The Milliman Mortgage Default Index (MMDI) is a lifetime default rate estimate calculated at the loan level for a portfolio of single-family mortgages. For the purposes of this index, default is defined as a loan that is expected to become 180 days or more delinquent over the life of the loan.1 The results of the MMDI reflect the most recent data acquisition available from Freddie Mac and Fannie Mae, with measurement dates starting from January 1, 2014.

Interact with the MMDI

Click here to explore the MMDI data on a more granular level, including loan origination and type.

Key findings

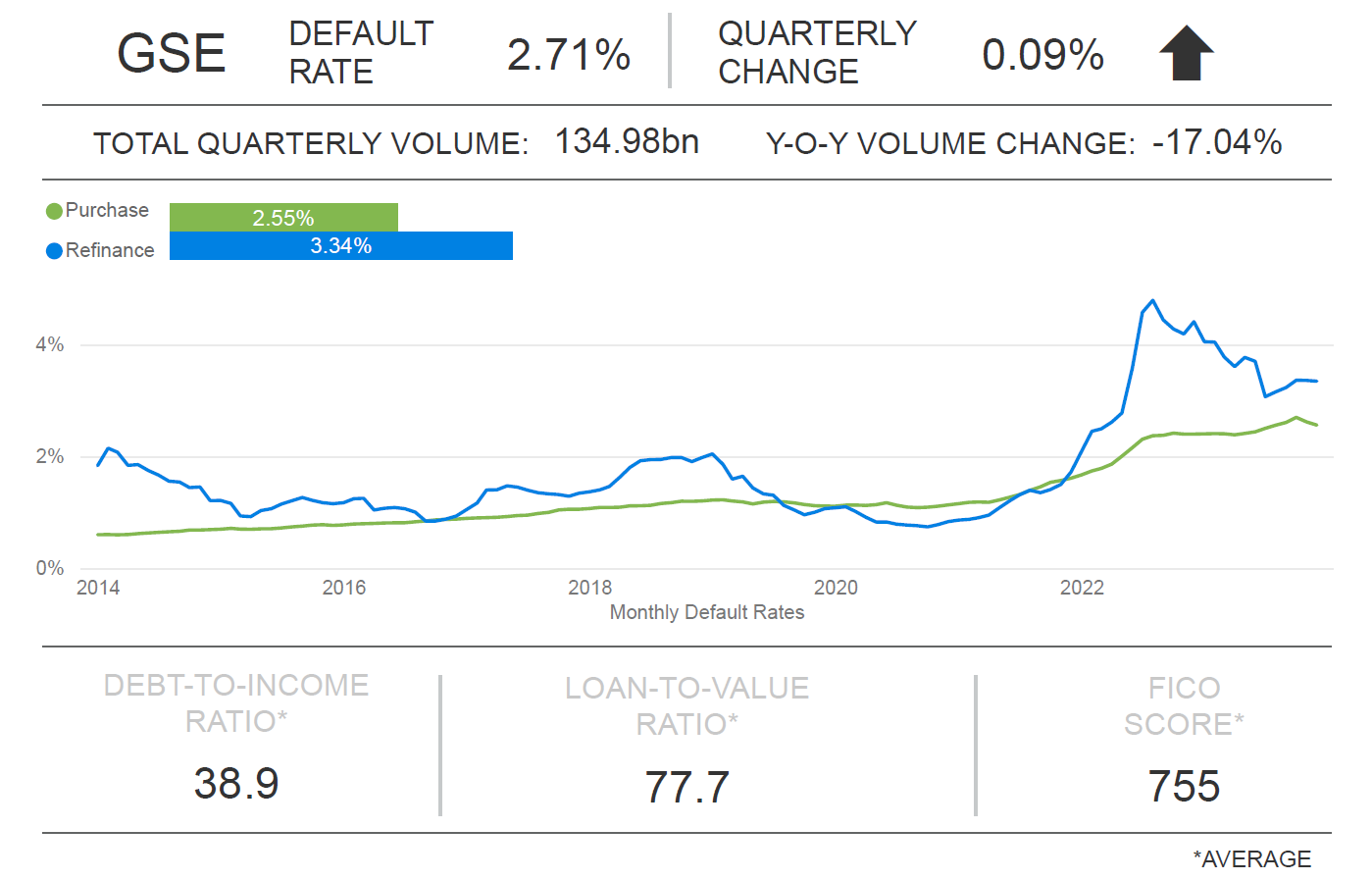

The value of the MMDI increased to 2.71% for loans acquired in the fourth quarter (Q4) of 2023, up from 2.62% for loans acquired in 2023 Q3. The projected slowing, and slight decrease in some markets, of home price appreciation is the primary cause of the increase. Figure 1 provides the quarter-end index results, segmented by purchase and refinance loans.

When reviewing quarter-over-quarter changes in the MMDI, it is important to note that the 2023 Q3 MMDI values have been restated since our last publication and were adjusted from 3.10% to 2.62%. This is a result of a change in methodology and updated data used to calculate home price appreciation. Historical home price appreciation and the forecast was revised up within the quarter,2 and home price appreciation is a key component of the index value. Interested readers can reach out to Milliman for more information on this change.

Figure 1: MMDI 2023 Q4 dashboard for GSE loans

Summary of trends

Over 2023 Q4, our latest MMDI results show that mortgage risk has increased for government-sponsored enterprise (GSE) acquisitions. There are three components of the MMDI: borrower risk, underwriting risk, and economic risk. The change in index value quarter-to-quarter was driven by economic risk. Borrower risk measures the risk of the loan defaulting due to borrower credit quality, initial equity position, and debt-to-income ratio.

Underwriting risk measures the risk of the loan defaulting due to mortgage product features such as amortization type, occupancy status, and other factors. Economic risk measures the risk of the loan defaulting due to historical and forecasted economic conditions.

Borrower risk results: 2023 Q4

Borrower risk decreased from 1.51% in 2023 Q2 to 1.48% in 2023 Q3, with purchase loans continuing to make up the bulk of originations at about 89% of total volume. Although purchase volume has been decreasing year-over-year, the quality of loans from a risk perspective has continued to be strong, keeping the default risk of new loan originations low.

Underwriting risk results: 2023 Q4

Underwriting risk represents additional risk adjustments for property and loan characteristics such as occupancy status, amortization type, documentation types, loan term, and other adjustments. Underwriting risk remains low and is negative for purchase mortgages, which are generally full-documentation, fully amortizing loans. For refinance loans, the data is segmented into cash-out refinance loans and rate/term refinance loans.

This quarter, approximately 69% of refinance originations were cash-out refinance loans. Recent increases in interest rates have made rate/term refinance noneconomic.

Economic risk results: 2023 Q4

Economic risk is measured by looking at historical and forecasted home prices. For GSE loans, economic risk increased quarter over quarter, from 1.16% in 2023 Q3 to 1.24% in 2023 Q4. Home price appreciation has been projected to slow and even slightly decrease in some markets after the boom that occurred over the course of the pandemic.

For more information on the housing market, please refer to our recent Milliman Insight article, “Forecasting the housing market: An economic outlook of housing affordability and home prices,” available at https://www.milliman.com/en/insight/forecasting-housing-market-economic-outlook-affordability-home-prices.

This publication of the MMDI uses the most recent data available to provide timely information on credit trends.

The MMDI reflects a baseline forecast of future home prices. To the extent actual or baseline forecasts diverge from the current forecast, future publications of the MMDI will change accordingly. For more detail on the MMDI components of risk, visit milliman.com/MMDI.

About the Milliman Mortgage Default Index

Milliman is expert in analyzing complex data and building econometric models that are transparent, intuitive, and informative. We have used our expertise to assist multiple clients in developing econometric models for evaluating mortgage risk both at the point of sale and for seasoned mortgages.

The Milliman Mortgage Default Index (MMDI) uses econometric modeling to develop a dynamic model that is used by clients in multiple ways, including analyzing, monitoring, and ranking the credit quality of new production, allocating servicing sources, and developing underwriting guidelines and pricing. Because the MMDI produces a lifetime default rate estimate at the loan level, it is used by clients as a benchmarking tool in origination and servicing. The MMDI is constructed by combining three important components of mortgage risk: borrower credit quality, underwriting characteristics of the mortgage, and the economic environment presented to the mortgage. The MMDI uses a robust data set of over 30 million mortgage loans, which is updated frequently to ensure it maintains the highest level of accuracy.

Milliman is one of the largest independent consulting firms in the world and has pioneered strategies, tools, and solutions worldwide. We are recognized leaders in the markets we serve. Milliman insight reaches across global boundaries, offering specialized consulting services in mortgage banking, employee benefits, healthcare, life insurance and financial services, and property and casualty (P&C) insurance. Within these sectors, Milliman consultants serve a wide range of current and emerging markets. Clients know they can depend on us as industry experts, trusted advisers, and creative problem-solvers.

Milliman's Mortgage Practice is dedicated to providing strategic, quantitative, and other consulting services to leading organizations in the mortgage banking industry. Past and current clients include many of the nation's largest banks, private mortgage guaranty insurers, financial guaranty insurers, institutional investors, and governmental organizations.

1 For example, if the MMDI is 10%, then we expect 10% of the mortgages originated in that month to become 180 days or more delinquent over their lifetimes.

2 Federal Housing Finance Agency. Technical Note: Source Update for County Recorder Data and Its Impact on FHFA HPI. Retrieved March 7, 2024, from https://www.fhfa.gov/DataTools/Downloads/Documents/HPI_Focus_Pieces/Source-Update-for-County-Recorder-Data-FHFA-HPI-Impact.pdf.