What is the issue and the proposed remedy?

CMS released the FY 2024 Inpatient Prospective Payment System (IPPS) Final Rule in August 2023 and calendar-year (CY) Outpatient Prospective Payment System (OPPS) Final Rule in November 2023. These rules finalized a 2023-2024 national unit cost trend of 3.1% and 3.4% for IPPS and OPPS, respectively. More information regarding these changes can be found in the section below and in a prior Milliman publication.1

The IPPS and OPPS Final Rules will result in large variations of unit cost trend in certain counties from 2023 to 2024. Some regions are expected to see unit cost increases much greater than the national average, while others will see increases somewhat lower than that average. As of early December 2023, these changes were not yet reflected in the initial PY 2024 Rate Book, which will be used to generate the initial PY 2024 Preliminary Benchmark Report scheduled for release on December 18, 2023. Thus, REACH ACOs should expect to see temporary benchmark headwinds or tailwinds in the initial Preliminary Benchmark Reports that will be eliminated in the revised report in February 2024.

Estimating the revisions to the PY 2024 Preliminary Benchmark Reports

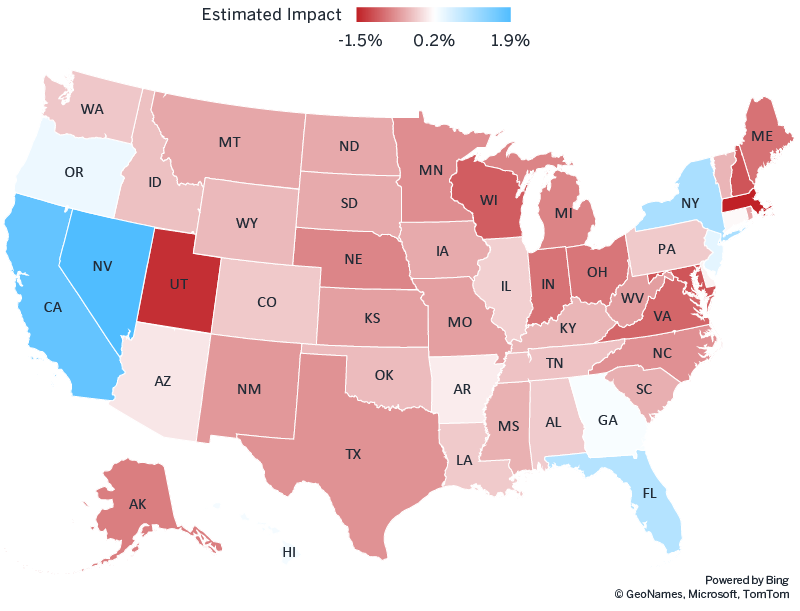

The initial PY 2024 Preliminary Benchmark Reports will not reflect 2024 fee schedule changes. Figure 1 shows our estimate of the revision impact ACOs will see in February 2024 at the state level. No restatement is expected for states with 2023 to 2024 IPPS and OPPS trends on par with the national trend, while we expect approximately a 1.5% positive restatement for states with an IPPS and OPPS trend 3% higher than the national trend (positive restatements are shaded blue in Figure 1), as approximately 50% of total Part A and B expenditures are subject to IPPS and OPPS. For this heat map, we estimated the percentage of Part A and B claims subject to IPPS and OPPS at the national level using Milliman Health Cost Guidelines™ and rolled up fee schedule changes to the state level.

ACOs should evaluate the potential restatement at a granular level, such as county or MSA, because there are variations within each state, depending on whether the area is impacted by the rural floor. For example, certain counties in upstate New York may see estimated benchmark restatements as high as 5% to 8%. Also, IPPS and OPPS do not apply to CAHs, which account for about 25% of acute care hospitals. Areas that mainly rely on CAHs likely will see less impact than estimated.

It is critical for REACH ACOs to understand the magnitude of the potential restatement to the initial PY 2024 Preliminary Benchmark Report when forecasting PY 2024 ACO REACH financial results.

Figure 1: Estimated restatement in PY 2024 preliminary benchmarks, December 2023 version to February 2024 version

What’s happening with Medicare fee schedules?

The IPPS dictates how regular acute hospitals are paid for services provided to Medicare beneficiaries based on a national standardized amount, adjusted for the patient’s condition and for differences in hospital wage levels through the hospital wage index.2 The hospital wage index is also used to adjust payments under OPPS. The 2024 IPPS Final Rule made significant changes to the rural wage index calculation methodology, impacting the rural floor and ultimately both IPPS and OPPS hospital payments.3

Medicare payment rules classify hospital labor market areas into rural and urban status, based on core-based statistical areas (CBSAs) established by OMB. Under IPPS rules, the area wage index applicable for any hospital located in an urban area of a state may not be less than the area wage index applicable to hospitals classified as rural in that state. This is referred to as the rural floor. Congress also required that the rural floor be implemented in a budget-neutral manner. This is implemented through an adjustment known as the “rural floor budget neutrality adjustment,” applied to the wage index of all hospitals.

Historically, hospitals reclassified from urban to rural under section 1886(d)(8)(E) of the Social Security Act were treated as distinct from geographically rural hospitals for the purposes of calculating the wage index. Beginning in FY 2024, however, CMS finalized a proposed rule to include reclassified rural hospitals along with geographically rural hospitals in the calculation of the hospital wage index.4

This change will impact the wage index calculations in multiple ways:

- Some rural areas will see increases in the wage index factors

- Some urban areas in states affected by 1) above will also see increases in the wage index factors, if affected by the rural floor

- The budget neutrality adjustment will impact wage index factors in all areas

These changes are not accounted for in ACO REACH benchmarks in PY 2024 because only the Medicare fee schedules through FY 2023 are used to set 2024 REACH benchmarks. Increases in the hospital wage index may contribute to an increase in ACO spending above the benchmark increase.

Which components of the ACO REACH financial benchmark are affected by Medicare fee schedules?

In ACO REACH, ACOs’ expenditures are compared to a financial benchmark as defined by the CMMI. At a high level, the financial benchmark is a blend of two components:

- Historical benchmark: The historical claims experience in the benchmark years (2017 through 2019) of beneficiaries attributed to the ACO’s participant providers.

- Regional benchmark: A risk-adjusted regional rate, based on the county rates in the ACO REACH Rate Book of the performance year.

The weight of the regional benchmark is 40% in Performance Year (PY) 2023, 45% in PY 2024, and 50% in PY 2025 and 2026, and thus both components contribute significantly to the final benchmark.

The steps of benchmark calculation are shown in Figure 2. Ideally, the final benchmark should account for 1) the changes in the Medicare fee schedules at the national level, and 2) the changes in county-level unit price relativity from the base year to the performance year. In the next two sections, we discuss how these factors are accounted for in the historical benchmark and regional benchmark components, through similar but different mechanics.

It is critical for REACH ACOs to understand the magnitude of the potential restatement to the initial PY 2024 Preliminary Benchmark Report when forecasting PY 2024 ACO REACH financial results.

Figure 2: Summary of ACO REACH Financial Benchmark Methodology

How are Medicare fee schedules accounted for in the historical benchmark component?

For the historical benchmark component, the historical expenditure is trended from the benchmark years (2017 to 2019) to the performance year using the adjusted Medicare fee-for-service (FFS) U.S. per capita cost (USPCC) trend. The Medicare FFS USPCC trend is a national per capita medical cost trend for the Medicare FFS population developed by CMS and used in the development of the Medicare Advantage Rate Book. To adjust the USPCC for ACO REACH financial calculations, uncompensated care payments are removed and hospice expenditures are added.

In addition to this national trend, there are spending differences among different regions due to changes in the Medicare fee schedule. To control for these geographic variations, CMMI applies a geographic adjustment factor (GAF) index to the benchmark. Effectively, the GAF reprices the historical claim experience underlying the historical benchmark component to the most recent region-specific fee schedule available.

The development of the ACO REACH PY 2024 GAF indices is shown in Figure 3. PY 2024 GAF indices control for Medicare fee schedule changes through 2023, but not changes through 2024.

Figure 3: CMMI’s summary of GAF indices for PY 2024.

REACH financial benchmarks are also affected by a retrospective trend adjustment (RTA). The RTA is based purely on actual and expected expenditure trends for the REACH national reference population and does not adjust for regional unit cost variation.

How are Medicare fee schedules accounted for in the regional benchmark component?

The Regional Benchmark component comes from the ACO REACH/KCC Rate Book. It is updated every performance year and establishes county rates that are (for the most part, minus other minor adjustments) the product of:

- National conversion factor: Estimated expenditure per beneficiary per month (PBPM) of beneficiaries eligible to participate in ACO REACH.

- County relative cost index: An index reflecting the difference between the expenditure of ACO REACH beneficiaries living in a given county and the national average.

The Rate Book is developed using the three most recent years for which complete Medicare FFS claims data are available as base years, which differ from the benchmark years. For each base year and each county, the county relative cost index is calculated by taking the ratio between the GAF-adjusted, risk-standardized county-level expenditure and the risk-standardized national average expenditure. By including a GAF adjustment in the calculation, the county relative cost index reflects changes in the relative cost in the same county between a base year and the performance year. However, because GAF is only controlling for fee schedules through 2023, the regional benchmark component will not control for the 2024 fee schedule differences between a particular county and the national average.

Conclusion

The initial PY 2024 ACO REACH Preliminary Benchmark Reports do not yet control for changes in the 2024 Medicare fee schedules. Revised Preliminary Benchmark Reports are expected in February 2024. REACH ACOs should evaluate the impact of restatement before February 2024 to help set expectation with stakeholders and to validate the revised ACO benchmarks from CMS.

It is critical for REACH ACOs to understand the magnitude of the potential restatement to the initial PY2024 Preliminary Benchmark Report when forecasting PY 2024 ACO REACH financial results.

Appendix: Acronyms

- ACO REACH: Accountable Care Organization Realizing Equity, Access, and Community Health

- CAH: Critical access hospital

- CBSA: Core-based statistical area

- CMMI: Centers for Medicare and Medicaid Innovation

- CMS: Centers for Medicare and Medicaid Services

- FY: Federal fiscal year (i.e., October 1 to September 30)

- IPPS: Inpatient Prospective Payment System

- KCC: Kidney Care Choices

- MSA: Metropolitan statistical area

- MSSP: Medicare Shared Savings Program

- OMB: U.S. Office of Management and Budget

- OPPS: Outpatient Prospective Payment System

- PY: Performance year

- RTA: Retrospective trend adjustment

1 Mills, C. & Truman, L. (November 1, 2023). 2024 Medicare IPPS and OPPS trend summary. Retrieved December 1, 2023, from https://www.milliman.com/en/insight/2024-medicare-ipps-and-opps-trend-summary

2 The IPPS adjusts payments for patient severity (Medicare Severity Diagnosis-Related Group [MS-DRG]), wage index, inliers and outliers, and other hospital-specific factors such as quality and Indirect Medical Education (IME). This paper focuses on the impact of 2023 to 2024 wage index changes.

3 The full text of the 2024 IPPS Final Rule is available at https://www.federalregister.gov/documents/2023/08/28/2023-16252/medicare-program-hospital-inpatient-prospective-payment-systems-for-acute-care-hospitals-and-the

4 CMS (August 1, 2023). FY 2024 Hospital Inpatient Prospective Payment System (IPPS) and Long-Term Care Hospital Prospective Payment System (LTCH PPS) Final Rule – CMS-1785-F and CMS-1788-F Fact Sheet. Retrieved December 1, 2023, from https://www.cms.gov/newsroom/fact-sheets/fy-2024-hospital-inpatient-prospective-payment-system-ipps-and-long-term-care-hospital-prospective-0.