WV) | 340% (SC) |

| Lowest | 152% (MS) | 192% (MS) |

| Data Volume ($M) | $68,069 | $15,700 |

Figure 9: Milliman and RAND outpatient reimbursement benchmark comparison

| OUTPATIENT | ||

| MILLIMAN | RAND | |

| Valuation Year | 2022 | 2018 |

| Nationwide Mean | 257% | 262% |

| Highest | 357% (WV) | 458% (WV) |

| Lowest | 186% (MS) | 164% (RI) |

| Data Volume ($ million) | $93,550 | $14,800 |

| Repricing/Methodology | Full OPPS and ambulatory surgical center (ASC) pricing | “Simulated Medicare Prices” that may “exclude some minor adjustments” |

Benchmarking commercial reimbursement

Commercial provider reimbursement arrangements can take many forms, ranging from simple discounts off of billed charges and fee schedules, to complex calculation methodologies and risk-sharing arrangements. Many commercial fee schedules utilize Medicare-like reimbursement structures based on diagnosis-related groups (DRGs), ambulatory payment classifications (APCs), and the resource-based relative value system (RBRVS). Commercial FFS payment contracts often use a combination of fee schedules and a percentage of billed charges.

Recently, payers and providers have recognized the predictability and administrative simplicity of utilizing Medicare fee schedules as the basis for commercial reimbursement arrangements.

Additionally, shared risk models including bundled payments and shared savings arrangements have become more prevalent. The Health Care Payment Learning & Action Network5 (HCP-LAN) estimates that alternative payment models increased from 22% of commercial payments in 2016 to 30% in 2018.

Comparing provider contracts that use differing pricing methodologies is difficult. Differences in billed charge levels limit the value of comparisons of the relative percentage of charges, and differences in membership and service mix complicate the results when comparing different providers, such as a large urban hospital and a critical access hospital.

One widely used method for evaluating provider reimbursement involves comparing the total commercial reimbursement to the Medicare FFS rates. This method has several benefits when compared to other comparison methods:

- Percentage of Medicare FFS rates comparisons do not rely on billed charge levels, which can vary widely across providers and regions.

- Medicare payment rates are well understood by payers and providers, making comparisons acceptable to all parties.

- The repriced Medicare-allowed reflects the mix of services across providers and plans, making results less dependent on the specific mix of services in the data set.

The primary drawbacks of this method are:

- The requirement of the expertise and/or software to price claims to the Medicare fee schedule.

- Contract language is needed to precisely define the Medicare definition and specify how updates to the Medicare fee schedules are accounted for.

In addition to enabling an apples-to-apples comparison between specific provider or payer contracts, comparing contracts as a percentage of Medicare FFS rates also eases comparison of aggregate reimbursement rates across geographic regions or to area reimbursement benchmarks.

An additional comparison point, the hospital transparency data, is now available, and with it prices for individual hospitals, networks, and procedures. This data can be coupled with market data to understand the network and hospital unit price positions in the market.

In addition to the reimbursement benchmarks captured here, provider and payer contracts may have additional shared savings or pay for quality provisions, which are not captured here. These contract features often result in additional payments between providers and payers. When benchmarking those types of arrangements, the additional payment transfers should also be taken into consideration.

Conclusion

Comparing commercial-allowed amounts to Medicare FFS rates requires either specialized expertise including an understanding of the complex Medicare FFS reimbursement rules, or software to assign the Medicare-allowed amounts.

Provider reimbursement as a percentage of Medicare FFS rates provides a consistent and well-understood basis for comparing reimbursement rates. Using this common basis enables comparison to reimbursement benchmarks. Provider contracts can also be compared to Milliman’s commercial reimbursement benchmarks to provide a better understanding of their position to the market average reimbursement.

1 See https://www.milliman.com/en/products/Medicare-Repricer.

2 We define fully loaded Medicare FFS rate as the Medicare prospective payment rates including add-on payments for outlier, disproportionate share, indirect medical education, uncompensated care, sole community hospitals, and Medicare-dependent hospitals. Pass-through payments are excluded. For non-PPS providers (e.g., critical access hospitals, Maryland waiver hospitals), we develop PPS rates using the market PPS pricing factors published by the Centers for Medicare and Medicaid Services (CMS).

3 Johnson, B. et al. (August 13, 2020). Comparing Commercial and Medicare Professional Service Prices. HCCI. Retrieved October 20, 2022, from https://healthcostinstitute.org/hcci-research/comparing-commercial-and-medicare-professional-service-prices.

4 Whaley, C.M. et al. (2020). Nationwide Evaluation of Health Care Prices Paid by Private Health Plans. RAND. Retrieved October 20, 2022, from http://www.rand.org/t/RR4394.

5 HCP-LAN. APM Measurement Effort Results. Retrieved October 20, 2022, from https://hcp-lan.org/apm-measurement-effort/.