In July 2020, Milliman professionals published the research report "Reinsurance as a capital management tool for life insurers." This report was written by our consultants Eamon Comerford, Paul Fulcher, Rosemary Maher and myself.

Capital management is an increasingly important topic for insurers as they look to find ways to manage their risks and the related capital requirements and to optimise their solvency balance sheets. Reinsurance is one of the key capital management tools available to insurers. The paper investigates common reinsurance strategies, along with new developments and innovative strategies that could be implemented by companies.

This blog post is the seventh in a series of posts about this research. Each post provides an overview of a certain section of the Milliman report.

Longevity risk reinsurance

For pension funds and pension insurers, longevity risk can be substantial. High capital requirements, reflecting this risk, are a key reason for insurers looking to de-risk longevity exposures. Reinsurance covers and capital market solutions can be used for this. Several of these solutions, including their characteristics, are included in the table in Figure 1.

As argued in earlier posts ("Decision process for reinsurance implementation" and "Evaluating reinsurance strategies"), insurers can choose from among several reinsurance strategies. They all have their own trade-offs and each one's effectiveness is dependent on a breadth of characteristics and considerations. Choosing which reinsurance strategy to implement is a complex puzzle to solve.

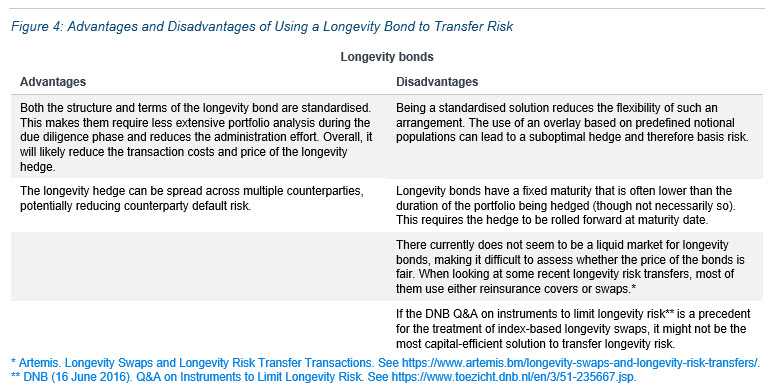

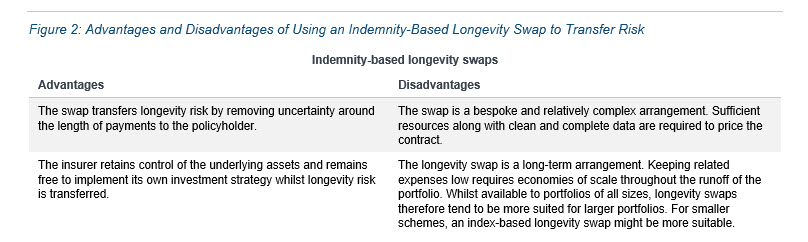

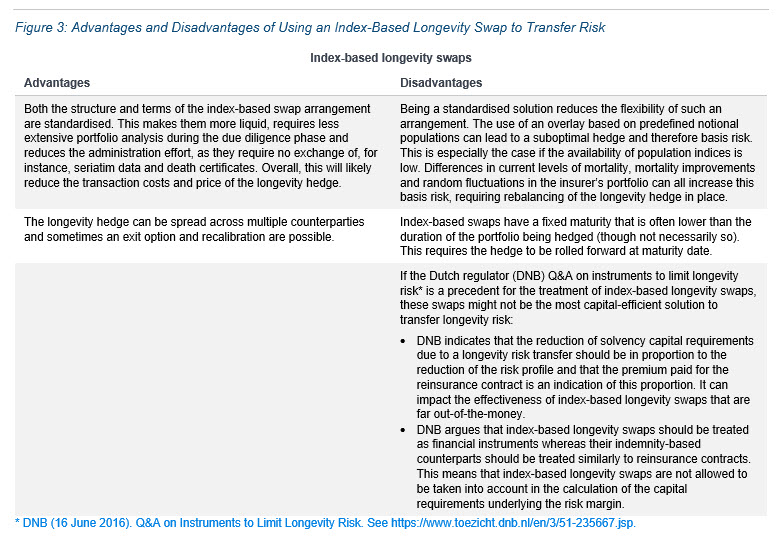

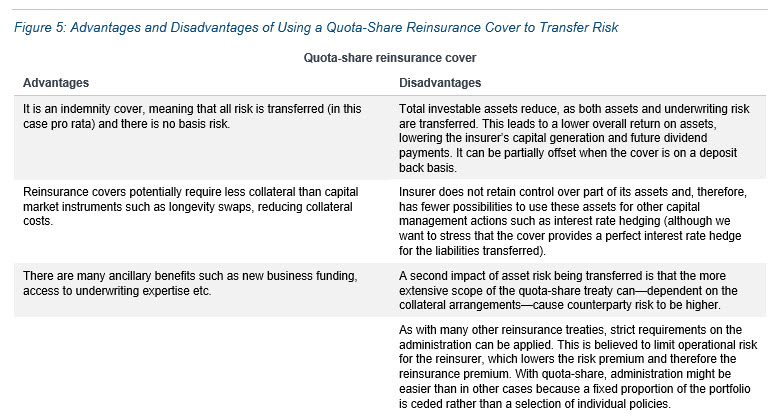

To help solve it, and to come to the right conclusions, it is important to fully understand the mechanics and characteristics of the reinsurance solution used to implement the strategy. In Figures 2 through 5, we give a brief overview of several solutions and their advantages and disadvantages.

Indemnity-based longevity swap

Index-based longevity swap

Securitisation using longevity bonds

Quota-share reinsurance cover

Milliman research paper

The full research paper can be found on Milliman's website here, where you can also find an executive summary version that notes some of the key highlights of the research and acts as a guide to the full paper.