The Coding Intensity Factor (CIF) is intended to establish revenue neutrality in the Realizing Equity, Access, and Community Health (REACH) program and causes all accountable care organizations (ACOs) to pay for increases in program-wide risk scores. Because the CIF is calculated after the application of the +/-3% floor and ceiling, some REACH ACOs could contribute materially to the CIF while also having their final risk scores increased by the -3% risk score floor.

What is the CIF?

For each of the two beneficiary categories—aged and disabled (AD) and end-stage renal disease (ESRD)—the REACH program employs a three-step process to determine the payment risk score (i.e., the risk score that will be used to adjust the final benchmark): normalization, a +/- 3% risk score floor and ceiling, and the Coding Intensity Factor (CIF).

- The normalization factor is meant to control for the general coding level of the entire ACO REACH national reference population, by ensuring the average normalized risk score of the reference population is 1.0 in each performance year. Between 2020 and 2023, the annualized growth rate of the Centers for Medicare and Medicaid Services (CMS) hierarchical condition category (HCC) V24 risk score normalization factor is 0.9% and 1.1%, for the AD and ESRD populations respectively.

- The +/- 3% risk score floor and ceiling are meant to limit the impact of and reduce incentives for coding intensity by each ACO by ensuring that the normalized risk score of the ACO in the performance year (PY) deviates by no more than 3% in either direction from that of the reference year (which is 2021 for PY2023, and 2022 for PY2024-PY2026). Starting from PY2024, the floor and ceiling will be applied after allowing for changes in demographics of the ACO’s aligned population.

- Finally, the CIF is a retrospective adjustment meant to control for the observed coding level of the aligned population in REACH, by ensuring model-wide zero-sum: i.e., that the normalized and capped risk score across all aligned beneficiaries in REACH ACOs in the PY is equal to the normalized risk score for the simulated attributed populations of the most recent base year, i.e., base year (BY) 3, 2019. For each beneficiary category, the CIF is applied uniformly to the claims-aligned and continuously voluntarily aligned population1 of all ACOs.

A CIF greater than 1.0 results in a reduction to every ACO’s payment risk score by the same percentage. ACOs with significant risk score growth from BY3 to the PY contribute to a higher CIF and can drive a decrease in benchmark for all ACOs.

The retrospective nature of the CIF introduces significant financial uncertainty to the participating ACOs. ACOs do not know what their final benchmarks are until the CIF is announced—usually in the preliminary settlement report in May of the year following the performance year. To alleviate this concern and to increase predictability for model participants, CMS announced that the CIF will be capped at 1.0% starting in PY2024.

Note that the ACO REACH CIF differs from the coding intensity adjustment used in Medicare Advantage (MA). The ACO REACH CIF is a retrospective and empirically determined factor designed to introduce revenue neutrality, whereas the MA coding intensity adjustment is set prospectively and is not intended to introduce program-wide revenue neutrality.

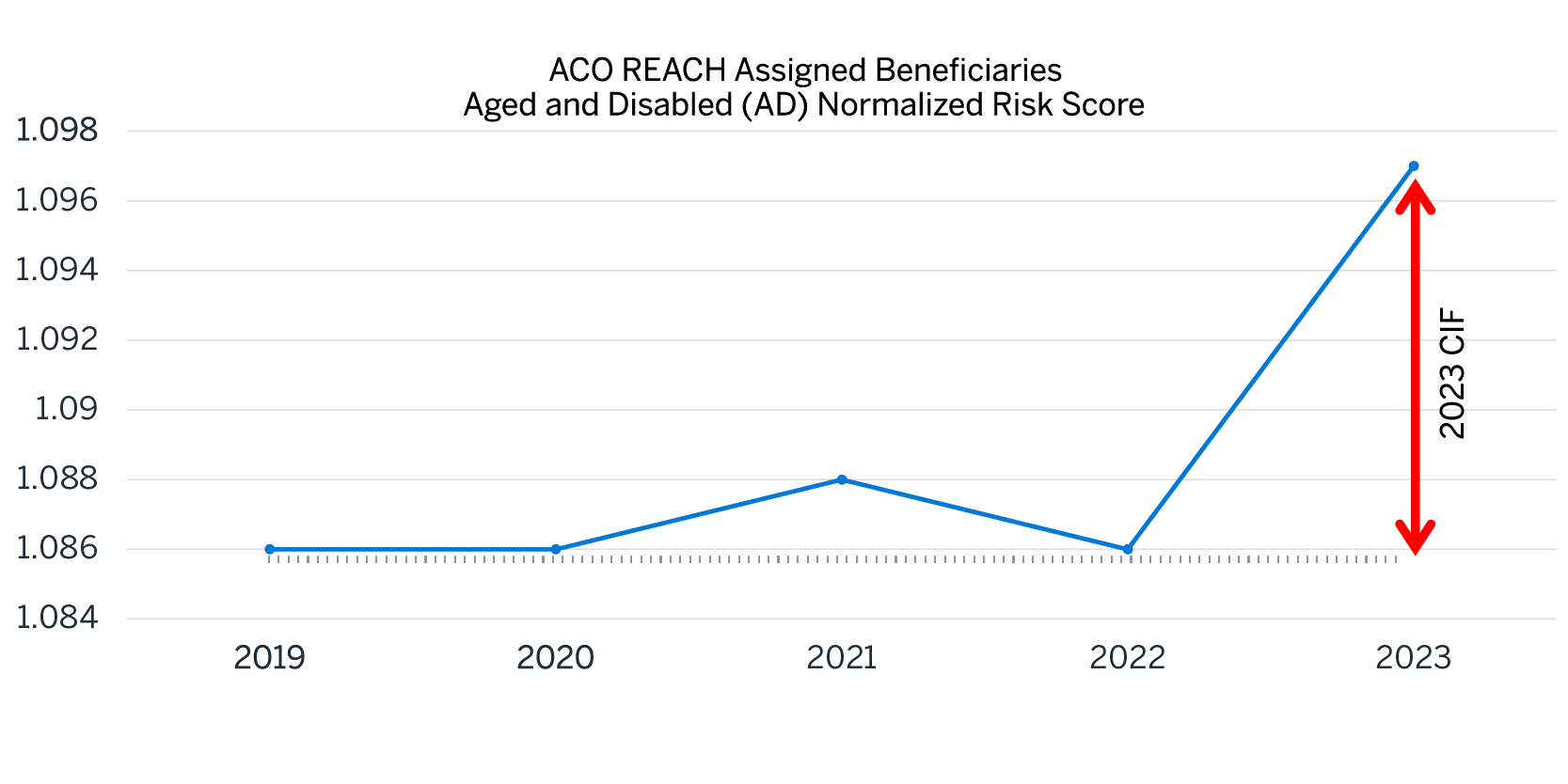

Figure 1 shows the calculation for the PY2023 CIF for the AD population using illustrative figures. All risk scores are based on the CMS-HCC V24 risk model. The 2019 and 2020 risk scores are based on Milliman’s ACO Builder and are normalized but uncapped. The 2021 and 2022 risk scores are estimated using the known 2021 and 2022 CIF. The 2023 risk score is estimated assuming a 1% CIF. The 2021-2023 risk scores represent normalized and capped risk scores.

Figure 1: Illustrative calculation of the CIF for PY2023

What is the impact of the CIF?

As shown in Figure 2, CIFs were very close to 1.0 in both PY2021 and PY2022. The PY 2023 CIF won’t be announced until May 2024, although the Center for Medicare and Medicaid Innovation (CMMI) suggested an estimated AD range of 1.0% to 1.4% on a recent webinar.2 There is no cap on the CIF for PY2023. For PY2024, the CIF will be capped at 1.0%.

Figure 2: Historical CIFs

| AD | ESRD | |

|---|---|---|

| PY2021 | 1.003 | 1.006 |

| PY2022 | 1.000 | 1.003 |

Since Q1 2022, Milliman has been conducting a quarterly CIF study using ACO-level data collected from Quarterly Benchmark Reports (QBRs) to get a more timely estimate of the CIF than CMS has historically provided. Recent CIF studies represent about 50% of the ACO REACH population. Please contact your Milliman consultant for more information.

How does the +/- 3% floor and ceiling impact the CIF?

The CIF is calculated after the application of the +/-3% floor and ceiling to each individual ACO. Everything else equal, the existence of the floor increases the CIF and the existence of the ceiling decreases the CIF.

Illustrative example: An ACO can hit the floor and still contribute to the CIF

When we think of contributors to the CIF (i.e., ACOs whose risk score performance would result in the CIF being greater than 1.0), we typically think of ACOs that exhibited risk score growth from BY3 to the PY. One might expect ACOs that increase the CIF would be unlikely candidates to hit their -3% risk score floor. However, the fact that the CIF is measured relative to BY3 (2019), and the +/-3% floor and ceiling are measured relative to the reference year (RY)—2021 for PY2023—may create an interesting phenomenon. Figure 3 and Figure 4 shows an example of an ACO that benefits materially from the -3% floor while also contributing materially to the CIF.

Figure 3: Illustrative ACO that contributes materially to the CIF while benefiting from the -3% floor

Figure 4: Illustrative example

| ACO Normalized Risk Score | |

|---|---|

| 2019 | 1.050 |

| 2020 | 1.100 |

| 2021 | 1.150 |

| 2022 | 1.120 |

| 2023 | 1.090 |

| Risk Score Change % | |

| 2019 – 2021 | 9.5% |

| 2021 – 2023 | -5.2% |

| 2021 – 2023 Floored | -3.0% |

| 2019 – 2023 | 3.8% |

| 2019 – 2023 Floored | 6.2% |

This is a hypothetical ACO whose risk score increased by 9.5% between 2019 and 2021 and then declined by 5.2% from 2021 to 2023. The PY2023 risk score is floored at 97% of the 2021 risk score, 1.150 * 0.97 = 1.116. Thus the ACO’s risk score used for financial benchmarks is 1.116, a 2.3% boost from the pre-floor risk score of 1.090.

Meanwhile, this ACO still contributes materially to the CIF due to its risk score having a net increase between 2019 and 2023. In fact, the floor boosts the 2019 to 2023 risk score growth from 3.8% to 6.2%, resulting in an even larger contribution to the CIF. This increase in the CIF would lower all REACH ACOs’ financial benchmarks, despite this ACO experiencing a risk score decline greater than 3% between 2021 and 2023.

These calculations are all illustrative. We also ignore certain nuances of the risk score and benchmarking calculations in ACO REACH, which are not material to the point being illustrated herein. For example, these calculations are performed separately for AD and ESRD beneficiaries; and voluntarily aligned beneficiaries are treated separately from claims-aligned beneficiaries.

Conclusion

The ACO REACH CIF is an important financial headwind all ACOs face. It has the potential to decrease REACH ACO financial benchmarks by a material amount (perhaps more than 1%) in PY2023, and by as much as 1% in PY2024 and beyond. ACO REACH rules could cause some ACOs to contribute materially to the CIF while still benefiting from the -3% floor. We recommend ACOs reach out to their Milliman consultants to discuss the CIF’s effects on ACO financials for PY2023 and beyond.

1 Risk scores for newly voluntarily aligned beneficiaries are not subject to the CIF or the floor and ceiling, because the ACOs are not responsible for the initial reporting of risk score diagnoses for the CMS-HCC prospective risk adjustment model. .

2 PY2023 Q3 Quarterly Benchmark Report (QBR) Webinar (November 16, 2023). More information can be found on the 4Innovation (4i) website at https://4innovation.cms.gov/landing.