Over the past decade, total healthcare costs in the United States have grown twice as quickly as all other non-healthcare-related costs (4.8% vs. 1.5%).1 Over time, health plans have worked to slow the growth of these healthcare expenses through key cost containment activities such as utilization management, population health management programs, benefit design, and provider contracting.

While these activities are important strategies for optimizing benefit expenses, their overall effectiveness is reliant on the participation of another party—a health plan member, contracted provider, or group purchaser—and therefore outside the complete control of the health plan.

What are administrative costs?

One category of expense that health plans should have a great degree of control over is administrative costs. Administrative costs are the expenses associated with operating a health plan and exclude the cost of claims. They are largely driven by staffing, technology, and operational processes. Health plans should have a degree of control over administrative costs as they are often dictated by business decisions.

Administrative costs for health plans are typically considered any costs that are not directly benefit costs. The Centers for Medicare and Medicaid Services (CMS) refers to administrative costs as “non-benefit expenses.”

Examples of administrative costs might include those associated with adjudicating claims, responding to customer inquiries, managing care, marketing and selling insurance policies, contracting with healthcare providers, legal, human resources (HR), information technology (IT), and numerous other activities.

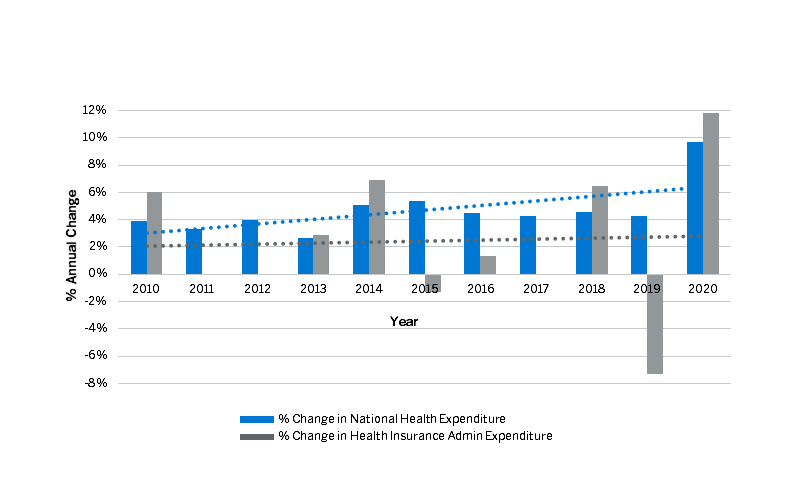

During the 10-year period from 2010 to 2020, inflation on total administrative expenditures to enable health insurance and government administrative services has tracked at approximately 2% average annual growth, compared to total healthcare inflation of 4.8%.1,2

These administrative costs totaled to over $280 billion in 2019.3

The relatively low growth of administrative expense as a proportion of total healthcare cost inflation may be driven by several factors, including increased regulatory requirements related to mandated medical loss ratios (MLRs), increased investment in automation for claims and transactional processes, and relatively low wage inflation over the period. In addition, health plans have continued to aggressively compete in the employer and group markets as well as for state Medicaid managed care contracts, which may contribute to greater efficiency and lower administrative rates.

Figure 1: National healthcare cost growth compared to health insurance administrative cost growth

The trends evidenced in Figure 1 indicate that, as demand and price for healthcare services has risen, health plans have worked to find efficiencies in their operations. These efficiencies have enabled plans to maintain relatively low administrative cost growth in the face of rising utilization of services and regulatory complexity.5

Given the narrow margins historically realized in the payer markets (2.35% average across all health products from 2011 to 20204 ), an increase or decrease in administrative costs could have a significant impact on the future outlook and strategy for these organizations, often impacting whether they realize a profit or loss in a given year.

Maintaining a strong focus on administrative cost levels can enable payers to efficiently meet market demand for services, control costs for consumers, and support their ongoing operations and strategies in the face of rising demand for services.

Factors influencing administrative costs

Administrative costs can be influenced by several factors, some of which include:

- Geography: The geography served by a payer organization can have important impacts on its administrative costs. Variation in administrative cost may be impacted by numerous factors including regional wage levels, regulatory requirements, and real estate costs. A rule of thumb is that approximately 60% of a health insurer’s costs are labor-related and thus labor cost differences can have material impacts on a payer’s overall administrative cost structure.

- Economies of scale: Larger more established health plans tend to have greater opportunities to achieve favorable economies of scale compared to smaller or start-up health plans. Economies of scale result from the ability to make a single investment, the cost for which can then be spread over and value realized for many applications and use cases or across a large population, thereby lowering the burden that expense has on the organization.

- Population morbidity: The prevailing disease profile and resulting risk scores of a population can affect administrative costs. For example, populations that have more chronic conditions generally require greater degrees of care management, claims processing, and other factors that can lead to increased administrative expense.

- Line of business: Administrative costs traditionally vary by line of business. In general, administrative costs have been historically higher for lines of business with more complex benefit designs or more administrative requirements, such as Medicaid managed care, individual marketplace plans, and Medicare Advantage plans.

- Information technology (IT): IT investments drive a significant portion of administrative costs today. Understanding the range of IT investments available and how to utilize technology to support automation efforts can allow an organization to achieve more efficient and cost-effective operations in the long term, which may offset the initial cost of the investment.

- Strategic priorities: Different strategies and approaches to growth or operational improvement and/or quality performance have differing levels of administrative cost burden. An organization’s strategies and priorities can help explain the drivers of high or low administrative costs across the functional areas of the organization.

It is important for organizations to understand the drivers of their administrative costs so that they can more readily influence them to suit their strategies and priorities.

Why are administrative costs important?

Traditionally, administrative cost was centralized with health insurance organizations. However, as the payer landscape has diversified, more organizations, including providers, third-party administrators (TPAs), and even large employers, are taking on risk and accountability for administration of healthcare benefits.

Payers focus on administrative costs to satisfy regulations, drive efficiency, manage expense levels, and plan for growth. For typical payer organizations, understanding administrative cost is important for three primary reasons.

- High administrative expenses must usually be supported by premium revenues. Health plans are experiencing continual pressure in competitive markets to offer low premiums. This is evidenced by the popularity of Medicare Advantage plans offered at zero premium. If a payer attempts to enter a market with the burden of administrative costs that are higher than their competition, it will find it difficult to competitively price their premiums.

- From 2011 to 2020, health insurers averaged a 2.35% profit margin across all lines of business.5 If health insurance payers can understand and reduce their administrative expenses even a single percentage point, it can make the difference between profitability and a loss.

- Overspending on administrative cost is wasteful. Excessive administrative expense crowds out other strategic and operational priorities that may have positive impacts on payer efficiency and growth. In addition, overspending limits opportunities to enhance benefits and make products more competitive.

Proactively understanding and working to control administrative cost is an important step in sustaining competitive premiums, growth, and margins.

How can administrative cost be analyzed?

One useful way to analyze and understand administrative costs for health plans is to compare cost levels to organizations of similar standing through benchmarking. The application of benchmarks can help health plans to determine the appropriateness of their operational spend across functional areas, identifying areas where they may be overinvesting or underinvesting or where their operations justifiably differ from those of other comparable entities.

By leveraging benchmark data, health plans can understand and assess staffing, cost, efficiency, and productivity, and gain clarity regarding where to focus efforts on improvement. As with any comparison, it’s important to establish benchmarks that are customized to provide an accurate comparison to equivalent operations, taking into account geography, scale, lines of business, and administrative complexity.

Summary

As healthcare costs continue to rise, a growing diversity of health plan organizations are prioritizing administrative cost analysis and control as a way to provide competitive costs to the markets they serve, maintain their margins, and enable strategic priorities. These costs account for over $280 billion of expense each year and, more than any other cost payers work to manage, those dollars can be controlled by the organizations themselves.3 Understanding how to control this category of expenses is key to impacting overall profitability, providing differentiation when bidding for federal or state-level programs, and supporting the continued cost-efficient delivery of services to members.

1 Calculated from Kaiser Family Foundation exhibit data (Total national health expenditures, US $ Billions, 1970-2020; and Percent change in total health expenditures per capita, 1980-202, and in Personal Consumption Expenditure price Index, 1980-2020), available at https://www.healthsystemtracker.org/chart-collection/u-s-spending-healthcare-changed-time/.

2 Calculated from Kaiser Family Foundation exhibit data (Net cost of health insurance and government administration, as a share of total health expenditures), available at https://www.healthsystemtracker.org/chart-collection/u-s-spending-healthcare-changed-time/.

3 CMS. National Health Expenditures Data: Historical. Retrieved December 28, 2022, from https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsHistorical/.

4 National Association of Insurance Commissioners. U.S. Health Insurance Industry: 2020 Annual Results, Figure 1 – Net Income and Profit Margin. Retrieved December 28, 2022, from https://content.naic.org/sites/default/files/inline-files/2020-Annual-Health-Insurance-Industry-Analysis-Report.pdf.

5 Health Care Cost Institute (May 2022). 2020 Health Care Cost and Utilization Report, Figure 4. Retrieved December 28, 2022, from https://healthcostinstitute.org/images/pdfs/HCCI_2020_Health_Care_Cost_and_Utilization_Report.pdf.