Background

With over a decade of new market data since the original calibration, it is time to revisit whether the current prescribed equity shocks under the Solvency Assessment and Management (SAM) framework reflect the risks faced by South African insurers. This review provides insights into the appropriateness of the current stress calibrations for global and South African equities, based on updated empirical analysis and parametric fitting. We examine whether recent market behaviour supports the continuation of current shocks or warrants recalibration.

Objectives of this paper

Assessing the appropriateness of the standard formula: Assisting heads of actuarial function and insurers in assessing the appropriateness of the equity sub-module of the standard formula. An assessment of the appropriateness of the standard formula is a regulatory requirement but should also be considered an essential part of ongoing risk management.

Driving risk management practices: Informing insurers' Own Risk and Solvency Assessment (ORSA) scenarios, calibrating economic capital scenarios and determining target capital ratios. To this end, moderate stresses (e.g., 1 in 25) are provided, as well as more extreme scenarios for stressing the balance sheet and balance sheet management approaches (e.g., 1 in 400).

Methodology: Empirical vs. parametric approaches

We followed the SAM working group methodology outlined in Position Paper 47.1 This considers using daily return data to calculate all rolling annual periods. These overlapping periods are not independent, which limits the ability to use certain techniques and construct meaningful confidence intervals.

Parametric estimates were made using maximum likelihood estimation (MLE), consistent with the position paper.

Data used (based on available data up to the date of extraction in all cases):

- For global equity, we have used data from the MSCI World Index for the period 1 January 1973 to end January 2024 (just beyond 2023 and therefore labelled as ‘2023’ in our analysis).

- For SA equity, we used the available JSE All Share Index (ALSI) from 1 July 1996 to 8 February 2024.

- As a measure of some of the assets represented under Other Equity, we have analysed the results of the MSCI Emerging Markets Index. This analysis is lighter than the global equity and SA equities analysis and uses a single index. Data was used for the period from 21 October 1998 to 16 February 2024.

The analysis employed both empirical and parametric approaches, comparing the results against global indices like the S&P 500 and as alternative South African indices, like the JSE Top 40.

The empirical results are more reliable than the selected parametric approaches as they better reflect the extreme risks in the data. More sophisticated parametric approaches, including those which allow for time-varying means and volatility, volatility clustering, and more directly consider the tails of the distribution may provide better results than an empirical approach. However, these entail additional subjective choices. For consistency with the original calibration we did not consider these approaches for this paper.

Findings: Are prescribed shocks still appropriate?

The table below shows a summary of results from the analysis, including key percentiles which can be used for assessing the adequacy of the standard formula or for selecting equity stresses within an ORSA.

Figure 1: SAM-prescribed equity stresses comparison to updated empirical estimate, 2023

| Global equity | SA equity | Other equity* emerging markets |

Infrastructure assets** |

|

|---|---|---|---|---|

| 1 in 200 prescribed stresses | 39.0% | 43.0% | 49.0% | 33.0% |

| Updated empirical VaR | ||||

| 1 in 400 | 45.3% | 37.1% | 58.4% | N/A |

| 1 in 200 | 43.4% | 35.3% | 56.7% | N/A |

| 1 in 100 | 40.2% | 33.1% | 54.1% | N/A |

| 1 in 25 | 22.2% | 23.1% | 32.5% | N/A |

| 1 in 10 | 15.0% | 8.5% | 24.0% | N/A |

* ‘Other equity’ incorporates a wide range of asset classes. The empirical VaR has been estimated based solely on the MSCI Emerging Market Index and may not be applicable to other types of equity, including unlisted equities, private equity, hedge funds and commodities

** Infrastructure assets have not been analysed in this paper and are included for completeness of the prescribed stresses

Global equities: A slight underestimation?

The table below shows statistics for the MSCI World Index from 1973 to 2023, including subsets for comparison of different time periods.

The results do not perfectly replicate the position paper values, but the differences are small. The exact dates of the time periods may differ, and the calculation of annual returns may have also differed due to non-trading days.

Figure 2: MSCI world empirical results

| Position paper 1973–2009 |

Replication of position paper 1973–2009 |

Period after position paper 2010–2023 |

Full period 1973–2023 |

|

|---|---|---|---|---|

| Mean | 7.4% | 7.5% | 8.9% | 7.9% |

| Std. deviation | 18.2% | 18.1% | 13.7% | 17.0% |

| Skewness | (18.0%) | (17.6%) | 62.1% | (8.8%) |

| Excess kurtosis | 72.0% | 70.4% | 146.7% | 98.8% |

| Percentiles | ||||

| 1 in 200 | (44.3%) | (44.3%) | (21.1%) | (43.4%) |

- Current prescription: The prescribed global equity stress is 39% under SAM, consistent with Solvency II Type 1 equity stress.

- Updated empirical VaR: Our analysis of the MSCI World Index from 1973 to 2023 suggests a 99.5% empirical VaR of 43.4%, slightly lower than the 44.3% from previous studies. However, it remains above the prescribed 39%.

- Recent trends (2010–2023): Surprisingly, volatility in global markets has declined, with the empirical VaR for the past decade coming in at just 21.1%. This drop suggests that recent market conditions may have been unusually stable, but long-term data still supports a stress level near 43%.

While recent data suggests lower volatility, long-term patterns show that the prescribed shock of 39% may underestimate the actual tail risk.

South African equities: Overestimating risk?

The table below shows statistics for the FTSE/JSE All Share Index (ALSI) from 1973 to 2023, including subsets for comparison of different time periods.

Figure 3: ALSI empirical results

| Position paper 1973–2009 |

Replication of position paper 1996–2009 |

Period after position paper 2010–2023 |

Full period 1996–2023 |

|

|---|---|---|---|---|

| Mean | 15.5% | 13.3% | 9.3% | 11.2% |

| Std. deviation | 25.9% | 22.6% | 11.5% | 17.8% |

| Skewness | 34.0% | (17.2%) | 65.5% | 12.4% |

| Excess kurtosis | 25.6% | (39.8%) | 210.8% | 64.0% |

| Percentiles | ||||

| 1 in 200 | (39.5%) | (37.3%) | (19.3%) | (35.2%) |

Position Paper 47 used returns from 1973. Due to lack of available data older than 1996 from the JSE, the position paper results could not be replicated exactly. The table above shows slightly different (2.2%) percentile estimates from the position paper to our partial replication. In general, more data would be better, although given the status of the South African economy and market prior to 1996 arising from international sanctions, an argument could be made for the debateable relevance of this data to reflect the current market and economy.

Consistent with the analysis for global equities, returns between 2010 and 2023 have demonstrated lower volatility than earlier periods. The decrease over the 1996 to 2023 period is large, going from 25.9% to 17.8%.

The 99.5% VaR estimated over all available periods is just 35.0%. This is lower than the prior analysis and lower than the regulatory stress, but also lower than the results for global equities.

In the position paper, the low VaR was a function of high standard deviation (25.9%) and positive skewness (34.0%) such that the parametric VaR using a normal distribution was high at 51.3%. This high normal VaR relative to the empirical VaR was a function of the high standard deviation which drives variability for the normal approximation.

Our updated analysis from 1996 to 2023 still shows this positive skewness. The parametric normal VaR (34.6%) estimate is now close to the empirical VaR (35.2%), so this argument for a higher prescribed stress falls away.

The 43.0% stress appears to overestimate SA equity risk based on current data. Aligning SA equity shocks with global equity stresses (39.0%) may be more appropriate, though care is needed to consider future shifts in volatility and skewness.

Emerging markets: Higher risks

The position paper shows a range of VaR measures, including (63.8%) for the MSCI Emerging Markets BRIC Index, which is fairly similar to the MSCI Emerging Markets Index used in this paper.

The table below shows that this measure of risk for other equity is higher than the prescribed stress of 49.0%.

Figure 4: Other equity empirical results based on MSCI Emerging Market Index only

| Position paper 1973–2009 |

Replication of position paper 1998–2009 |

Period after position paper 2010–2023 |

Full period 1998–2023 |

|

|---|---|---|---|---|

| 1 in 200 percentiles | Hedge funds (23.1%) Commodities (59.5%) Emerging markets (63.8%) Private equity (68.7%) |

(58.5%) | (30.4%) | (57.6%) |

Firm conclusions should not be drawn from this analysis since we only considered one subset of this equity category. However, it may provide useful input in forming views on the appropriateness of the standard formula specifically for emerging market investments, for setting other stress test scenarios, and as a comparison to the SA equity stress.

The overall emerging market index is a broader, more diversified index than the JSE as a single country index. It remains surprising that the SA equity risk appears to be lower than the MSCI Emerging Market Index.

Further work on the other asset types included within other equity risk is necessary before firmer conclusions can be drawn.

Diversification: Do correlation parameters still apply?

We also considered the relationship between the rolling annual period returns. The original SAM calibration assumes a 75.0% tail correlation between global equity, SA equity and other equity.

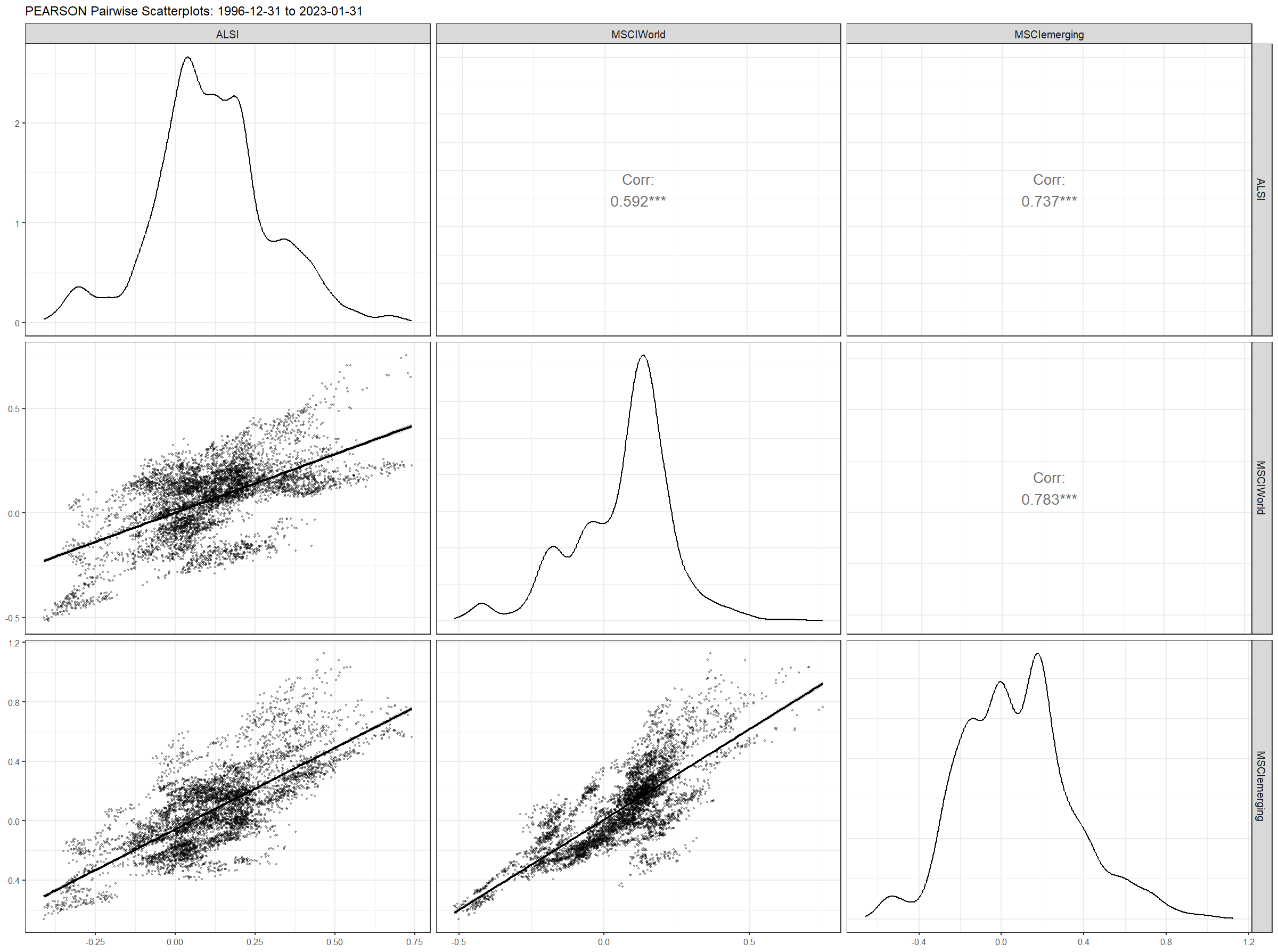

The figure below shows a pairwise analysis of correlation coefficients and univariate distributions, including scatterplots to understand this relationship. The figure shows Pearson correlation coefficients over all data, rather than a measure of tail dependence.

Figure 5: Pearson correlations and univariate distributions

If Spearman (ranked) correlation coefficients are used, the coefficients decrease by between 4% and 6%. Spearman’s correlation coefficient was used for Solvency II and SAM calibrations and aligns with how the parameter is used in the Solvency Capital Requirement (SCR) aggregation.

However, the scatterplots provide visual evidence that the tail dependence (for the left tail) may be stronger than over the entire distribution. This can be estimated using an appropriate copula, but the tail correlation can also be evaluated directly by calculating the tail dependence using an empirical approach based on the joint exceedance of extreme quantiles (e.g., 5%, 1%, 0.05%). This method estimates the probability of one variable being extreme given that the other is extreme, using the empirical distribution of the data without assuming any particular dependence structure or distribution.

Figure 6: Lower tail dependence estimation (Spearman) for 1% tail from 1996 to 2023

| MSCI World | JSE ALSI | MSCI Emerging | |

|---|---|---|---|

| MSCI World | 100% | 65% | 77% |

| JSE ALSI | 65% | 100% | 58% |

| MSCI Emerging | 77% | 58% | 100% |

This resulted in lower upper tail dependence measures and, depending on the extreme percentile considered, slightly higher dependence parameters. Interesting, the level of lower tail dependence has generally increased since 2009.

The lower tail dependence parameters between the three equity subclasses ranges from 61% to 77% for the 5% tail, and 58% to 77% for the 1% tail.

This supports the SAM calibration of 75% tail dependence parameters between each of these equity classes.

Conclusion

- Global equity: The current 39% prescribed shock for global equities may be too low, with empirical evidence suggesting a 43% shock would be more appropriate. Insurers should incorporate this into their internal capital models and stress testing.

- SA equity: The 43% stress for SA equities appears too conservative, given the 35.2% empirical VaR. Aligning SA equity with global equities at 39% would be more reasonable. Insurers could adjust their internal capital models and ORSA scenarios accordingly.

- Emerging markets: With the high observed volatility and VaR, the 49% stress for other equity may be insufficient when applied to emerging market share returns.

- Correlation factors of 75% are reasonable and supported across a range of measures of fail dependence.

While the current analysis provides strong empirical support for recalibrating global and SA equity stresses, further refinement using techniques like extreme value theory or GARCH models could offer additional insights. Future studies could also explore the evolving role of tail dependencies and correlations, particularly in emerging markets.

1 Solvency Assessment and Management: Steering Committee, Position Paper 47 (v 4) Equity Risk. (2015.) Retrieved 7 November 2024 from https://www.fsca.co.za/Regulated%20Entities/SAM%20DOCUMENTS/Position%20Paper%2047%20(v%204)%20FINAL.pdf.