The 2025 Medicare Advantage (MA) and Part D (MA-PD) bidding cycle brought unprecedented challenges with a redesigned Part D benefit, MA revenue pressures, and rising healthcare trends. On September 27, 2024, the Centers for Medicare and Medicaid Services (CMS) released the 2025 landscape file, providing the first view of plan sponsors’ reactions to market headwinds. This article highlights the key changes to premiums and plan offerings in the MA-PD market. A similar paper outlining highlights and changes to the standalone prescription drug plan (PDP) market can be found here.

Fewer plans, fewer carriers, and a significant uptick in plan terminations

- Fewer general enrollment plan offerings as plans chase higher revenue associated with D-SNPs and C-SNPs: The number of MA-PD plans available to eligible members decreased nearly 2% for 2025 to 5,635 plans, a first for the MA-PD market.1 However, this varies considerably by type of plan. Non-special needs plan (non-SNP, or general enrollment) offerings decreased by 5% while institutional SNP plans (I-SNPs) also decreased 8%. Both dual-eligible (D-SNP) and chronic (C-SNP) plan types had considerable growth in plan offerings, increasing by 8% and 21%, respectively.

In the general enrollment market, CVS and Centene were drivers of the plan offering decreases, both cutting over 60 plans from their overall offerings. Devoted Health is bucking this trend by adding 75 general enrollment plans in 2025, the most of any major carrier. United is reducing its footprint in the I-SNP market by nearly 30 plans. On the other hand, UnitedHealthcare (United), CVS, and Devoted Health are all growing their D-SNP plan counts by double-digits and, further, United is adding over 40 C-SNPs to its portfolio.

Figure 1: Number of MA-PD plans by plan type, 2024 and 2025

- Carrier exits and plan terminations: Six Medicare Advantage organizations (MAOs) are ceasing operations in 2025, impacting about 93,700 individual MA-PD members. In addition, existing MAOs are terminating plans at a considerably higher rate than in prior years, with nearly 1.4 million members being forced to shop due to their MA-PD plans being shut down entirely—a 450% increase from 2024. Service area reduction (SAR) activity also increased, leading to nearly 540,000 members losing access to their current plans in their service areas. We discuss this in more detail later in this paper.

- Average monthly member premiums: The number of general enrollment MA-PD plans with $0 member premium decreased by about 1% relative to 2024. However, the percentage of membership that remains in a general enrollment $0 premium plan remained relatively constant at about 75%. Additionally, the average premium for a general enrollment plan decreased slightly. This may change as the approximately 1.4 million members in terminated 2024 plans seek new coverage.

The percentage of general enrollment plans offering Part B premium buy-downs, however, increased nearly 14% relative to 2024, and in 2025 just over 32% of general enrollment plans will include some non-$0 Part B premium buy-down. The average Part B premium buy-down amount increased by about $2.50.

Figure 2: General enrollment market metrics, 2024 and 2025*

| 2024 | 2025 | |

|---|---|---|

| (A) Member-Weighted Average Member Premium (C+D) | $14.77 | $13.50 |

| (B) Number of Plans with $0 Premium | 2,933 | 2,835 |

| (C) Member-Weighted Average Part B Premium Buy-down | $9.74 | $12.23 |

| (D) Number of Plans with Part B Premium Buy-down | 791 | 1,323 |

* The 2025 member-weighted averages are calculated prior to open enrollment, use September 2024 membership, and account for cross-walked plans. The 2024 member-weighted averages are calculated after 2024 open enrollment, and use February 2024 membership. Part B buy-down average reflects all plans in the average, not just those that offer a Part B buy-down.

Carrier exits and plan terminations will force more MA-PD members to shop than ever before

Carrier exits

Six MA-PD organizations will fully exit the market in 2025:2

- Premera Blue Cross – approximately 32,600 MA-PD members, Washington

- Blue Cross and Blue Shield of Kansas City (announced in May 2024) – approximately 30,600 MA-PD members, Kansas and Missouri

- Health Partners Unity Point Health, Inc. – approximately 10,300 members, Illinois and Iowa

- Care N’ Care – approximately 9,800 members, Texas

- Moda Partners, Inc. – approximately 6,500 MA-PD members, Oregon

- Western Health Advantage – approximately 3,600 members, California

Many of the organizations cited increasing market pressures and financial pressures as rationale for exiting the MA market.

Plan terminations

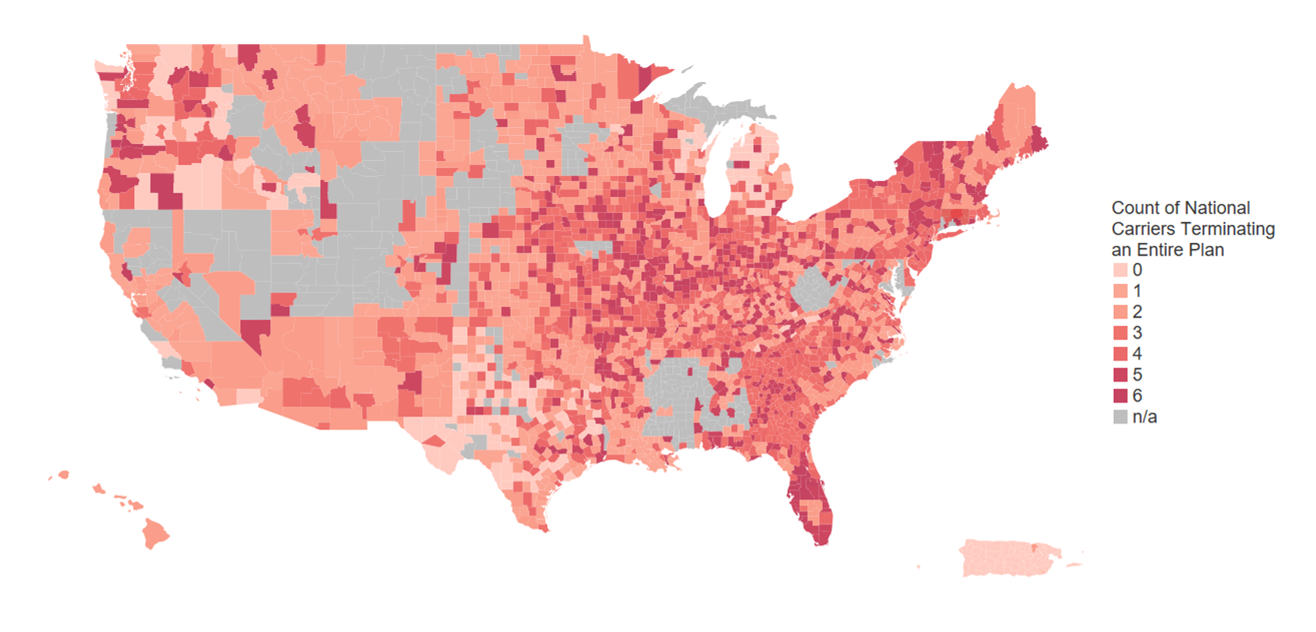

In total, full plan terminations for 2025 are impacting around 1.4 million individual MA-PD members. We isolated 647 plan benefit packages (PBPs, or a contract plan defined as HXXXX-XXX) fully terminating in 2025,3 a 107% increase relative to 2024 terminations. Terminated plans from four national organizations, United, CVS, Humana, and Centene, make up about 60% of the total terminated plans and about 70% of the 1.4 million members who will be forced to shop for a different plan. Additionally, 2024 membership in terminated plans for these nationals is disproportionality from preferred provider organization (PPO) plan types; for CVS and Humana nearly 80% of membership is from PPO plans, while for United it is closer to 70%, The footprint of terminated plans is shown in the map in Figure 3, where darker red indicates more national organizations terminated a 2024 plan within a particular county, as well as Elevance and Cigna (which are not offered nationally but often considered national organizations).

Figure 3: Counties where national carriers fully terminated at least one 2024 plan for 2025 AEP

National carriers identified as United, CVS, Humana, Centene, Elevance, and Cigna. Where 0 national carriers terminated plans, this indicates a plan was terminated, but by a nonnational carrier. The map indicates where national organizations fully terminated at least one 2024 plan, and does not indicate that the organization fully exited the county.

National MAOs are offering new plans in service areas where 2024 plans were terminated

Many of the national plans, however, also introduced new plans in service areas where they are terminating 2024 plans, perhaps hoping they can retain members who are happy with their brand and service without a formal cross-walk. A possible rationale for not cross-walking membership into these new plans is that, in terminating a plan and starting a new one, these plans are not subject to the total beneficiary cost (TBC) test, which only allows plan benefits to be degraded or premiums increased up to a certain limit. Many of these organizations have had earnings calls where they have cited concerns with 2025 MA-PD margins, which may have been an impetus for shutting down these plans (they were possibly not financially viable or could not be financially viable within the confines of the TBC test limitations).

Of the national MAOs:

- United: Terminated 83 plans in 779 counties, has 107 new plan offerings.

- Humana: Terminated 77 plans in 1,629 counties, has 89 new plan offerings.

- CVS: Terminated 129 plans in 1,124 counties, has 138 new plan offerings.

- Centene: Terminated 96 plans in 732 counties, has 40 new plan offerings.

Service area reductions

SAR activity also increased into 2025, with organizations reducing the service area of PBPs, but not removing them from their portfolios altogether. As noted above, this impacted about 540,000 members,4 and again national carriers drove a significant portion of this activity, with 55% of the SAR activity due to Humana and 24% from CVS.

Member premium and cost-sharing changes are significant, adding uncertainty around 2025 buying habits and shopping preferences

Focusing on general enrollment plan offerings, the impact of the Inflation Reduction Act (IRA) and other MA headwinds caused carriers to adjust their plan offerings differently relative to 2024 in order to preserve margin.

Premium and maximum out-of-pocket (MOOP) impacts

Figure 4: Average national carrier general enrollment member premiums, 2024 and 2025

The 2025 member-weighted averages are calculated prior to 2025 open enrollment, use September 2024 membership, and account for cross-walked plans. The 2024 member-weighted averages are calculated after 2024 open enrollment, and use February 2024 membership.

The general enrollment membership-weighted premium decreased from $13.93 to $13.50 in 2025. However, carriers were split on whether they increased or decreased their average general enrollment premium. Notably, Humana decreased average premium by $1.19, and United maintained its strategy of higher average premium relative to all other national players. United has a higher percentage of its membership in premium-bearing plans, which results in the outcome shown in Figure 4.

Figure 5: Average national carrier general enrollment member in-network MOOPs, 2024 and 2025

The 2025 member-weighted averages are calculated prior to 2025 open enrollment, use September 2024 membership, and account for cross-walked plans. The 2024 member-weighted averages are calculated after 2024 open enrollment, and use February 2024 membership.

All carriers, with the exception of Centene, increased their membership-weighted in-network MOOPs. Humana plan MOOPs increased by the largest margin among national MAOs, with an average increase of over $600. United, CVS, and Cigna plans’ average MOOPs increased by $270, $210, and $170, respectively, while Elevance increased its average MOOP by less than $100. As the market average MOOP in 2025 remains under $5,000, carriers pursue differing strategies with regards to MOOP.

Part C and Part D deductible impacts

Figure 6: Average national carrier general enrollment member Part C deductible, 2024 and 2025

The 2025 member-weighted averages are calculated prior to 2025 open enrollment, use September 2024 membership, and account for cross-walked plans. The 2024 member-weighted averages are calculated after 2024 open enrollment, and use February 2024 membership.

Humana and Cigna significantly increased their Part C medical deductibles in their 2025 offerings. Part C deductibles prior to 2024 only impacted about 4.4% of MA-PD general enrollment members. In 2025, this number nearly doubles to 8%. Payers appear to be reacting to revenue pressures and high medical trend by utilizing medical deductibles to keep premium low.

Figure 7: Average national carrier general enrollment member Part D deductible, 2024 and 2025 (excludes MA only plans)

The 2025 member-weighted averages are calculated prior to 2025 open enrollment, use September 2024 membership, and account for cross-walked plans. The 2024 member-weighted averages are calculated after 2024 open enrollment, and use February 2024 membership.

Part D deductibles increased materially for United, Humana, CVS, and Centene—which drives the market average change from an average general enrollment MA-PD Part D deductible of $63 in 2024 to $225 in 2025. The massive change in Part D plan strategy is likely to be correlated with the IRA and the corresponding change in payer plan liability due to the Part D benefit redesign5 as well as the “greater of” MOOP accumulation.6 However, carriers such as Elevance and Cigna have clear strategies to avoid adding Part D deductibles even in light of increasing plan liability from the IRA. Note that, when deductibles are added, they generally are only applied to brand and specialty tiers (generally Tiers 3, 4, and 5).

Other items of note at the carrier level to consider when reviewing Tier 3 and Tier 4 (i.e., brand tier) cost sharing for general enrollment MA-PD plans:7

- United and Cigna kept Tier 3 and Tier 4 as copay tiers on most plans.

- Humana moved most of its MA-PD cost sharing to a coinsurance structure for Tier 4, and maintained a copay benefit on Tier 3.

- CVS and Elevance moved to a coinsurance structure on both brand tiers on nearly all plans.

- Centene was the only national MA-PD to have a coinsurance structure on Tier 4 for the majority of its enhanced alternative (EA) plans in 2024. In 2025, Centene also moved Tier 3 to a coinsurance structure for all plans.

Different strategies on Part D deductibles as well as brand copay and coinsurance strategy may indicate certain organizations favoring limited member disruption (copay structure) versus margin or selection concerns (coinsurance structure).

Should we expect more changes to the 2026 MA-PD market?

In 2026 we will again see significant changes to stakeholders in Medicare Advantage as the last major provision of the IRA, drug price negotiation, begins its direct impact on plans, members, and pharmaceutical manufacturers. Additionally, CMS changes to the star rating program will bring about material changes in funding to a number of payers in the MA-PD space,8 impacting the 2026 bid cycle, which will have downstream impacts on members, risk-bearing providers, and other stakeholders. Proactively building strategies to address the IRA and the now public 2025 landscape information, especially with respect to competitor strategy, should be top of mind for all MA-PD stakeholders.

Critical evaluation of how plan sponsors and national carriers could react, as well as how buying habits and shopping preferences may change, will be critical for success in the MA-PD space moving forward.

Caveats, limitations, and qualifications

The information in this paper is intended to describe premium changes and trends in the Medicare MA-PD market. It may not be appropriate, and should not be used, for other purposes.

We relied on publicly available enrollment and premium data from the Centers for Medicare and Medicaid Services (CMS) to support the data presented in this paper, as well as the 2025 Milliman MACVAT®. We excluded Employer Group Waiver Plans (EGWPs), Prescription Drug Plans (PDPs), Medicare-Medicaid Plans (MMPs), Medical Savings Account (MSA) plans, and Cost plans. Where applicable, we excluded SNPs and focused our analysis on the general enrollment (non-SNP) market. If this information is incomplete or inaccurate, our observations and comments may not be appropriate. We reviewed the data for reasonability but did not audit the data.

Julia Friedman is a member of the American Academy of Actuaries and meets the qualification standards of the American Academy of Actuaries to render the actuarial opinion contained herein.

1 Excludes Employer Group Wavier Plan (EGWP), PDP, Medicare-Medicaid Plan (MMP), Cost, and Medicare Savings Account (MSA) plan types.

2 Membership counts calculated as of February 2024. Excludes EGWP, PDP, MMP, Cost, and MSA plan types.

3 This does not include plans that implemented a service area reduction (SAR) to a PBP, which means they continued to offer the plan but in a reduced service area.

5 Gergen, R., Leciejewski, Z., Koenig, D., & Pierce, K. (January 2023). Medicare Part D Risk and Claim Cost Changes With the Inflation Reduction Act. Milliman White Paper. Retrieved October 17, 2024, from https://www.milliman.com/en/insight/medicare-part-d-risk-claim-cost-changes-inflation-reduction-act.

6 Karcher, J., Magnusson, J.S., & Robb (Klein), M. (August 27, 2024). Out of whose pocket? Many beneficiaries will spend less than expected to reach the IRA’s new $2,000 out-of-pocket spending limit. Retrieved October 17, 2024, from https://www.milliman.com/en/insight/out-of-whose-pocket-inflation-reduction-act.

7 Review of retail 30 cost sharing for general enrollment plans with enhanced alternative (EA) Part D plan designs.

8 Rogers, H.M., Smith, M., & Yurkovic, M. (October 2023). Future of Medicare Star Ratings: The Reimagined CMS Bonus System. Milliman White Paper. Retrieved October 17, 2024, from https://www.milliman.com/en/insight/future-of-medicare-star-ratings-reimagined-cms-bonus-system.